Insider Trading Report: B. Riley Financial (RILY)

Bryant Riley, Chairman and Co-CEO of

B. Riley Financial (RILY), recently added 63,527 shares. The buy increased his holdings by 1 percent, and came to a total purchase price of just over $2.6 million. The buy comes about 10 days after a $2.2 million buy for just over 51,500 shares. And other company insiders, including both executives and directors, have been sizeable buyers in recent months. The last insider sale, from a major holder, occurred back in May. Overall, insiders at the financial ...

Read More About This

B. Riley Financial (RILY), recently added 63,527 shares. The buy increased his holdings by 1 percent, and came to a total purchase price of just over $2.6 million. The buy comes about 10 days after a $2.2 million buy for just over 51,500 shares. And other company insiders, including both executives and directors, have been sizeable buyers in recent months. The last insider sale, from a major holder, occurred back in May. Overall, insiders at the financial ...

Read More About This

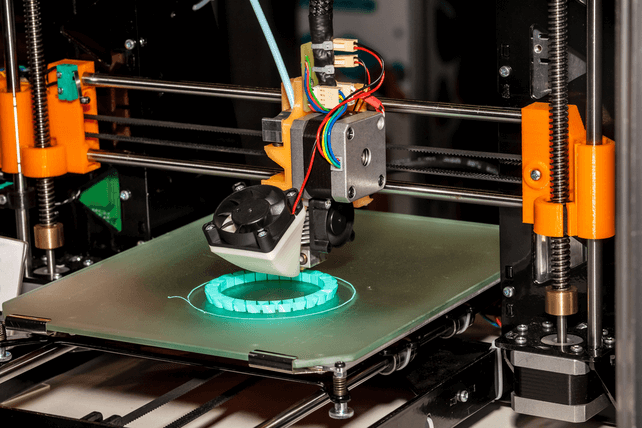

Unusual Options Activity: 3D Systems Corporation (DDD)

Shares of 3D printing hardware and software provider

3D Systems Corporation (DDD) has lost over 62 percent of its value in the past year. One trader sees a further drop ahead. That’s based on the February $8 puts. With 59 days until expiration, 3,473 contracts traded compared to a prior open interest of 128, for a 27-fold increase in volume on the trade. The buyer of the puts paid $0.75 to make the bearish bet. The stock recently traded around $8.20, making this ...

Read More About This

3D Systems Corporation (DDD) has lost over 62 percent of its value in the past year. One trader sees a further drop ahead. That’s based on the February $8 puts. With 59 days until expiration, 3,473 contracts traded compared to a prior open interest of 128, for a 27-fold increase in volume on the trade. The buyer of the puts paid $0.75 to make the bearish bet. The stock recently traded around $8.20, making this ...

Read More About This

Play This Stealth Winner in the Cloud Space

In any sector or trend, a few companies come to dominate. The headline names may attract considerable attention, but the real returns can often be in the companies providing the infrastructure behind it.

These “pick and shovel” plays may lack for an exciting story, but when it comes to investing, a boring idea that’s profitable tends to have a better valuation than going after the exciting story. In the cloud services space, server processors make the most attractive story.

Rather than focus ...

Read More About This

Read More About This

Insider Trading Report: VAALCO Energy (EGY)

George Maxwell, CEO at

VAALCO Energy (EGY), recently bought 5,000 shares. The buy increased his holdings by 3.9 percent, and came to a total cost of $21,650. The CEO last bought shares in November, grabbing 20,000 shares for just over $111,000. The most recent buy comes about one month after the company CFO bought 4,250 shares as well. Overall, company insiders have been mixed over the past three years, with large holders making big sales while some insiders have been buyers. Insiders ...

Read More About This

VAALCO Energy (EGY), recently bought 5,000 shares. The buy increased his holdings by 3.9 percent, and came to a total cost of $21,650. The CEO last bought shares in November, grabbing 20,000 shares for just over $111,000. The most recent buy comes about one month after the company CFO bought 4,250 shares as well. Overall, company insiders have been mixed over the past three years, with large holders making big sales while some insiders have been buyers. Insiders ...

