Unusual Options Activity: PulteGroup (PHM)

Shares of homebuilder

PulteGroup (PHM) have been sliding in recent months. But one investor sees the possibility for a rally in the coming months. That’s based on the July $45 calls. With 92 days until expiration, 27,149 contracts traded compared to a prior open interest of 119, for a 228-fold rise in volume on the trade. The buyer of the calls paid $2.18 to get into the trade. Shares recently traded for just under $42, so shares would need to rally about ...

Read More About This

PulteGroup (PHM) have been sliding in recent months. But one investor sees the possibility for a rally in the coming months. That’s based on the July $45 calls. With 92 days until expiration, 27,149 contracts traded compared to a prior open interest of 119, for a 228-fold rise in volume on the trade. The buyer of the calls paid $2.18 to get into the trade. Shares recently traded for just under $42, so shares would need to rally about ...

Read More About This

Downgrades For Top Companies Offer a Counter-Intuitive Buying Opportunity

Wall Street analysts tend to be quick to upgrade stocks that are rallying, and quick to downgrade a stock after it’s fallen. Traders who take the opposite tack tend to cash out during a rally, and tend to end up buying in when shares are at a bargain price.

With many companies already down heavily, it’s no surprise that downgrades continue to trickle in, even though the worst may have passed for the stock market for some time.

Case in point?

Nvidia (NVDA) ...

Read More About This

Nvidia (NVDA) ...

Read More About This

Insider Trading Report: Confluent (CFLT)

Brad Gerstner, a major owner at

Confluent (CFLT), recently added 439,200 shares. The buy increased his holdings by 8.3 percent, and came to a total price of just over $17.1 million. That follows up on two buys he also made in the last month, one for 175,000 shares just over $6.7 million, and one for 201,700 shares for just over $7 million. Going back further, company insiders have been more prone to sell shares. Insiders own just under 0.4 percent of the ...

Read More About This

Confluent (CFLT), recently added 439,200 shares. The buy increased his holdings by 8.3 percent, and came to a total price of just over $17.1 million. That follows up on two buys he also made in the last month, one for 175,000 shares just over $6.7 million, and one for 201,700 shares for just over $7 million. Going back further, company insiders have been more prone to sell shares. Insiders own just under 0.4 percent of the ...

Read More About This

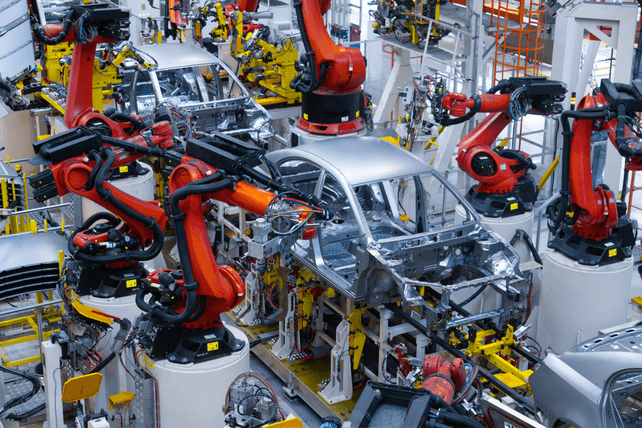

Unusual Options Activity: General Motors (GM)

Shares of

General Motors (GM) are near a 52-week low thanks to high inflation, supply chain shortages impacting auto production, and the view of a slowing economy. One trader is betting on a rebound in the coming weeks. That’s based on the June $42 calls. With 65 days until expiration, 24,263 contracts traded hands, a 144-fold surge in volume compared to the prior open interest of 169. The buyer of the calls paid $2.32 to get into the trade. Shares recently traded just ...

Read More About This

General Motors (GM) are near a 52-week low thanks to high inflation, supply chain shortages impacting auto production, and the view of a slowing economy. One trader is betting on a rebound in the coming weeks. That’s based on the June $42 calls. With 65 days until expiration, 24,263 contracts traded hands, a 144-fold surge in volume compared to the prior open interest of 169. The buyer of the calls paid $2.32 to get into the trade. Shares recently traded just ...

Read More About This

The Best Market Defense Is… A Good Defense Stock

Historically, defense stocks haven’t necessarily related to the defense and aerospace industry. However, in today’s economic and geopolitical climate, it’s not a bad place to look.

The space has tended to consistently outperform the overall stock market, and even with a spike in recent weeks, shares of many big names haven’t reached an overvalued level right now. That points to further moves higher, even if geopolitical tensions calm down.

One such name in the space is

General Dynamics (GD). The defense company trades ...

Read More About This

General Dynamics (GD). The defense company trades ...

Read More About This

Insider Trading Report: Dave & Buster’s Entertainment (PLAY)

Kevin Sheehan, Interim CEO at

Dave & Buster’s Entertainment (PLAY), recently added 10,000 shares. The buy increased his holdings by 6.5 percent, and came to a total purchase price of $405,800. This marks the first insider buy of the year. The CEO was the last buyer of 2021 as well. However, other companies insiders, all C-suite executives, have all been regular sellers of shares going back to 2019. Overall, insiders own about 2.2 percent of the company. Shares of the entertainment company are ...

Read More About This

Dave & Buster’s Entertainment (PLAY), recently added 10,000 shares. The buy increased his holdings by 6.5 percent, and came to a total purchase price of $405,800. This marks the first insider buy of the year. The CEO was the last buyer of 2021 as well. However, other companies insiders, all C-suite executives, have all been regular sellers of shares going back to 2019. Overall, insiders own about 2.2 percent of the company. Shares of the entertainment company are ...

Read More About This

Unusual Options Activity: Carnival Cruise Lines (CCL)

Shares of

Carnival Cruise Lines (CCL) have been trading in a range over the past year. One trader sees shares, near the low end of their range right now, heading higher in the next few weeks. That’s based on the May 6th $18.50 calls. With 24 days until expiration, 15,210 contracts traded compared to an open interest of 122, for a 125-fold surge in volume on the trade. The buyer of the calls paid $1.10 to get into the trade. The stock last ...

Read More About This

Carnival Cruise Lines (CCL) have been trading in a range over the past year. One trader sees shares, near the low end of their range right now, heading higher in the next few weeks. That’s based on the May 6th $18.50 calls. With 24 days until expiration, 15,210 contracts traded compared to an open interest of 122, for a 125-fold surge in volume on the trade. The buyer of the calls paid $1.10 to get into the trade. The stock last ...

Read More About This

In the Retail Trade, Stick with This Key Metric

Every sector has a key metric that may be more important than things like earnings or profit margins in the short-term. For instance, the restaurant industry may look at how many times its tables turn over customers during the course of an evening.

For retailers, the key metric is same-store sales. It cuts through the false growth that could be reported if a company is expanding by opening new locations, even if it may be cannibalizing existing locations.

One company capable of ...

Read More About This

Read More About This