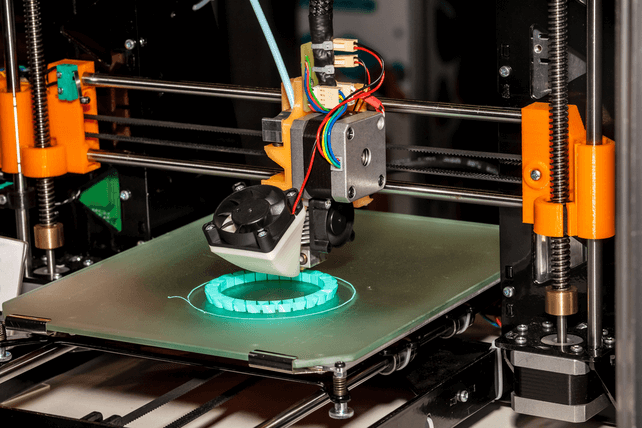

Insider Trading Report: 3D Systems Corp (DDD)

Jim Kever, a director at

3D Systems Corp (DDD), recently picked up 10,000 shares. The buy increased his holdings by 2.5 percent, and came to a total cost of just over $106,000. The buy comes one week after the company president and CEO picked up 10,141 shares, also for a total cost of around $106,000. Going back over the past three years, company insiders, including both executives and directors, have been inclined to be sellers of shares. Overall, insiders at the company own ...

Read More About This

3D Systems Corp (DDD), recently picked up 10,000 shares. The buy increased his holdings by 2.5 percent, and came to a total cost of just over $106,000. The buy comes one week after the company president and CEO picked up 10,141 shares, also for a total cost of around $106,000. Going back over the past three years, company insiders, including both executives and directors, have been inclined to be sellers of shares. Overall, insiders at the company own ...

Read More About This

Unusual Options Activity: Bank of America (BAC)

Shares of megabank

Bank of America (BAC) have shed about 13 percent in the past year. One trader sees a potential rebound playing out through the next year. That’s based on the March 2023 $50 calls. With 290 days left on the option, 12,368 contracts traded compared to a prior open interest of 367, for a 34-fold rise in volume on the trade. The buyer of the calls paid $0.55 to get into the trade. Shares recently traded for just under $37, so ...

Read More About This

Bank of America (BAC) have shed about 13 percent in the past year. One trader sees a potential rebound playing out through the next year. That’s based on the March 2023 $50 calls. With 290 days left on the option, 12,368 contracts traded compared to a prior open interest of 367, for a 34-fold rise in volume on the trade. The buyer of the calls paid $0.55 to get into the trade. Shares recently traded for just under $37, so ...

Read More About This

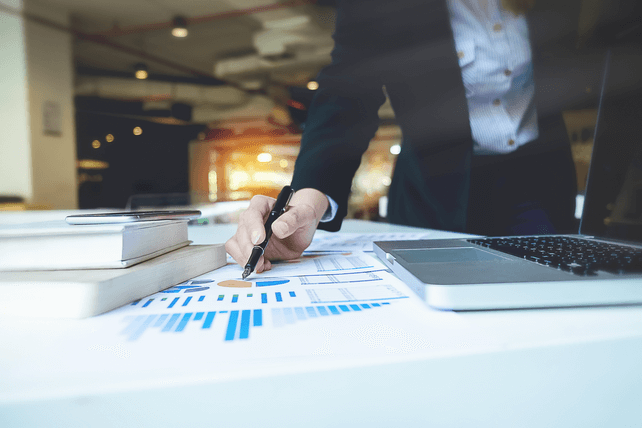

Even With Weak Earnings, Industry Leadership Matters

In a bull market, great companies will rise… but so will ones that aren’t the leaders of their sector. When markets are in turmoil, it’s industry leaders that will likely perform best, even if they’re suffering from a drop in earnings.

That can be seen with the most recent earnings season. Many companies across the board were down. But those that are leading in their industry have been faring relatively better.

Case in point? Semiconductor company

Nvidia (NVDA). The company reported revenue ...

Read More About This

Nvidia (NVDA). The company reported revenue ...

Read More About This

Insider Trading Report: Blackstone (BX)

James Breyer, a director at

Blackstone (BX), recently picked up 9,326 more shares of the company. The buy increased his holdings by 37 percent, and came to a total purchase price of just under $1,000,000. This follows from a series of buys from another director over the past four months, totaling just over 10,000 shares. Going back over the past three years, these are the only insider buys at the company, with sales by company executives and insiders occurring on a regular ...

Read More About This

Blackstone (BX), recently picked up 9,326 more shares of the company. The buy increased his holdings by 37 percent, and came to a total purchase price of just under $1,000,000. This follows from a series of buys from another director over the past four months, totaling just over 10,000 shares. Going back over the past three years, these are the only insider buys at the company, with sales by company executives and insiders occurring on a regular ...

