Insider Trading Report: PennyMac Financial Services (PFSI)

Farhad Nanji, a director at

PennyMac Financial Services (PFSI), recently added 160,854 shares to his holdings. The buy increased his stake by just over 4 percent, and came to a total purchase price of $10.45 million. This follows up from a buy from the director a week before, in the amount of 282,872 shares, an $18.2 million buy. Going further back, there is a mix of insider buys and sales, with more buys from directors and sales largely from insiders. Overall, insiders own ...

Read More About This

PennyMac Financial Services (PFSI), recently added 160,854 shares to his holdings. The buy increased his stake by just over 4 percent, and came to a total purchase price of $10.45 million. This follows up from a buy from the director a week before, in the amount of 282,872 shares, an $18.2 million buy. Going further back, there is a mix of insider buys and sales, with more buys from directors and sales largely from insiders. Overall, insiders own ...

Read More About This

Unusual Options Activity: BridgeBio Pharma (BBIO)

Shares of biotech firm

BridgeBio Pharma (BBIO) have been trending down in the past year, with a big decline recently. However, one trader sees a rebound in shares in the weeks ahead. That’s based on the January $75 call options. With 50 days until expiration, over 11,795 contracts traded against a prior open interest of 119, for a 100-fold surge in volume. The buyer of the calls paid $2.22 to make the trade. Shares recently traded around $40, so the $75 calls would ...

Read More About This

BridgeBio Pharma (BBIO) have been trending down in the past year, with a big decline recently. However, one trader sees a rebound in shares in the weeks ahead. That’s based on the January $75 call options. With 50 days until expiration, over 11,795 contracts traded against a prior open interest of 119, for a 100-fold surge in volume. The buyer of the calls paid $2.22 to make the trade. Shares recently traded around $40, so the $75 calls would ...

Read More About This

The Latest Corporate Shakeup May Be a Boon for This Social Media Play

Most company executives want to leave at what they view as the top. Many aren’t fortunate in that regard. But those who succeed can also leave a company before building problems can come to the forefront, and potentially damage shareholder value.

In the short-term, the market may give the thumbs-up to a leaving CEO by giving shares a boost on optimism the next CEO will fare better.

That could be the case with

Twitter (TWTR). CEO and co-founder Jack Dorsey announced his ...

Read More About This

Twitter (TWTR). CEO and co-founder Jack Dorsey announced his ...

Read More About This

Insider Trading Report: EOG Resources (EOG)

Michael Kerr, a director at

EOG Resources (EOG), recently bought 50,000 shares. The buy increased his stake by nearly 47 percent, and came to a total purchase price of $4.3 million exactly. This marks the first insider buy at the company in the past three years. Company insiders have typically been sellers of shares. The sales have been clustered by company executives, and appears to be based on the exercise of stock options. Company insiders own just 0.4 percent of shares. Those company ...

Read More About This

EOG Resources (EOG), recently bought 50,000 shares. The buy increased his stake by nearly 47 percent, and came to a total purchase price of $4.3 million exactly. This marks the first insider buy at the company in the past three years. Company insiders have typically been sellers of shares. The sales have been clustered by company executives, and appears to be based on the exercise of stock options. Company insiders own just 0.4 percent of shares. Those company ...

Read More About This

Unusual Options Activity: Goodyear Tire & Rubber (GT)

Shares of auto parts supplier

Goodyear Tire & Rubber (GT) have been on a tear this year, more than tripling the returns on the S&P 500. One trader sees that overall trend continuing in the next few days following last week’s market pullback. That’s based on the December 10 $22 calls. With 9 days until expiration, over 5,210 contracts traded against an open interest of 107, for a 49-fold rise in volume. The buyer of the calls paid $0.35 to make the ...

Read More About This

Goodyear Tire & Rubber (GT) have been on a tear this year, more than tripling the returns on the S&P 500. One trader sees that overall trend continuing in the next few days following last week’s market pullback. That’s based on the December 10 $22 calls. With 9 days until expiration, over 5,210 contracts traded against an open interest of 107, for a 49-fold rise in volume. The buyer of the calls paid $0.35 to make the ...

Read More About This

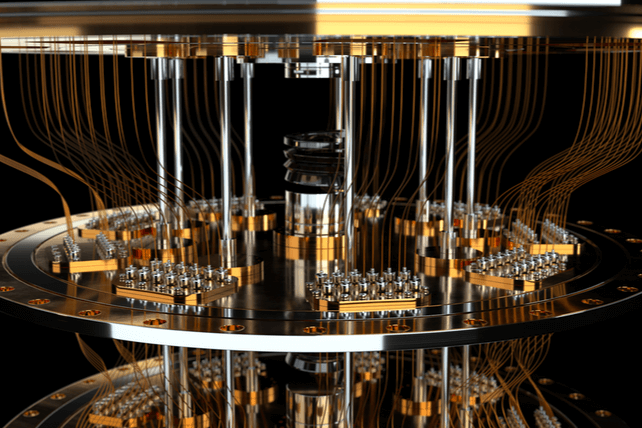

One Surprising Player May Win in the Quantum Computing Space

As a tech trend, quantum computing, a new and innovative way of processing information much more efficiently than traditional models, comes in and out of favor with investors. That hasn’t stopped a number of startup and old companies alike from working in the space.

Yet one company that’s been a recent laggard in tech is now leading the way. And it could lead to a renewed surge in lackluster share prices.

The company is

International Business Machines (IBM). The tech giant best known ...

Read More About This

International Business Machines (IBM). The tech giant best known ...

Read More About This

Insider Trading Report: Biglari Holdings (BH)

Sardar Biglari, Chairman & CEO of

Biglari Holdings (BH), recently added 28,966 more shares. The buy increased his stake by 2.25 percent, and came to a total cost of just over $4.62 million. Biglari was the most recent buyer as well with a pickup back in August, before shares traded 40 percent higher. He and other insiders have been active over the past three years, with every transaction involving the pickup of shares. Overall, insiders own 0.5 percent of company shares. Shares ...

Read More About This

Biglari Holdings (BH), recently added 28,966 more shares. The buy increased his stake by 2.25 percent, and came to a total cost of just over $4.62 million. Biglari was the most recent buyer as well with a pickup back in August, before shares traded 40 percent higher. He and other insiders have been active over the past three years, with every transaction involving the pickup of shares. Overall, insiders own 0.5 percent of company shares. Shares ...

Read More About This

Unusual Options Activity: American Airlines (AAL)

Shares of passenger carrier

American Airlines (AAL) dropped nearly 9 percent on Friday, following the announcement of a new Covid variant. One trader is betting on a rebound in the months ahead. That’s based on the June $17 calls. With 198 days until expiration, over 4,690 contracts traded, a 31-fold jump in volume from the prior open interest of 150. The buyer of the calls paid $1.19 to do so. Shares last traded around $17.75, meaning the option is already $0.75 in-the-money, an ...

Read More About This

American Airlines (AAL) dropped nearly 9 percent on Friday, following the announcement of a new Covid variant. One trader is betting on a rebound in the months ahead. That’s based on the June $17 calls. With 198 days until expiration, over 4,690 contracts traded, a 31-fold jump in volume from the prior open interest of 150. The buyer of the calls paid $1.19 to do so. Shares last traded around $17.75, meaning the option is already $0.75 in-the-money, an ...

Read More About This