A Recovering Economy Makes this Retail Trade Likely to Trend Higher

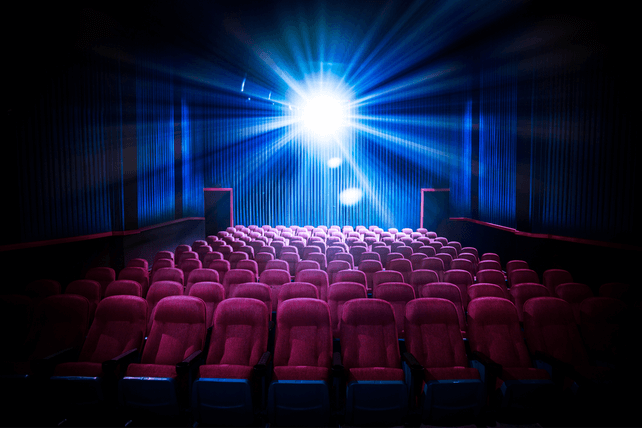

Many industries fared well during the pandemic, but others were essentially closed down entirely. Any in-person entertainment experience was one of them, which nearly led to the bankruptcy of a number of firms.

One such company,

AMC Entertainment (AMC), was able to ride a wave of retail investor interest higher. And that higher share price gave the company a second lease on life as they were able to issue new shares to raise cash and pay down debt. Now, the company is benefitting ...

Read More About This

AMC Entertainment (AMC), was able to ride a wave of retail investor interest higher. And that higher share price gave the company a second lease on life as they were able to issue new shares to raise cash and pay down debt. Now, the company is benefitting ...

Read More About This

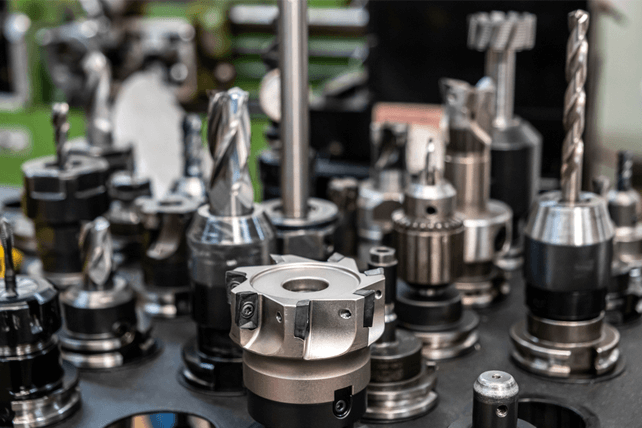

Insider Trading Report: Illinois Tool Works (ITW)

Jay Henderson, a director at

Illinois Tool Works (ITW) recently bought 10,000 shares. The buy increased his stake by over 112 percent, and came to a total purchase price of just over $2.35 million. This marks the first insider buy at the company since May 2020. Otherwise, company insiders, mostly executives, have been steady sellers of shares over the past few years. That’s true even as shares have trended higher over time. Overall, insiders at the company own 0.2 percent of shares. The ...

Read More About This

Illinois Tool Works (ITW) recently bought 10,000 shares. The buy increased his stake by over 112 percent, and came to a total purchase price of just over $2.35 million. This marks the first insider buy at the company since May 2020. Otherwise, company insiders, mostly executives, have been steady sellers of shares over the past few years. That’s true even as shares have trended higher over time. Overall, insiders at the company own 0.2 percent of shares. The ...

Read More About This

Unusual Options Activity: Nvidia (NVDA)

Shares of graphics processing company

Nvidia (NVDA) have seen a big move higher since tech stocks rebounded in the past two months. One trader sees the possibility of a sizeable pullback here. That’s based on the February $320 puts. With 93 days left until expiration, over 5,010 contracts traded against a prior open interest of 104, for a 48-fold rise in volume. The buyer of the puts paid $40.68 for the contracts on average. With shares around $300 at the moment, the ...

Read More About This

Nvidia (NVDA) have seen a big move higher since tech stocks rebounded in the past two months. One trader sees the possibility of a sizeable pullback here. That’s based on the February $320 puts. With 93 days left until expiration, over 5,010 contracts traded against a prior open interest of 104, for a 48-fold rise in volume. The buyer of the puts paid $40.68 for the contracts on average. With shares around $300 at the moment, the ...