Read More About This

Unusual Options Activity: The Home Depot (HD)

Shares of home improvement retailer

The Home Depot (HD) are down about in-line with the market over the past year. One trader sees a further drop in the weeks ahead. That’s based on the February 2023 $290 put. With 60 days until expiration, 13,502 contracts traded compared to a prior open interest of 311 for a 41-fold jump in volume on the trade. The buyer of the puts paid $4.03 to make the bearish bet. Home Depot shares recently traded just over $325, ...

Read More About This

The Home Depot (HD) are down about in-line with the market over the past year. One trader sees a further drop in the weeks ahead. That’s based on the February 2023 $290 put. With 60 days until expiration, 13,502 contracts traded compared to a prior open interest of 311 for a 41-fold jump in volume on the trade. The buyer of the puts paid $4.03 to make the bearish bet. Home Depot shares recently traded just over $325, ...

Read More About This

This Tech Industry Leader Offers High Appreciation Potential and a High Dividend

Investors often see a trade-off between high growth opportunities and income. However, in a market selloff, growth names can go on sale. And when they do, any dividend that they may be paying can become much larger than average.

Striking a balance between the two involves looking at where some of the best bargains lie under current market conditions. But investors looking for growth and income have a growing number of opportunities right now.

One such opportunity is in

Qualcomm (QCOM). The manufacturer ...

Read More About This

Qualcomm (QCOM). The manufacturer ...

Read More About This

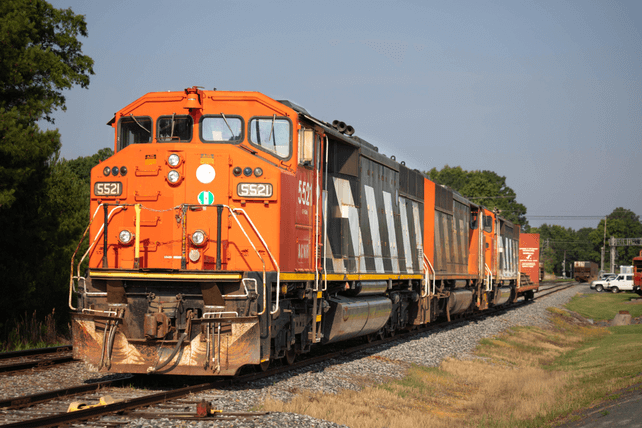

Insider Trading Report: FreightCar America (RAIL)

Matthew Tonn, Chief Commercial Officer at

FreightCar America (RAIL), recently picked up 5,700 shares. The buy increased his holdings by 3.5 percent, and came to a total cost just over $20,000. This is the first insider activity at the company since June, following a 2,550 share pickup from the company CEO. Going back over the past 3 years, executives, directors, and major owners have all been buying up shares, with no insider sales. Overall, insiders own 31.3 percent of the railcar manufacturer. Shares ...

Read More About This

FreightCar America (RAIL), recently picked up 5,700 shares. The buy increased his holdings by 3.5 percent, and came to a total cost just over $20,000. This is the first insider activity at the company since June, following a 2,550 share pickup from the company CEO. Going back over the past 3 years, executives, directors, and major owners have all been buying up shares, with no insider sales. Overall, insiders own 31.3 percent of the railcar manufacturer. Shares ...

Read More About This

Unusual Options Activity: GameStop (GME)

Shares of video game retailer

GameStop (GME) are down nearly 45 percent in the past year, nearly triple the amount the S&P 500 has declined. One trader sees a further decline in the coming months. That’s based on the March $21 puts. With 90 days until expiration, 7,230 contracts traded compared to a prior open interest of 103, for a 70-fold rise in volume on the trade. The buyer of the puts paid $4.58 to get in. Shares recently traded right around $21, ...

Read More About This

GameStop (GME) are down nearly 45 percent in the past year, nearly triple the amount the S&P 500 has declined. One trader sees a further decline in the coming months. That’s based on the March $21 puts. With 90 days until expiration, 7,230 contracts traded compared to a prior open interest of 103, for a 70-fold rise in volume on the trade. The buyer of the puts paid $4.58 to get in. Shares recently traded right around $21, ...

Read More About This