Read More About This

Unusual Options Activity: Macy’s (M)

Shares of department store

Macy’s (M) soared nearly 20 percent last Thursday, as the company announced better-than-expected earnings. One trader sees the potential for shares to move higher. That’s based on the July $27 calls. With 46 days until expiration, 20,375 contracts traded compared to a prior open interest of 326, for a 63-fold jump in volume on the trade. The buyer of the calls paid $0.66 to get in. Shares last traded just under $23, so they would need to rise just ...

Read More About This

Macy’s (M) soared nearly 20 percent last Thursday, as the company announced better-than-expected earnings. One trader sees the potential for shares to move higher. That’s based on the July $27 calls. With 46 days until expiration, 20,375 contracts traded compared to a prior open interest of 326, for a 63-fold jump in volume on the trade. The buyer of the calls paid $0.66 to get in. Shares last traded just under $23, so they would need to rise just ...

Read More About This

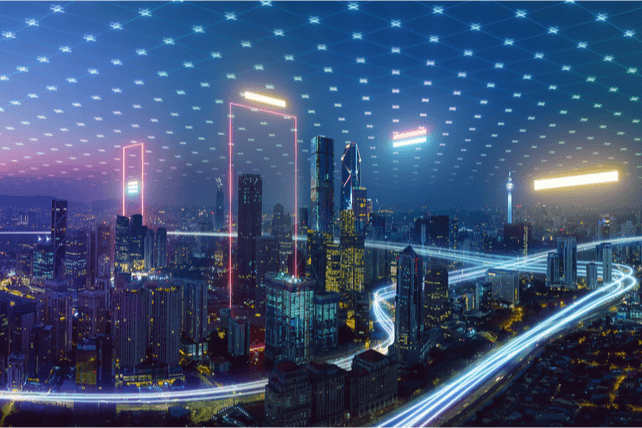

Consider Luxury Goods Amid Today’s Market Turmoil

During the Covid crisis, there was talk of a K-shaped recovery, with the wealthy seeing solid returns while those less fortunate would continue to suffer. That appears to be playing out today. While the wealthy are being hit harder by the stock market decline, they’re less vulnerable to changes in housing and energy prices.

That may be why luxury goods sales have been holding up so far this year, even as it appears most consumers are spending more to get less ...

Read More About This

Read More About This

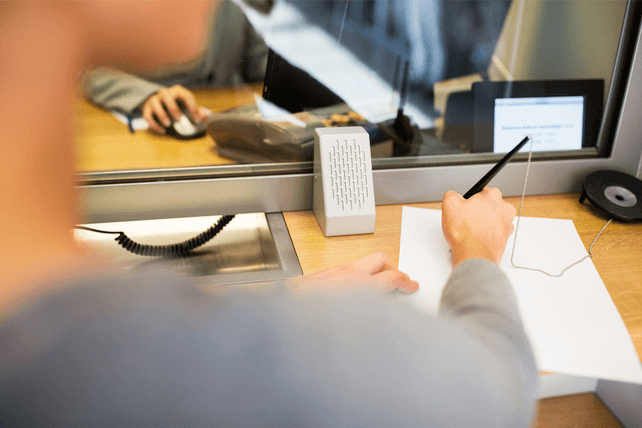

Insider Trading Report: HomeStreet Inc (HMST)

John Michel, CFO at

HomeStreet Inc (HMST), recently added 3,000 shares. The buy increased his holdings by just over 5 percent, and came to a total cost of $119,400. He was joined by the company’s CIO, who picked up 1,000 shares for just over $39,000 on the same day. And in the prior week, a company director acquired 27,000 shares. Insiders have largely been notable buyers of shares going back over the past three years, with only a handful of sales. Overall, insiders ...

Read More About This

HomeStreet Inc (HMST), recently added 3,000 shares. The buy increased his holdings by just over 5 percent, and came to a total cost of $119,400. He was joined by the company’s CIO, who picked up 1,000 shares for just over $39,000 on the same day. And in the prior week, a company director acquired 27,000 shares. Insiders have largely been notable buyers of shares going back over the past three years, with only a handful of sales. Overall, insiders ...

Read More About This

Unusual Options Activity: Avaya Holdings (AVYA)

Shares of digital communications company

Avaya Holdings (AVYA) have been sliding in recent months. One trader sees further downside ahead in the coming days. That’s based on the June 17th $3.00 put option. With 21 days until expiration, 20,384 contracts traded hands, compared to a prior open interest of 368, for a 57-fold rise in volume on the trade. The buyer of the puts paid $0.53 to bet on a further downside. Shares recently traded for about $3.20, so they’d need to fall ...

Read More About This

Avaya Holdings (AVYA) have been sliding in recent months. One trader sees further downside ahead in the coming days. That’s based on the June 17th $3.00 put option. With 21 days until expiration, 20,384 contracts traded hands, compared to a prior open interest of 368, for a 57-fold rise in volume on the trade. The buyer of the puts paid $0.53 to bet on a further downside. Shares recently traded for about $3.20, so they’d need to fall ...

Read More About This