Unusual Options Activity: Public Service Enterprise Group (PEG)

Electric and gas utility company Public Service Enterprise Group (PEG) is up 23% over the past year. One trader is betting the utility will trend even higher in the second half of the year.

That’s based on the December 20 $82.50 calls. With 140 days until expiration, 7,000 contracts traded compared to a prior open interest of 113, for a 62-fold rise in volume on the trade. The buyer of the calls paid $3.40 to make the bullish bet.

PEG shares recently ...

Read More About This

Read More About This

The Beat-and-Raise Stocks Are the Clear Winners This Earnings Season

Earnings season is underway. And this quarter, companies that miss on expectations are getting hit harder than average. However, companies that beat expectations are being rewarded above average.

And for companies that aren’t only beating on earnings, but are raising their expectations for the full-year, that trend is even better. As investors demand to see results from companies this quarter, those who can deliver are in great shape.

That includes payment company PayPal (PYPL). Shares popped higher after the company beat ...

Read More About This

Read More About This

Insider Activity Report: Kaiser Aluminum Corp (KALU)

Keith Harvey, President and CEO of Kaiser Aluminum (KALU), recently bought 2,588 shares. The buy increased his position by 3%, and came to a total cost of $199,871.

This marks the first insider buy over the past two years. Otherwise, company insiders have been occasional sellers of shares, with the company CFO selling shares on a regular basis in 2022 and 2023. There was only one sale this year, by a SVP, back in May, when Kaiser traded over 20% higher.

Overall, ...

Read More About This

Read More About This

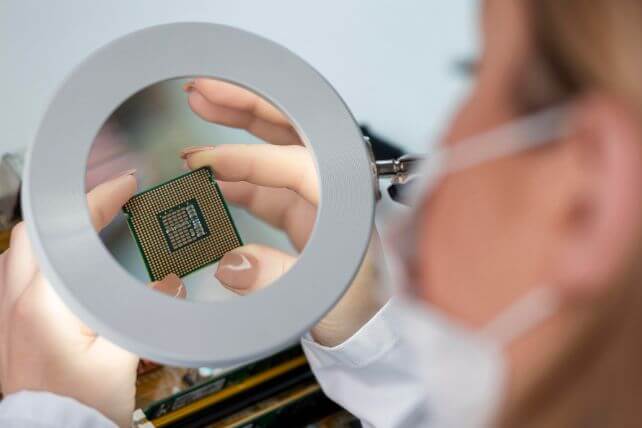

Unusual Options Activity: Intel (INTC)

Chipmaker Intel (INTC) is down 14% over the past year, underperforming the chip space as a whole. One trader sees a further decline in the weeks ahead.

That’s based on the August 23 $26 puts. With 22 days until expiration, 18,424 contracts traded compared to a prior open interest of 109, for a massive 169-fold rise in volume on the trade. The buyer of the puts paid $0.28 to make the bearish bet.

Intel shares recently traded for just over $30. Shares ...

Read More About This

Read More About This

This Down-But-Not-Out Company Could Stage a Rally Over the Summer

Earnings season gives companies an opportunity to not only report how well they’ve done in the most recent quarter, but how they expect the next few quarters to play out. For companies that don’t have good numbers to report now, future expectations can help soothe the markets.

That’s especially true when a company has been facing some known challenges. That can include a rise in competition, price pressure, or changing customer tastes.

For fast food giant McDonald’s (MCD), it’s been a mix ...

Read More About This

Read More About This

Insider Activity Report: Scholastic Corporation (SCHL)

Peter Warwick, President and CEO of Scholastic Corporation (SCHL), recently bought 1,674 shares. The buy increased his position by 2%, and came to a total cost of $50,997. He was joined by the company’s Chief Strategy Officer, who bought $50,430 in shares on the same day.

Warwick was the last buyer of shares at the company in September 2022, when he bought 3,245 shares for just over $100,000. There have been two insider sales in the interim.

Overall, Scholastic insiders own ...

Read More About This

Read More About This

Unusual Options Activity: Macy’s (M)

Department store chain

Macy’s (M) has traded flat over the past year, as the company has been targeted for a buyout, but rejected that offer. One trader sees shares trending lower into next year. That’s based on the February 2025 $15 puts. With 205 days until expiration, 3,325 contracts traded compared to a prior open interest of 114, for a 29-fold rise in volume on the trade. The buyer of the puts paid $1.22 to make the bearish bet. Macy’s recently traded for ...

Read More About This

Macy’s (M) has traded flat over the past year, as the company has been targeted for a buyout, but rejected that offer. One trader sees shares trending lower into next year. That’s based on the February 2025 $15 puts. With 205 days until expiration, 3,325 contracts traded compared to a prior open interest of 114, for a 29-fold rise in volume on the trade. The buyer of the puts paid $1.22 to make the bearish bet. Macy’s recently traded for ...

Read More About This

The Market Rotation Has Arrived – Great Stocks Are Cleared to Jump Higher

For nearly 18 months, big-cap tech stocks have dominated the market. Most stocks have traded flat or even declined over that time. But in the past few weeks, tech stocks have pulled back, but other stocks have started to show signs of life.

Given how long the big tech outperformance lasted, there’s more room to run higher. Even for stocks that have already had some big jumps over the past few weeks.

That includes industrial conglomerate 3M (MMM). Shares soared over 20% ...

Read More About This

Read More About This