Stick With Conventional Companies Still Growing Profits

During a market boom, it’s tempting to start buying into more speculative companies. While that can potentially mean bigger returns, it also increases the risks. Conversely, companies that have a conventional line of business can continue to grow, even if they also invest in more speculative endeavors.

Right now, many companies that have been dabbling in new technologies are seeing lower-than-expected demand. But as long as their core business is strong, shares should continue to rise.

For instance, demand for electric vehicles ...

Read More About This

Read More About This

Insider Activity Report: Community Trust Bancorp (CTBI)

Andy Waters, an EVP at Community Trust Bancorp (CTBI), recently bought 10,000 shares. The buy increased his stake by 71%, and came to a total cost of $322,700.

This marks the first insider buy since January, when several executives bought shares. That includes a 10,033 buy from another EVP, for just over $324,000, and a director bought 2,129 shares for $84,205. There have been a few inside sales as well, but buyers have far outnumbered sellers over the past two years.

Overall, ...

Read More About This

Read More About This

Unusual Options Activity: GE Aerospace (GE)

Aerospace and airplane component manufacturer GE Aerospace (GE) is up over 70% in the past year. One trader sees further gains in the weeks ahead.

That’s based on the August 16 $200 calls. With 22 days until expiration, 10,2298 contacts traded compared to a prior open interest of 107, for a 96-fold rise in volume on the trade. The buyer of the calls paid $0.31 to make the bullish bet.

GE Aerospace shares recently traded for about $174, meaning the stock would ...

Read More About This

Read More About This

A Tech Name Worth Buying on Market Dips

Last week’s market selloff was heavy on tech. Given how tech stocks tend to outperform the market, their underperformance in a selloff makes sense. Investors patient enough to wait for a 10-20% pullback in industry-leading tech stocks are often rewarded for their performance afterwards.

Getting a reasonable entry price on a high-growth stock can lead to better returns than just buying at the top, or just holding indefinitely.

With last week’s selloff hitting the chip space rather hard, semiconductor stocks might be ...

Read More About This

Read More About This

Insider Activity Report: J.B. Hunt Transportation Services (JBHT)

Persio Lisboa, a director at

J.B. Hunt Transportation Services (JBHT), recently bought 600 shares. The buy increased the director’s stake by 20%, and came to a total cost of $98,082. This is the first insider buy since April, when the company CEO bought 6,200 shares, paying just under $999,000 to do so. And another company director bought shares in March. Otherwise, company insiders have largely been sellers over the past two years, and usually following the exercise of stock options. Overall, JBHT ...

Read More About This

J.B. Hunt Transportation Services (JBHT), recently bought 600 shares. The buy increased the director’s stake by 20%, and came to a total cost of $98,082. This is the first insider buy since April, when the company CEO bought 6,200 shares, paying just under $999,000 to do so. And another company director bought shares in March. Otherwise, company insiders have largely been sellers over the past two years, and usually following the exercise of stock options. Overall, JBHT ...

Read More About This

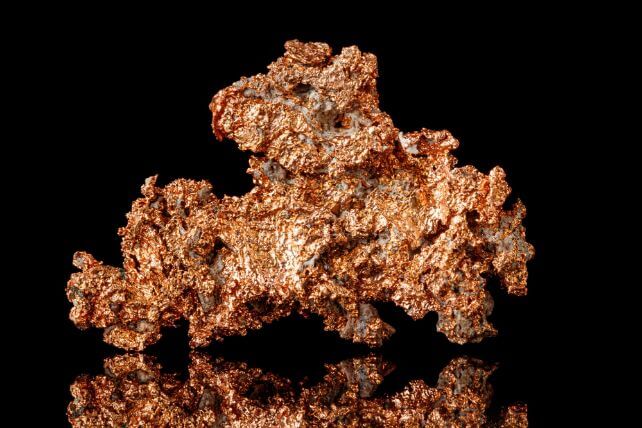

Unusual Options Activity: Freeport-McMoRan (FCX)

Copper producer

Freeport-McMoRan (FCX), is up 9% over the past year, slightly lagging the overall market. One trader sees shares trending higher into the autumn. That’s based on the October 18 $55 calls. With 86 days until expiration, 5,020 contracts traded compared to a prior open interest of 182, for a 28-fold rise in volume on the trade. The buyer of the calls paid $0.82 to make the bullish bet. Freeport shares recently traded for about $46, so they would need to rise ...

Read More About This

Freeport-McMoRan (FCX), is up 9% over the past year, slightly lagging the overall market. One trader sees shares trending higher into the autumn. That’s based on the October 18 $55 calls. With 86 days until expiration, 5,020 contracts traded compared to a prior open interest of 182, for a 28-fold rise in volume on the trade. The buyer of the calls paid $0.82 to make the bullish bet. Freeport shares recently traded for about $46, so they would need to rise ...

Read More About This

Fixable Problems Create Buying Opportunities

Markets don’t just react to events. They often overreact. That’s why when a short-term problem flares up and goes away, the market tends to react sharply, then revert back to whatever it was doing before.

Last week saw the largest IT outage in history. A security software update caused a number of systems to slow down, crash, or otherwise stop responding altogether. However, the world was largely able to move on and get its work done.

However, the cybersecurity stock involved, CrowdStrike ...

Read More About This

Read More About This

Insider Activity Report: U.S. Bancorp (USB)

Aleem Gillani, a director at U.S. Bancorp (USB), recently bought 10,000 shares. The buy is an initial stake for the director, and came to a cost of $499,900.

This marks the first insider buy since January 2017. This year, there have been four insider sales, three of which occurred following the exercise of stock options. The largest sale was for $3.86 million from the company’s President and CEO.

Overall, USB insiders own 0.1% of shares.

The regional bank is up 16% over ...

Read More About This

Read More About This