Unusual Options Activity: Novartis (NVS)

Shares of drug manufacturer

Novartis (NVS) are slightly up over the past year. One trader sees a further rally occurring in the first half of the year. That’s based on the July $85 calls. With 197 days until expiration, 3,071 contracts traded compared to a prior open interest of 119, for a 26-fold rise in volume on the trade. The buyer of the calls paid $8.30 to make the bullish bet. Shares recently traded just under $91, meaning the options are more than ...

Read More About This

Novartis (NVS) are slightly up over the past year. One trader sees a further rally occurring in the first half of the year. That’s based on the July $85 calls. With 197 days until expiration, 3,071 contracts traded compared to a prior open interest of 119, for a 26-fold rise in volume on the trade. The buyer of the calls paid $8.30 to make the bullish bet. Shares recently traded just under $91, meaning the options are more than ...

Read More About This

Watch For Companies Grabbing Market Share in a Tough Economy

There are many ways to value a company. For an industry with only a few players, one key metric is market share. That’s because when there are just a few companies in an industry, it’s growth is largely over. So what matters most is being able to grow by getting consumers to switch.

In a slowing economy, companies focusing on growing their market share could be solid winners… and could also show investors which companies to avoid right now.

For instance, dating ...

Read More About This

Read More About This

Insider Trading Report: CrowdStrike Holdings (CRWD)

Roxanne Austin, a director at

CrowdStrike Holdings (CRWD), recently added 25,000 shares. The buy increased her holdings by 62 percent, and came to a total cost of just under $2.5 million. This marks the first insider buy since back in June, when another director picked up a mere 81 shares. Otherwise, company officers and directors have largely been sellers of shares, following the exercise of options. Overall, company insiders own 1.3 percent of shares. Shares of the cloud services protection company have been ...

Read More About This

CrowdStrike Holdings (CRWD), recently added 25,000 shares. The buy increased her holdings by 62 percent, and came to a total cost of just under $2.5 million. This marks the first insider buy since back in June, when another director picked up a mere 81 shares. Otherwise, company officers and directors have largely been sellers of shares, following the exercise of options. Overall, company insiders own 1.3 percent of shares. Shares of the cloud services protection company have been ...

Read More About This

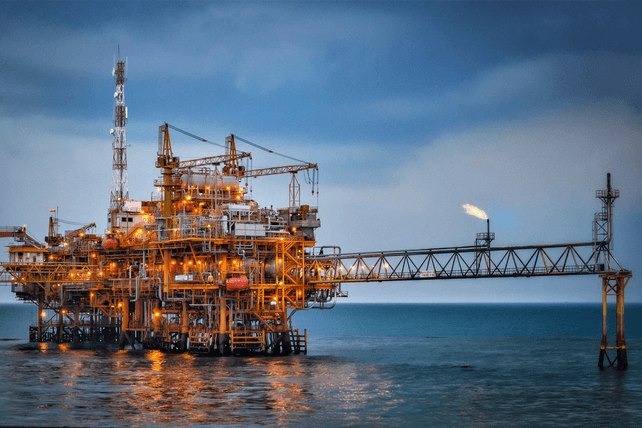

Unusual Options Activity: Occidental Petroleum Corporation (OXY)

Shares of oil and gas major

Occidental Petroleum Corporation (OXY) are up 112 percent over the past year. One trader sees a pullback coming in the next 18 months. That’s based on the June 2024 $50 puts. With 534 days until expiration, 5,001 contracts traded compared to a prior open interest of 101, for a 50-fold rise in volume on the trade. The buyer of the puts paid $6.45 to make the bet. Occidental shares recently traded for about $62, so the ...

Read More About This

Occidental Petroleum Corporation (OXY) are up 112 percent over the past year. One trader sees a pullback coming in the next 18 months. That’s based on the June 2024 $50 puts. With 534 days until expiration, 5,001 contracts traded compared to a prior open interest of 101, for a 50-fold rise in volume on the trade. The buyer of the puts paid $6.45 to make the bet. Occidental shares recently traded for about $62, so the ...

