Another Hardware Play Joins the AI Boom

We’re nearly two years into a bull market driven by AI. We’ve seen big tech companies soar as new AI programs have rolled out. More recently, investors have turned to data centers, and now nuclear energy as ways to benefit from this rollout.

There’s one more component that’s starting to gain attention and traction for the AI boom. It’s a hardware play that’s been overlooked among the massive demand for GPUs and servers.

The play? Hard drive storage. No matter how complicated ...

Read More About This

Read More About This

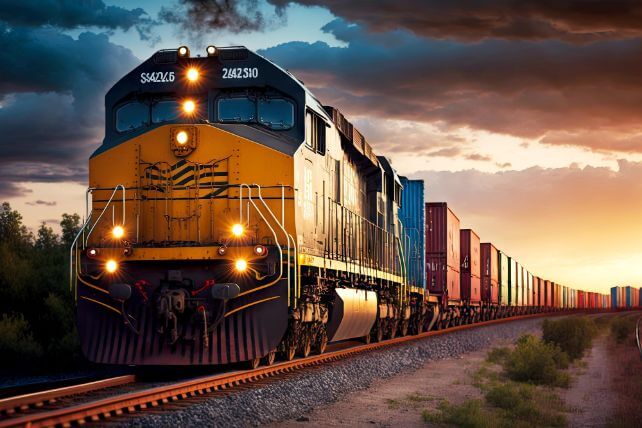

Insider Activity Report: Norfolk Southern (NSC)

Two directors at Norfolk Southern (NSC), Sameh Fahmy and Richard Anderson, both bought 1,000 shares. Both paid just over $255,000 to make their buys, which increased their stakes by 11% and 33%, respectively.

Fahmy was the last director to buy with another 1,000 share pickup in early August, at a lower price of $244,000. Otherwise, there have been two insider sales this year, one of which came from a former CEO. Multiple directors have been buyers going back into the spring.

Overall, ...

Read More About This

Read More About This

Unusual Options Activity: General Motors (GM)

Car manufacturer General Motors (GM) has soared 94% over the past year, seeing more than twice the gains of the S&P 500. One trader sees a pullback in shares occurring over the next year.

That’s based on the September 2025 $47 puts. With 325 days until expiration, 10,000 contracts traded compared to a prior open interest of 170, for a 59-fold rise in volume on the trade. The buyer of the puts paid $3.35 to make the bearish bet.

General Motors shares ...

Read More About This

Read More About This

AI Spending Trends Point to a Strong Future For this Software Giant

Investors have spent the past few quarters looking at how companies are spending on AI. Some of that is to see how that spending is impacting the bottom line. Companies that spend without early results are starting to get punished.

Likewise, companies that have been investing in AI and are seeing a payoff are being rewarded by the market. Companies that can grow their AI-driven services, even if they spend more on AI, could be winning trades for investors.

For instance, workflow ...

Read More About This

Read More About This

Insider Activity Report: Texas Capital Bancshares (TCBI)

Robert Stallings, a director at Texas Capital Bancshares (TCBI), recently bought 20,000 shares. The buy increased his position by 3%, and came to a total cost of $425,600.

Stallings has been a monthly buyer of shares with buys as high as $580,000 of shares at one time. Another company director was a buyer of 2,000 shares in February for $117,560. There have been no insider sales over the past year.

Overall, Texas Capital Bancshares insiders own 1.6% of shares.

The regional bank ...

Read More About This

Read More About This

Unusual Options Activity: Wynn Resorts (WYNN)

Hotel and casino operator Wynn Resorts (WYNN) is up 12% over the past year, but shares were underwater until a large rally last month. One trader sees the stock trending higher into the spring.

That’s based on the March 2025 $87.50 calls. With 144 days until expiration, 38,508 contracts traded compared to a prior open interest of 102, for a massive 378-fold jump in volume on the option contract. The buyer of the calls paid $15.15 to make the bullish bet.

Wynn ...

Read More About This

Read More About This

Short-Term Fears Create Reasonable Long-Term Buying Opportunities

The stock market often climbs the “wall of worry.” Any negative event, no matter how small, seems like a potential threat to a stock that’s been rallying. Over time, most negative events look like little more than a speed bump on a long-term stock chart.

Even the Crash of 1987, when stocks slid 19% in a day doesn’t look so bad on a multi-decade chart. For traders, smaller selloffs from short-term news events can be a top time to buy.

One possible ...

Read More About This

Read More About This

Insider Activity Report: NerdWallet (NRDS)

Topline Capital Partners, a major holder of NerdWallet (NRDS), recently bought 461,777 shares. The buy increased the fund’s stake by 10%, and came to a total cost of $5,275,974.

This marks the first buy since September 2023, when the company CEO bought $255,676 of shares. Otherwise, company insiders have been slight sellers of shares, with two directors and a company Vice President selling off small amounts of their positions. Overall, more insiders have sold, but buying has far exceeded selling.

Overall, Read More About This