Insider Trading Report: Thor Industries (THOR)

Todd Woelfer, Chief Operating Officer at

Thor Industries (THOR), recently added 1,225 shares. The buy increased his holdings by 1.8 percent, and came to a total price of just under $100,000. This follows up on some recent buys from company insiders in the past few months, including two director buys back in June. Buying activity goes back to last December, with insider sales earlier in 2021. Overall, insiders at the company own about 4.5 percent of shares. The recreational vehicle manufacturing company is ...

Read More About This

Thor Industries (THOR), recently added 1,225 shares. The buy increased his holdings by 1.8 percent, and came to a total price of just under $100,000. This follows up on some recent buys from company insiders in the past few months, including two director buys back in June. Buying activity goes back to last December, with insider sales earlier in 2021. Overall, insiders at the company own about 4.5 percent of shares. The recreational vehicle manufacturing company is ...

Read More About This

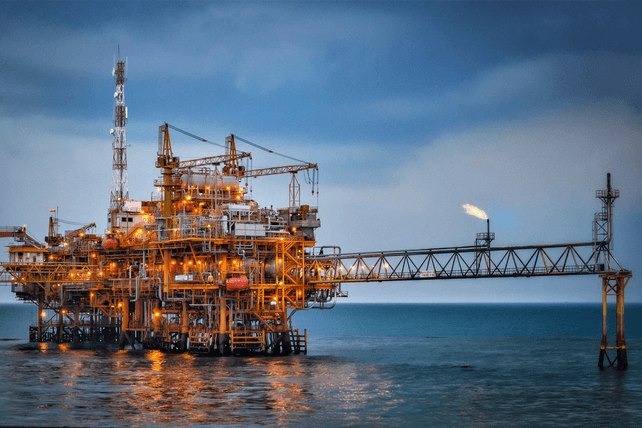

Unusual Options Activity: Transocean (RIG)

Shares of offshore oil and gas equipment company

Transocean (RIG) are down about 30 percent in the past year, even as energy prices have been rising. One trader sees the potential for a further decline in shares in the next 11 months. That’s based on the May 2023 $1.50 puts. With 308 days until expiration, 15,308 contracts traded compared to a prior open interest of 104, for a massive 147-fold rise in volume on the trade. The buyer of the puts paid ...

Read More About This

Transocean (RIG) are down about 30 percent in the past year, even as energy prices have been rising. One trader sees the potential for a further decline in shares in the next 11 months. That’s based on the May 2023 $1.50 puts. With 308 days until expiration, 15,308 contracts traded compared to a prior open interest of 104, for a massive 147-fold rise in volume on the trade. The buyer of the puts paid ...

Read More About This

Now’s The Time to Look for Well-Managed Companies Lagging Peers

A company’s management can make or break a business. Some managers are so good that they can even become household names. Most aren’t so lucky. That’s how rare that quality is.

In today’s markets, with nearly everything selling off, great companies with strong management are seeing their share price sag even if they’re setting up their business to prosper with the next economic turnaround.

One case in point is Jamie Dimon, CEO at

JPMorgan Chase (JPM). The bank has sagged nearly 30 percent ...

Read More About This

JPMorgan Chase (JPM). The bank has sagged nearly 30 percent ...

Read More About This

Insider Trading Report: Schnitzer Steel Industries (SCHN)

Wayland Hicks, a director at

Schnitzer Steel Industries (SCHN), recently added 2,000 shares. The buy increased the director’s stake by just under 2 percent, and came to a total purchase price of $61,700. This marks the first insider buy at the company in the past three years. Company insiders, including both executives and directors, have been regular sellers of shares over the past three years, largely clustered around the issuance of stock options. Overall, insiders at the company own 5.8 percent of ...

Read More About This

Schnitzer Steel Industries (SCHN), recently added 2,000 shares. The buy increased the director’s stake by just under 2 percent, and came to a total purchase price of $61,700. This marks the first insider buy at the company in the past three years. Company insiders, including both executives and directors, have been regular sellers of shares over the past three years, largely clustered around the issuance of stock options. Overall, insiders at the company own 5.8 percent of ...