Read More About This

Wait to Buy a Turnaround Play Until There’s a Sign of a Turnaround

Any successful company will eventually struggle with slowing demand. Those that are successful are able to turn around a declining situation. But many “turnaround” stories are just that – stories.

It’s crucial for investors to be able to separate true turnarounds from talk of improvement. That’s why investors should wait for trends such as improving profit margins or improved earnings before waiting to invest in such a story.

One surprising story from 2022 has been that of

Netflix (NFLX). The company struggled in ...

Read More About This

Netflix (NFLX). The company struggled in ...

Read More About This

Insider Trading Report: Enterprise Products Partners (EPD)

Marcy Barth, a director at

Enterprise Products Partners (EPD), recently added 5,000 shares. The buy increased her stake by 6 percent, and came to a total cost of just under $120,000. The buy came as the company Co-CEO bought 25,000 shares on two separate days, paying nearly $600,000 to increase his holdings by about 15 percent. Other company insiders have been buyers in recent months, with the last insider sale occurring in March 2021. Overall, company insiders own 27.2 percent of the ...

Read More About This

Enterprise Products Partners (EPD), recently added 5,000 shares. The buy increased her stake by 6 percent, and came to a total cost of just under $120,000. The buy came as the company Co-CEO bought 25,000 shares on two separate days, paying nearly $600,000 to increase his holdings by about 15 percent. Other company insiders have been buyers in recent months, with the last insider sale occurring in March 2021. Overall, company insiders own 27.2 percent of the ...

Read More About This

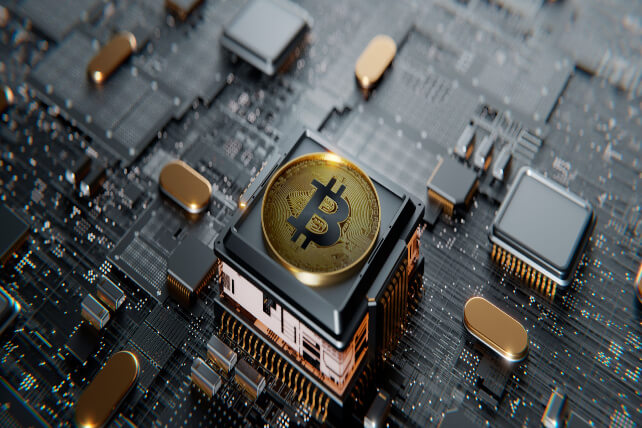

Unusual Options Activity: MicroStrategy (MSTR)

Shares of analytics software company

MicroStrategy (MSTR) are down 75 percent over the past year, largely due to the company’s decision to leverage up its balance sheet to buy Bitcoin. One trader sees a modest rebound in the coming weeks. That’s based on the January $160 calls. With 18 days until expiration, 4,737 contracts traded compared to a prior open interest of 199, for a 24-fold rise in trading volume. The buyer of the calls paid $3.65 to make the bet. Shares Read More About This

MicroStrategy (MSTR) are down 75 percent over the past year, largely due to the company’s decision to leverage up its balance sheet to buy Bitcoin. One trader sees a modest rebound in the coming weeks. That’s based on the January $160 calls. With 18 days until expiration, 4,737 contracts traded compared to a prior open interest of 199, for a 24-fold rise in trading volume. The buyer of the calls paid $3.65 to make the bet. Shares Read More About This

For Market-Beating Long-Term Results, Follow the Big Money

It’s no surprise that when it comes to investing, larger players can have some advantages. One advantage smaller investors have, however, is the ability to see what the big players are doing and follow along. In a bear market, they may even get a better deal.

By following investors with a strong track record, it’s possible to beat the market over time. And to do so with less volatility than other market strategies.

One move investors can make now is to follow ...

Read More About This

Read More About This