One Way to Play to This Top Long-Term Investment Strategy Now

In frustrating markets, a few long-term strategies can work well that investors may want to consider now. One such strategy is to invest in companies that pay dividends. Taking that approach gives investors a longer-term view.

Within the dividend-paying universe, companies that have a history of raising their dividends tend to perform even better than those that just pay a dividend. Over time, the results can compound for market-beating performance, as long as investors remain patient.

One such company that just raised ...

Read More About This

Read More About This

Insider Trading Report: Rocket Companies (RKT)

Jay Farner, CEO at

Rocket Companies (RKT), recently added 45,900 shares. The buy increased his holdings by nearly 2 percent, and came to a total purchase price of around $400,000. This follows up on other buys from the company CEO since the start of the year. Each buy is usually in the $400,000 to $600,000 area. The last insider sale at the company occurred in March 2021. Overall, insiders at the company own about 1.7 percent of shares. The mortgage company provider has ...

Read More About This

Rocket Companies (RKT), recently added 45,900 shares. The buy increased his holdings by nearly 2 percent, and came to a total purchase price of around $400,000. This follows up on other buys from the company CEO since the start of the year. Each buy is usually in the $400,000 to $600,000 area. The last insider sale at the company occurred in March 2021. Overall, insiders at the company own about 1.7 percent of shares. The mortgage company provider has ...

Read More About This

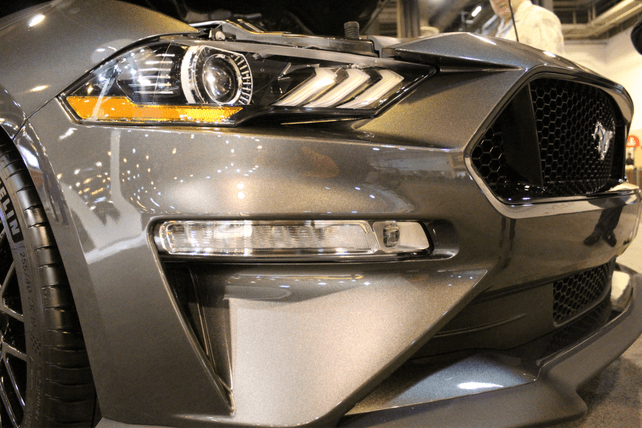

Unusual Options Activity: Ford Motor Company (F)

Shares of

Ford Motor Company (F) are down about 15 percent in the past year. One trader sees the potential for the company to drop further in the coming weeks. That’s based on the July $16 puts. With 38 days until expiration, 15,636 contracts traded compared to a prior open interest of 521, for a 30-fold rise in volume on the trade. The buyer of the puts paid $2.59 to get into the trade. Shares recently traded for about $13.50, so the $16 ...

Read More About This

Ford Motor Company (F) are down about 15 percent in the past year. One trader sees the potential for the company to drop further in the coming weeks. That’s based on the July $16 puts. With 38 days until expiration, 15,636 contracts traded compared to a prior open interest of 521, for a 30-fold rise in volume on the trade. The buyer of the puts paid $2.59 to get into the trade. Shares recently traded for about $13.50, so the $16 ...

Read More About This

Separate the Growth Plays from the Hype Plays for Big Profits Ahead

Growth investing isn’t dead. But companies that were posting strong growth in the past year are either going to falter now that the economy has slowed – or they’ll continue to show that they’re strong growth plays in the years ahead.

Investors can follow some big trends seeing capital flows and deals occurring now to get an idea of where the best opportunities are for growth stocks. One such trend still seeing investor interest right now is in AI.

Otherwise known as ...

Read More About This

Read More About This

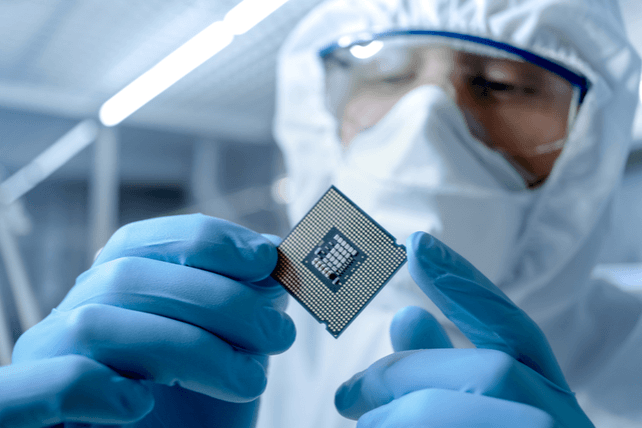

Insider Trading Report: Wolfspeed (WOLF)