Read More About This

This e-Commerce Play Offers Excellent Reward for the Risk

E-commerce continues to grow as a trend, with more customers making more purchases online globally. While that trend may look played out, companies are still posting record numbers.

Alibaba (BABA) just reported an 8.5 percent increase in sales for its Singles Day holiday. The downside? Growth came in at a reported a 26 percent increase from 2019 to 2020 thanks to the pandemic. While that trend is slowing, it’s still a worthwhile one, especially given how shares have performed recently. Thanks to a ...

Read More About This

Alibaba (BABA) just reported an 8.5 percent increase in sales for its Singles Day holiday. The downside? Growth came in at a reported a 26 percent increase from 2019 to 2020 thanks to the pandemic. While that trend is slowing, it’s still a worthwhile one, especially given how shares have performed recently. Thanks to a ...

Read More About This

Insider Trading Report: Cheesecake Factory (CAKE)

Edie Ames, a director at

Cheesecake Factory (CAKE) recently added 1,650 shares. The buy increased her stake by 25.6 percent, and came to a total purchase price of just under $75,000. This is the second buy from the same director this year, following a 500 share buy back in August. Otherwise, insiders have largely been sellers over the past year, with company executives selling off shares. Overall, insiders at the company own 6.8 percent of shares. Shares of the restaurant chain are up ...

Read More About This

Cheesecake Factory (CAKE) recently added 1,650 shares. The buy increased her stake by 25.6 percent, and came to a total purchase price of just under $75,000. This is the second buy from the same director this year, following a 500 share buy back in August. Otherwise, insiders have largely been sellers over the past year, with company executives selling off shares. Overall, insiders at the company own 6.8 percent of shares. Shares of the restaurant chain are up ...

Read More About This

Unusual Options Activity: Aurora Cannabis (ACB)

Shares of pot producer

Aurora Cannabis (ACB) have been trending higher in the past few weeks, thanks to strong earnings in the sector. One trader sees shares moving even higher in the coming weeks. That’s based on the December 3 $9.00 calls. Over 26,340 contracts traded against an open interest of 199, for a 221-fold jump in volume. The trade has 17 days left to play out. The buyer of the calls paid $0.70 to make the trade. With shares already rallying to ...

Read More About This

Aurora Cannabis (ACB) have been trending higher in the past few weeks, thanks to strong earnings in the sector. One trader sees shares moving even higher in the coming weeks. That’s based on the December 3 $9.00 calls. Over 26,340 contracts traded against an open interest of 199, for a 221-fold jump in volume. The trade has 17 days left to play out. The buyer of the calls paid $0.70 to make the trade. With shares already rallying to ...

Read More About This

This Slow-and-Steady Sector Could Unlock Big Profits In the 5G Boom

Lost among the shuffle of some of today’s tech trends, the 5G network continues to roll out. The technology includes faster download speeds and a better ability to use video and other tools for communication, work, and play while on the go.

It’s a trend combining a number of things from wireless chips to the location of cell towers. With many ways to profit, investors need a way to narrow down opportunities.

One such way might be to look at companies that ...

Read More About This

Read More About This

Insider Trading Report: The Scotts Miracle Grow Company (SMG)

Gerald Volas, a director at

The Scotts Miracle Grow Company (SMG), recently bought 6,000 shares. The buy increased his stake by 1,376 percent, and came to a total price of just under $1.03 million. This marks the first insider buy of the past three years. Over the past three years, company insiders from major owners to directors to executives have been exclusive sellers of shares. Company insiders of the consumer lawn and garden products company own 28 percent of shares. The stock is ...

Read More About This

The Scotts Miracle Grow Company (SMG), recently bought 6,000 shares. The buy increased his stake by 1,376 percent, and came to a total price of just under $1.03 million. This marks the first insider buy of the past three years. Over the past three years, company insiders from major owners to directors to executives have been exclusive sellers of shares. Company insiders of the consumer lawn and garden products company own 28 percent of shares. The stock is ...

Read More About This