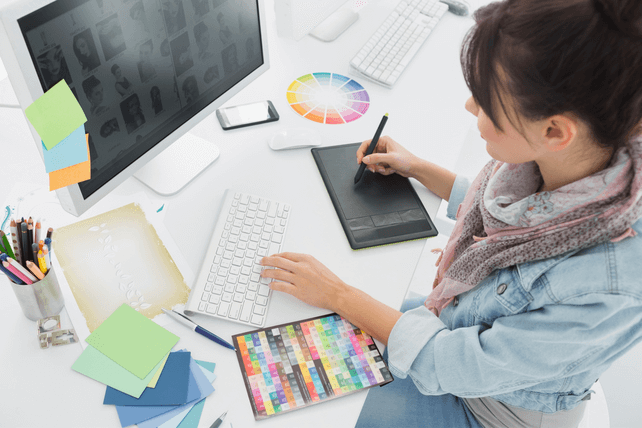

Unusual Options Activity: Adobe (ADBE)

Publishing software company

Adobe (ADBE) has been sliding well off its peak. One trader sees the potential for a strong rebound in the months ahead. That’s based on the July $575 calls. With 80 days until expiration, 1,405 contracts traded compared to a prior open interest of 110, for a 13-fold rise in volume on the trade. The buyer of the calls paid $0.90 to get in. Shares recently traded just under $410, so they would need to rise $165, or about 40 ...

Read More About This

Adobe (ADBE) has been sliding well off its peak. One trader sees the potential for a strong rebound in the months ahead. That’s based on the July $575 calls. With 80 days until expiration, 1,405 contracts traded compared to a prior open interest of 110, for a 13-fold rise in volume on the trade. The buyer of the calls paid $0.90 to get in. Shares recently traded just under $410, so they would need to rise $165, or about 40 ...

Read More About This

In Rough Markets, Consider This Overlooked Niche Financial Space

When it comes to the financial sector of the market, most traders look at big banks, credit card companies, and even insurance firms. But there are other parts of the sector that could benefit traders who buy while stocks are out of favor.

One such area is in the asset management space. Companies that cater to providing funds and access to financial markets for individuals and other companies alike tend to trade relatively cheaply to the overall market.

That could soon change, ...

Read More About This

Read More About This

Insider Trading Report: CBL & Associates Properties (CBL)

Jonathan Heller, a director at

CBL & Associates Properties (CBL), recently bought 100,000 shares. The buy increased his position by nearly 1,200 percent. The buy came to a total cost of $3.225 million. This marks the first insider buy since last November, when a different director picked up nearly $260,000 of shares. Otherwise, company insiders have generally been sellers of shares, albeit in smaller quantities. Insiders at the company own 0.3 percent of shares. Shares of the retail REIT have performed about in-line ...

Read More About This

CBL & Associates Properties (CBL), recently bought 100,000 shares. The buy increased his position by nearly 1,200 percent. The buy came to a total cost of $3.225 million. This marks the first insider buy since last November, when a different director picked up nearly $260,000 of shares. Otherwise, company insiders have generally been sellers of shares, albeit in smaller quantities. Insiders at the company own 0.3 percent of shares. Shares of the retail REIT have performed about in-line ...

Read More About This

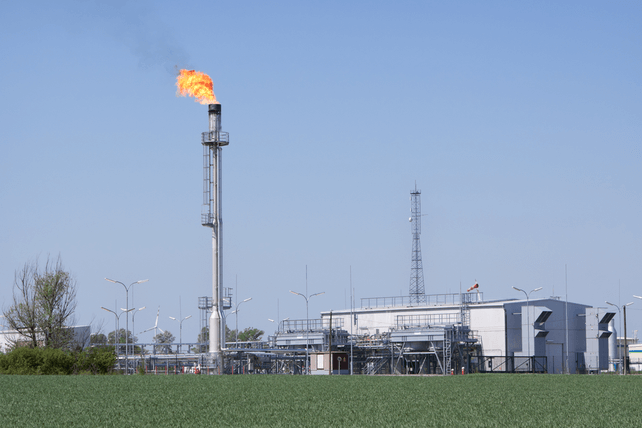

Unusual Options Activity: EQT Corporation (EQT)

Oil and gas exploration company

EQT Corporation (EQT) have been soaring in the past few months, but shares have started to weaken recently. One trader sees the potential for a rebound in the weeks ahead. That’s based on the June $49 calls. With 53 days until expiration, 11,878 contracts traded compared to a prior open interest of 567, for a 21-fold jump in volume on the trade. The buyer of the calls paid $1.95 to enter the trade. Shares recently traded around $42, ...

Read More About This

EQT Corporation (EQT) have been soaring in the past few months, but shares have started to weaken recently. One trader sees the potential for a rebound in the weeks ahead. That’s based on the June $49 calls. With 53 days until expiration, 11,878 contracts traded compared to a prior open interest of 567, for a 21-fold jump in volume on the trade. The buyer of the calls paid $1.95 to enter the trade. Shares recently traded around $42, ...

Read More About This

Keep Investing in Companies That Can Beat Inflation’s Bite

Some companies are able to pass on price increases to consumers easily. Others are not, and often have to absorb the costs. A consumer goods company can likely raise prices just over the rate of inflation most of the time, and not lose too much business.

Companies like a utility or telecom, which may have to wait for approval to raise prices, on the other hand, may not be so lucky.

As investors continue to remain defensive right now, it’s clear that ...

Read More About This

Read More About This

Insider Trading Report: New York City REIT (NYC)

Nicholas Schorsch, a major owner at

New York City REIT (NYC), recently added 12,500 shares. The buy increased his holdings by just under 1 percent, and came to a total price of $167,125. The move came the day after he made another buy, also for the same number of shares, paying just slightly over $162,000. Other insiders at the company have been regular buyers over the past two years. The last insider sale was modest and occurred back in 2019. Overall, insiders at ...

Read More About This

New York City REIT (NYC), recently added 12,500 shares. The buy increased his holdings by just under 1 percent, and came to a total price of $167,125. The move came the day after he made another buy, also for the same number of shares, paying just slightly over $162,000. Other insiders at the company have been regular buyers over the past two years. The last insider sale was modest and occurred back in 2019. Overall, insiders at ...

Read More About This

Unusual Options Activity: Marriott International (MAR)

Shares of hotel chain

Marriott International (MAR) have been in an uptrend over the past few months, with a big surge in recent weeks. One trader sees a potential move higher in the coming months. That’s based on the July $160 calls. With 84 days until expiration, 7,003 contracts traded compared to a prior open interest of 158, for a 44-fold jump in volume on the contracts. The buyer of the calls paid $34.00 to get into the trade. Shares of Marriott just ...

Read More About This

Marriott International (MAR) have been in an uptrend over the past few months, with a big surge in recent weeks. One trader sees a potential move higher in the coming months. That’s based on the July $160 calls. With 84 days until expiration, 7,003 contracts traded compared to a prior open interest of 158, for a 44-fold jump in volume on the contracts. The buyer of the calls paid $34.00 to get into the trade. Shares of Marriott just ...

Read More About This

Suppliers Continue to Offer the Best Return Potential Here

It may sound like a cliché at this point, but when there’s a gold rush, the folks selling picks and shovels tend to be the ones to make a consistent profit. No matter what the industry, the key suppliers are the ones that tend to perform the best as other companies in the space duke it out for market share.

That’s why such companies could provide great returns here. With many companies still reporting supply chain issues, suppliers that can deliver ...

Read More About This

Read More About This