Unusual Options Activity: The Walt Disney Company (DIS)

Shares of entertainment giant

The Walt Disney Company (DIS) shed over 7 percent on Thursday following lackluster earnings. Traders were active in the options market, betting that shares would soon rebound. Of several highly active trades in the company, the February $165 calls attracted 4,488 contracts against a prior interest of 111, for a 40-fold jump in volume. The buyer of the calls paid $7.85 to make the trade, which expires in 95 days. With the stock knocked down to about $162, the ...

Read More About This

The Walt Disney Company (DIS) shed over 7 percent on Thursday following lackluster earnings. Traders were active in the options market, betting that shares would soon rebound. Of several highly active trades in the company, the February $165 calls attracted 4,488 contracts against a prior interest of 111, for a 40-fold jump in volume. The buyer of the calls paid $7.85 to make the trade, which expires in 95 days. With the stock knocked down to about $162, the ...

Read More About This

Overly Bearish Analysts Point to a Rebound in this Big Data Play

With so many new technologies unfolding today, big data is sometimes lost in the shuffle. But by using algorithms and artificial intelligence data can be processed in different ways, sometimes yielding different solutions to problems or a new view of data than human intelligence can provide.

That has the potential to make huge changes to society. But it’s a story that’s somewhat out of favor right now.

Consider the case of

Palantir Technologies (PLTR). The company beat on sales in its most recent ...

Read More About This

Palantir Technologies (PLTR). The company beat on sales in its most recent ...

Read More About This

Insider Trading Report: Bed Bath & Beyond (BBBY)

Gustavo Arnal, CFO of

Bed Bath & Beyond (BBBY), recently bought 12,500 shares. The buy increased his stake by just over 4 percent, and came to a total purchase price of just over $255,000. That buy came just a few days after two different directors bought shares. One picked up 12,500 shares, paying nearly $250,000, and another bought 25,000 shares across two days. The last insider sales occurred back in July, when shares were trading more than 30 percent higher than their ...

Read More About This

Bed Bath & Beyond (BBBY), recently bought 12,500 shares. The buy increased his stake by just over 4 percent, and came to a total purchase price of just over $255,000. That buy came just a few days after two different directors bought shares. One picked up 12,500 shares, paying nearly $250,000, and another bought 25,000 shares across two days. The last insider sales occurred back in July, when shares were trading more than 30 percent higher than their ...

Read More About This

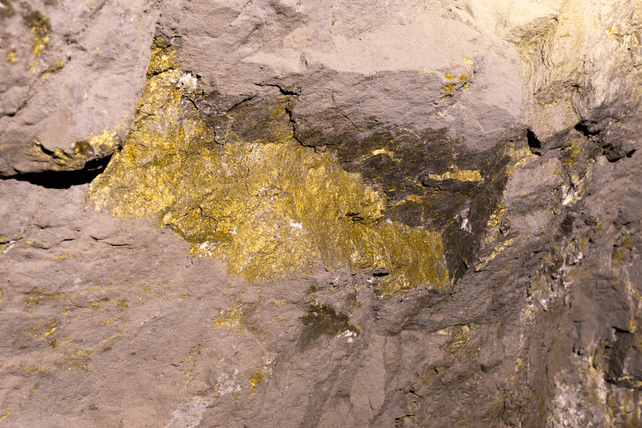

Unusual Options Activity: SSR Mining (SSRM)

Shares of gold mining company

SSR Mining (SSRM) have been trending higher in recent days, likely fueled by a rising price of gold. One trader sees the potential for a bigger move higher in the coming months. That’s based on the March $20 calls. With 125 days until expiration, 5,555 contracts traded against an open interest of 105, for a 53-fold jump in volume. The buyer of the calls paid $1.33 to make the trade. The Canadian-based gold mining company has seen shares ...

Read More About This

SSR Mining (SSRM) have been trending higher in recent days, likely fueled by a rising price of gold. One trader sees the potential for a bigger move higher in the coming months. That’s based on the March $20 calls. With 125 days until expiration, 5,555 contracts traded against an open interest of 105, for a 53-fold jump in volume. The buyer of the calls paid $1.33 to make the trade. The Canadian-based gold mining company has seen shares ...

Read More About This

Earnings Miss Overshadows Rally Potential in This Crypto Name

Cryptocurrencies are trending higher, with Bitcoin and Ethereum hitting new all-time highs in the past week. One beneficiary from this trend has been any company that either facilitates crypto trading or holds cryptocurrencies.

There’s now a short-term buying opportunity in

Coinbase (COIN), the brokerage that went public when Bitcoin first peaked earlier this year. The company’s latest earnings showed last quarter’s slowdown, and user growth was lackluster, so shares are dropping. Revenue came in at $1.3 billion instead of $1.6 billion, and ...

Read More About This

Coinbase (COIN), the brokerage that went public when Bitcoin first peaked earlier this year. The company’s latest earnings showed last quarter’s slowdown, and user growth was lackluster, so shares are dropping. Revenue came in at $1.3 billion instead of $1.6 billion, and ...

Read More About This

Insider Trading Report: Bally’s Corporation (BALY)

Lee Fenton, CEO of

Bally’s Corporation (BALY), recently bought 5,750 shares of company stock. The buy increased his stake by almost 2.5 percent, and came to a total purchase price of just under $259,000. He was joined by two division presidents as well as a president of retail, who all bought on the same date at slightly different prices. All told, this cluster of insiders bought nearly $850,000 in company shares. This marks a sharp reversal from the past three years, where insiders ...

Read More About This

Bally’s Corporation (BALY), recently bought 5,750 shares of company stock. The buy increased his stake by almost 2.5 percent, and came to a total purchase price of just under $259,000. He was joined by two division presidents as well as a president of retail, who all bought on the same date at slightly different prices. All told, this cluster of insiders bought nearly $850,000 in company shares. This marks a sharp reversal from the past three years, where insiders ...

Read More About This

Unusual Options Activity: The TJX Companies (TJX)

Shares of clothing retailing chain

The TJX Companies (TJX) have been somewhat range-bound this year, but have been rallying to the higher end of their range in the past few weeks. One trader sees the chance for a further rally past the holiday season. That’s based on the January $82.50 calls. With 71 days until expiration, 7,542 contracts traded against a prior open interest of 233, for a 34-fold rise in volume. The buyer of the calls paid $0.39 to make the ...

Read More About This

The TJX Companies (TJX) have been somewhat range-bound this year, but have been rallying to the higher end of their range in the past few weeks. One trader sees the chance for a further rally past the holiday season. That’s based on the January $82.50 calls. With 71 days until expiration, 7,542 contracts traded against a prior open interest of 233, for a 34-fold rise in volume. The buyer of the calls paid $0.39 to make the ...

Read More About This

Fear Hits this Key Digital Commerce Player

Earnings season can give a snapshot into how a company is doing. It can also give a view into how traders view a company’s prospects based on one-time events that may not have a massive bearing over the long haul.

Case in point?

PayPal (PYPL). The company reported earnings after the market close Monday, and the headline numbers were pretty solid. Shares dropped anyway. Shares of the payment giant are now slightly down for the year, having slid nearly 20 percent in the ...

Read More About This

PayPal (PYPL). The company reported earnings after the market close Monday, and the headline numbers were pretty solid. Shares dropped anyway. Shares of the payment giant are now slightly down for the year, having slid nearly 20 percent in the ...

Read More About This