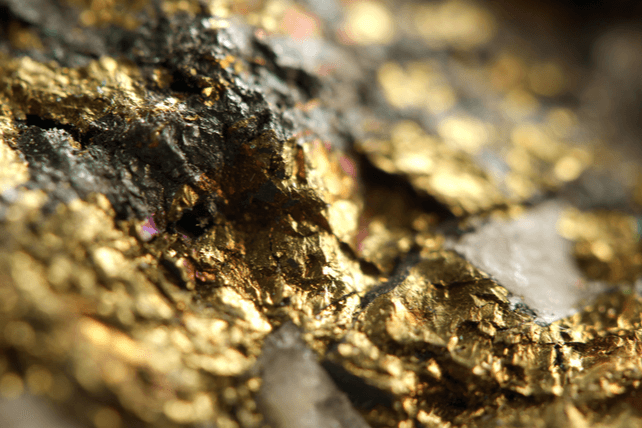

Unusual Options Activity: Newmont Corporation (NEM)

Shares of gold mining firm

Newmont Corporation (NEM) have shed 27 percent of their value over the past year, as gold has failed to keep up with inflation. One trader sees the potential for a rebound in the months ahead. That’s based on the December $50 calls. With 137 days until expiration, 5,411 contracts traded compared to a prior open interest of 314, for a 17-fold rise in volume on the trade. The buyer of the calls paid $0.80. Shares recently traded around ...

Read More About This

Newmont Corporation (NEM) have shed 27 percent of their value over the past year, as gold has failed to keep up with inflation. One trader sees the potential for a rebound in the months ahead. That’s based on the December $50 calls. With 137 days until expiration, 5,411 contracts traded compared to a prior open interest of 314, for a 17-fold rise in volume on the trade. The buyer of the calls paid $0.80. Shares recently traded around ...

Read More About This

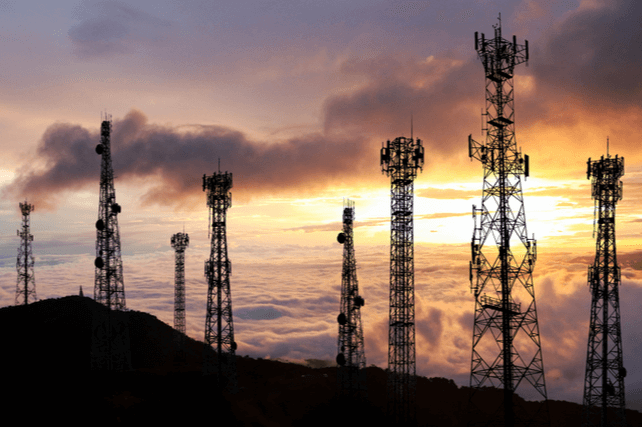

Stick With Earnings Winners in Today’s Economy

Earnings season is coming in mixed. It often does. In a bull market, a few misses can be written off. In a bear market… companies that miss tend to get punished.

While that creates a potential buying opportunity, companies that miss in multiple quarters could be in for some rough performance. Traders looking for companies moving higher ahead of the rest of the market should focus on companies beating on earnings now.

One such play is

T-Mobile US (TMUS). The wireless telecom play ...

Read More About This

T-Mobile US (TMUS). The wireless telecom play ...

Read More About This

Insider Trading Report: Conagra Brands Inc (CAG)

Emanuel Chirico, a director at

Conagra Brands Inc (CAG), recently picked up 30,000 shares. The buy increased his stake by just over 29 percent, and came to a total purchase price just over $1.02 million. This purchase marks the last insider buy since last July. There have only been a few modest buys from insiders over the past three years. For the most part, company insiders, including both directors and executives, have largely been sellers of shares. Overall, insiders at the company own ...

