Insider Activity Report: Fidelity National Information Services (FIS)

Jeffrey Goldstein, a director at Fidelity National Information Services (FIS), recently bought 626 shares. The buy increased his stake by 6%, and came to a total cost of $55,245.

The director has been a buyer in each of the past two quarters, for about the same dollar amount. Other directors were buyers at the start of 2024 and into last year. The company CEO sold about 15% of his position in mid-2023, cashing out for about $187,000.

Overall, FIS insiders own ...

Read More About This

Read More About This

Unusual Options Activity: Walgreens Boots Alliance (WBA)

Drugstore chain Walgreens Boots Alliance (WBA) has been a poor performer, with shares cut in half over the past year. One trader sees shares bouncing higher into the end of the year.

That’s based on the December 20 $12.50 calls. With 59 days until expiration, 20,753 contracts traded compared to a prior open interest of 332, for a 63-fold rise in volume on the trade. The buyer of the calls paid $0.28 to make the bullish bet.

Walgreens shares recently traded for ...

Read More About This

Read More About This

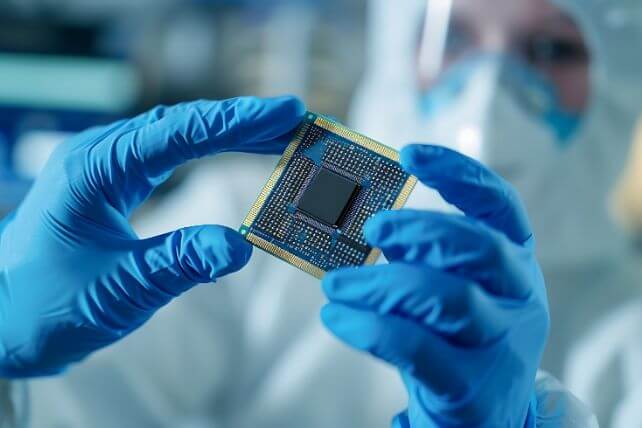

Buy the Facts, Not the Fears in this Tech Play

Last week saw some volatility in the chipmaker stocks. With earnings season underway, some swings are always likely. There’s been some jockeying in recent years as companies have worked to retool for the AI boom.

Shifting market share can lead to big moves in a stock. But some chipmaker suppliers are also in a strong position to benefit no matter which chipmaker comes out with the latest model. These companies benefit from the overall increase in chip sales.

That’s great for chipmaking ...

Read More About This

Read More About This

Insider Activity Report: Atlas Energy Solutions (AESI)

Gregory Shepard, a major holder at Atlas Energy Solutions (AESI), recently bought 2,200 shares. The buy increased his position by less than 1%, and came to a total cost of $43,736.

Shepard was the last buyer of shares with a 3,248 share pickup for just over $70,000 back in July, and further pickups in the mid-six-figure range earlier in the year. A few other major holders have been gradually selling off their position in recent months.

Overall, Atlas insiders own 42.7% ...

Read More About This

Read More About This

Unusual Options Activity: DigitalBridge Group (DBRG)

Digital infrastructure operator DigitalBridge Group (DBRG) has traded flat over the past year. One trader sees the potential for shares to decline over the coming weeks.

That’s based on the November 15 $14 puts. With 27 days until expiration, 5,179 contracts traded compared to a prior open interest of 116, for a 45-fold rise in volume on the trade. The buyer of the puts paid $0.15 to make the bearish bet.

Digital Bridge shares recently traded for about $15.85, so the stock ...

Read More About This

Read More About This

As the Market Boom Continues, Invest with Investment Banks

As financial markets trend higher, trading fees and an increase in other market activity is driving the profits of big banks higher. Even with shifting interest rates, which some have seen as a potential drag on productivity, Wall Street banks are on set to grow their profits.

In fact, many of the big banks have seen a surge in fixed-income activity, likely from investors looking to lock in high rates ahead of the Federal Reserve’s first interest rate cut.

That’s allowed firms ...

Read More About This

Read More About This

Insider Activity Report: Marvell Technology (MRVL)

Matthew Murphy, CEO and Chairman at Marvell Technology (MRVL), recently bought 13,000 shares. The buy increased his stake by 6%, and came to a total cost of just over $1 million.

This marks the first insider buy since June, when a company director bought 1,923 shares at a cost of just over $100,000. Otherwise, there have been several insider sales, including two from the company CFO. Generally, insiders have been more likely to be sellers over the past two years.

Overall, Read More About This

Unusual Options Activity: American Airlines (AAL)

Airliner American Airlines (AAL) is up 12% over the past year, with half that gain coming following the company’s latest earnings report. One trader sees shares continuing higher over the coming weeks.

That’s based on the November 29 $13 calls. With 42 days until expiration, 71,983 contracts traded compared to a prior open interest of 192, for a 375-fold rise in volume on the trade. The buyer of the calls paid $0.82 to make the bullish bet.

American Airlines recently traded for ...

Read More About This

Read More About This