Read More About This

Unusual Options Activity: Amazon (AMZN)

Shares of tech and retail giant

Amazon (AMZN) are more than 40 percent off of their 52-week high after adjusting for the stock’s recent share split. One trader sees a rebound in shares in the latter half of the year. That’s based on the December $166 calls. With 155 days until expiration, 3,019 contracts traded compared to a prior open interest of 124, for a 24-fold rise in volume on the trade. The buyer of the calls paid $0.86 to make a ...

Read More About This

Amazon (AMZN) are more than 40 percent off of their 52-week high after adjusting for the stock’s recent share split. One trader sees a rebound in shares in the latter half of the year. That’s based on the December $166 calls. With 155 days until expiration, 3,019 contracts traded compared to a prior open interest of 124, for a 24-fold rise in volume on the trade. The buyer of the calls paid $0.86 to make a ...

Read More About This

Keep Accumulating Industry-Leading, Inflation-Beating Consumer Goods Plays Here

Markets can turn on a dime. One piece of good news, whether from earnings reports, the Federal Reserve, or a change in government policy could turn around the current market fears. While there may be more downside first, that just gives investors a few extra weeks or even months to buy great companies at reasonable prices.

That’s especially true when buying shares of consumer goods companies. These stocks tend to trade at a premium, but can become a reasonable value in ...

Read More About This

Read More About This

Insider Trading Report: Earthstone Energy (ESTE)

Jay Joliat, a director at

Earthstone Energy (ESTE), added 20,237 shares. The buy increased his holdings by nearly 10 percent, and came to a total price just under $236,000. This marks the first insider buy at the company since early 2021. Otherwise, company insiders, including both executives and directors. Over the past three years, the insider sales have been relatively consistent, with only a few periods of insider buys. Overall, insiders own just over 10 percent of the company. Shares of the energy ...

Read More About This

Earthstone Energy (ESTE), added 20,237 shares. The buy increased his holdings by nearly 10 percent, and came to a total price just under $236,000. This marks the first insider buy at the company since early 2021. Otherwise, company insiders, including both executives and directors. Over the past three years, the insider sales have been relatively consistent, with only a few periods of insider buys. Overall, insiders own just over 10 percent of the company. Shares of the energy ...

Read More About This

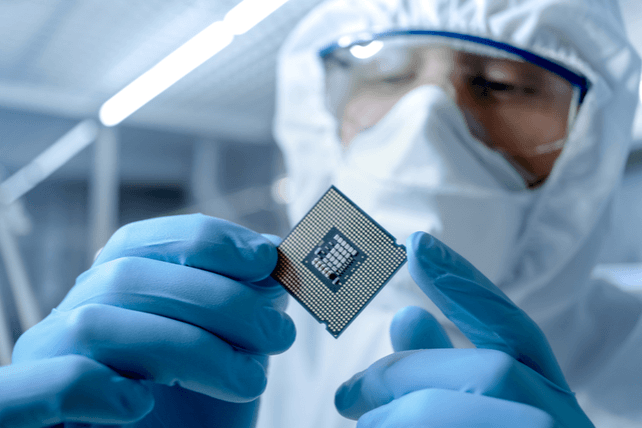

Unusual Options Activity: Micron Technology (MU)

Shares of semiconductor company

Micron Technology (MU) have lost one-quarter of their value in the past year. One trader sees a possibility for further downside in the months ahead. That’s based on the December $52.50 puts. With 156 days left until expiration, 14,048 contracts traded compared to a prior open interest of 500, for a 28-fold rise in volume on the trade. The buyer of the puts paid $4.28 to bet on shares further declining. Shares recently traded for about $57.80, so they’d ...

Read More About This

Micron Technology (MU) have lost one-quarter of their value in the past year. One trader sees a possibility for further downside in the months ahead. That’s based on the December $52.50 puts. With 156 days left until expiration, 14,048 contracts traded compared to a prior open interest of 500, for a 28-fold rise in volume on the trade. The buyer of the puts paid $4.28 to bet on shares further declining. Shares recently traded for about $57.80, so they’d ...

Read More About This