Read More About This

Conagra Brands Inc (CAG), recently picked up 30,000 shares. The buy increased his stake by just over 29 percent, and came to a total purchase price just over $1.02 million. This purchase marks the last insider buy since last July. There have only been a few modest buys from insiders over the past three years. For the most part, company insiders, including both directors and executives, have largely been sellers of shares. Overall, insiders at the company own ...

Read More About This

Unusual Options Activity: Shopify (SHOP)

Shares of online retailer

Shopify (SHOP) have shed nearly 80 percent of their value in the past year as tech stock valuations have dropped. One trader sees shares potentially stabilizing and moving higher from here. That’s based on the November $25 calls. With 112 days until expiration, 25,039 contracts traded compared to a prior open interest of 115, for a staggering 218-fold jump in volume on the trade. The buyer of the calls paid $12.35 to get in. The stock recently traded just ...

Read More About This

Shopify (SHOP) have shed nearly 80 percent of their value in the past year as tech stock valuations have dropped. One trader sees shares potentially stabilizing and moving higher from here. That’s based on the November $25 calls. With 112 days until expiration, 25,039 contracts traded compared to a prior open interest of 115, for a staggering 218-fold jump in volume on the trade. The buyer of the calls paid $12.35 to get in. The stock recently traded just ...

Read More About This

High Profit Margin Companies Will Win in Time

The current earnings season is showing which companies can fare well with high inflation right now, and which companies are struggling. While a company may report far different earnings than average right now, companies with high profit margins will likely continue to grow in time.

That’s because these companies can either reinvest at a high rate of return, or give capital back to shareholders via dividends or share buybacks.

One company faring well right now and posting a strong profit margin is

Visa ...

Read More About This

Visa ...

Read More About This

Insider Trading Report: Baker Hughes Company (BKR)

Michael Dumais, a director at

Baker Hughes Company (BKR), recently added 10,000 shares. The buy increased his holdings by nearly 67 percent, and came to a total price of just under $244,000. This marks the first insider buy at the company since September 2020. Otherwise, company insiders have been regular and steady sellers of shares in the past two years, with a more even mix of buyers and sellers going back to 2019 and early 2020. Overall, insiders at the company own about ...

Read More About This

Baker Hughes Company (BKR), recently added 10,000 shares. The buy increased his holdings by nearly 67 percent, and came to a total price of just under $244,000. This marks the first insider buy at the company since September 2020. Otherwise, company insiders have been regular and steady sellers of shares in the past two years, with a more even mix of buyers and sellers going back to 2019 and early 2020. Overall, insiders at the company own about ...

Read More About This

Unusual Options Activity: Rollins Inc. (ROL)

Shares of pesticide control company

Rollins Inc. (ROL) have traded flat over the past year. One trader sees the possibility for a decline in the weeks ahead. That’s based on the August $35 puts. With 22 days until expiration, 12,561 contracts traded compared to a prior open interest of 206, for a 61-fold rise in volume on the trade. The buyer of the puts paid $1.88 to get into the trade. The stock recently traded just over $36, so the stock would need ...

Read More About This

Rollins Inc. (ROL) have traded flat over the past year. One trader sees the possibility for a decline in the weeks ahead. That’s based on the August $35 puts. With 22 days until expiration, 12,561 contracts traded compared to a prior open interest of 206, for a 61-fold rise in volume on the trade. The buyer of the puts paid $1.88 to get into the trade. The stock recently traded just over $36, so the stock would need ...

Read More About This

Beat the Bear Market with Safe Companies Now

Traders have largely priced in a recession, with slowing growth all but certain for some time to come. The slowdown is being done in order to combat high inflation. Part of that is to lower prices. That could cause some big changes for retail companies.

Investors already saw

Walmart (WMT) warn that they would miss their full-year profit target, as a number of items would have to go on sale in order for the company to clear its excess inventory. While that’s tough ...

Read More About This

Walmart (WMT) warn that they would miss their full-year profit target, as a number of items would have to go on sale in order for the company to clear its excess inventory. While that’s tough ...

Read More About This