Loan Le Duy, a director at

Wolfspeed (WOLF), recently bought 1,000 shares. The buy increased his holdings by nearly 5 percent, and came to a total price of just over $75,000. This follows up on a number of other buys in the past month, including a 4,000 share buy from the President and CEO, and a buy from a director for just over $500,000. Insiders have been buyers for the past year, but have been more mixed over the last three years. Overall, ...

Read More About This

Wolfspeed (WOLF), recently bought 1,000 shares. The buy increased his holdings by nearly 5 percent, and came to a total price of just over $75,000. This follows up on a number of other buys in the past month, including a 4,000 share buy from the President and CEO, and a buy from a director for just over $500,000. Insiders have been buyers for the past year, but have been more mixed over the last three years. Overall, ...

Read More About This

Unusual Options Activity: Park Hotels & Resorts (PK)

Shares of hotel proprietor

Park Hotels & Resorts (PK) have been trading in a range for the past year. One trader sees some potential downside in the weeks ahead. That’s based on the July $17.50 put. With 39 days until expiration, 6,748 contracts traded compared to a prior open interest of 149, for a 49-fold rise in volume on the trade. The buyer of the puts paid $0.73 to make the downside bet. Share recently traded just over $18.50, so the stock ...

Read More About This

Park Hotels & Resorts (PK) have been trading in a range for the past year. One trader sees some potential downside in the weeks ahead. That’s based on the July $17.50 put. With 39 days until expiration, 6,748 contracts traded compared to a prior open interest of 149, for a 49-fold rise in volume on the trade. The buyer of the puts paid $0.73 to make the downside bet. Share recently traded just over $18.50, so the stock ...

Read More About This

For Long-Term Results, look to the Companies Consolidating Now

When the economy sours and the business outlook drops, some companies look for an opportunity to increase their business with strategic acquisitions. Those companies can increase their industry dominance and become stronger over time, and shares will likely rally as the economy does.

As long as such deals pass regulatory muster, large companies that buy up other companies to grow through acquisition can likely see further growth in the years ahead.

One company making long-term strategic moves now is

Oracle (ORCL). The database ...

Read More About This

Oracle (ORCL). The database ...

Read More About This

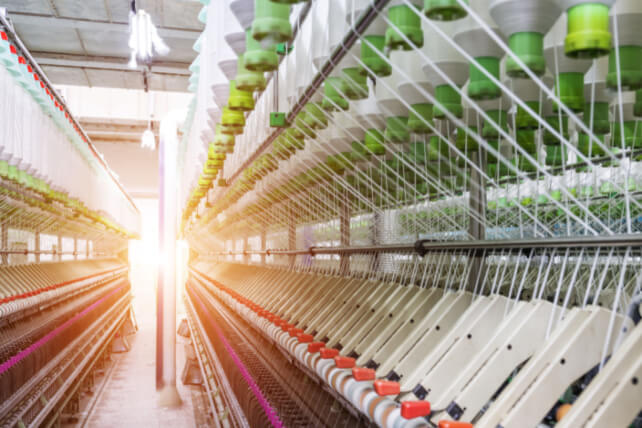

Insider Trading Report: VF Corp (VFC)

Rodney McMullin, a director at

VF Corp (VFC) recently bought 3,000 shares. The buy increased his stake by nearly 12 percent, and came to a total cost of just under $150,000. That’s the fourth such buy from the director this year. The other three buys were also for 3,000 shares each. Going further back, there’s a mix of both insider buying and selling, by both directors and C-suite executives. Overall, company insiders own about 5.5 percent of shares. Shares of the apparel manufacturer ...

Read More About This

VF Corp (VFC) recently bought 3,000 shares. The buy increased his stake by nearly 12 percent, and came to a total cost of just under $150,000. That’s the fourth such buy from the director this year. The other three buys were also for 3,000 shares each. Going further back, there’s a mix of both insider buying and selling, by both directors and C-suite executives. Overall, company insiders own about 5.5 percent of shares. Shares of the apparel manufacturer ...

Read More About This