Amid a Shortage for Tech Parts, This One Niche Continues to Thrive

While the semiconductor chip shortage appears likely to continue well into next year, a number of tech plays are still able to avoid the challenge presented by that shortage.

One particularly strong tech niche is one that has exploded during the pandemic era, specifically that of cloud services. As the world has continued to work remotely, companies playing to the cloud trend have done exceptionally well.

There’s no better case study for this trend than

Microsoft (MSFT). The tech giant saw its cloud-software ...

Read More About This

Microsoft (MSFT). The tech giant saw its cloud-software ...

Read More About This

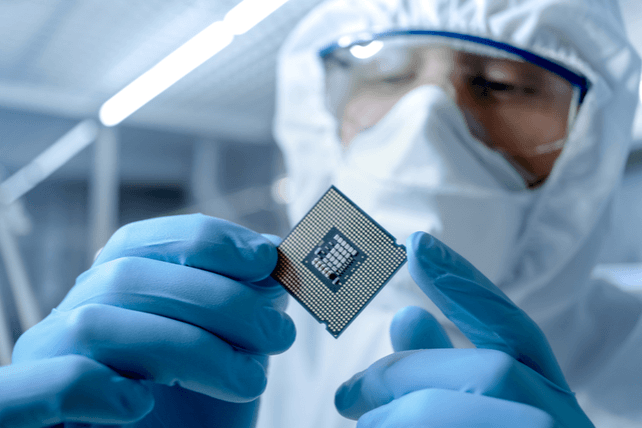

Insider Trading Report: Intel (INTC)

Patrick Gelsinger, CEO at

Intel (INTC), recently picked up 10,000 shares of the company. The buy increased his stake by nearly 21 percent, and came to a total purchase price of just over $995,000. He was joined by a number of company directors, one of whom picked up 20,000 shares totaling just under $2 million. The smallest director buy in this latest cluster was for 5,000 shares, coming in at just under $250,000. This is a solid show of strength from company management ...

Read More About This

Intel (INTC), recently picked up 10,000 shares of the company. The buy increased his stake by nearly 21 percent, and came to a total purchase price of just over $995,000. He was joined by a number of company directors, one of whom picked up 20,000 shares totaling just under $2 million. The smallest director buy in this latest cluster was for 5,000 shares, coming in at just under $250,000. This is a solid show of strength from company management ...

Read More About This

Unusual Options Activity: PepsiCo (PEP)

Shares of beverage and snack company

PepsiCo (PEP) have been trending steadily higher in the past year, with a nice rally following earnings earlier this month. One trader sees that uptrend continuing, and quickly. That’s based on the November 5 $165 calls. Expiring in 8 days, over 22,426 contracts traded against a prior open interest of 196, for a 114-fold surge in volume. The buyer of the calls paid $0.30 to make the trade. With shares last going for around $161, the stock ...

Read More About This

PepsiCo (PEP) have been trending steadily higher in the past year, with a nice rally following earnings earlier this month. One trader sees that uptrend continuing, and quickly. That’s based on the November 5 $165 calls. Expiring in 8 days, over 22,426 contracts traded against a prior open interest of 196, for a 114-fold surge in volume. The buyer of the calls paid $0.30 to make the trade. With shares last going for around $161, the stock ...

Read More About This

With Or Without Crypto Mining Demand, This Tech Stock a Buy

Led by Bitcoin, cryptocurrencies are moving higher. That’s great for cryptos themselves, as well as a number of companies that play to integrating cryptos into the existing financial system and the public’s mind.

However, many tech companies have been burned, as crypto mining has gone in and out of favor over the years. That’s created a lot of uncertainty for a number of companies in terms of marginal demand, and the market hates uncertainty.

Case in point?

Nvidia (NVDA). The leading producer of ...

Read More About This

Nvidia (NVDA). The leading producer of ...

Read More About This

Insider Trading Report: Texas Capital Bancshares (TCBI)

Julie Anderson, CFO at

Texas Capital Bancshares (TCBI), recently added 4,000 shares to her holdings. The buy increased her stake by just over 6 percent, and came to a total price of just under $242,000. She was joined by a director on the same day who picked up 1,000 shares, valued at just under $60,000. And a director bought last week, picking up 5,000 shares, at a cost of just over $300,000 in a cluster of insider buying. Overall, there’s been just one ...

Read More About This

Texas Capital Bancshares (TCBI), recently added 4,000 shares to her holdings. The buy increased her stake by just over 6 percent, and came to a total price of just under $242,000. She was joined by a director on the same day who picked up 1,000 shares, valued at just under $60,000. And a director bought last week, picking up 5,000 shares, at a cost of just over $300,000 in a cluster of insider buying. Overall, there’s been just one ...

Read More About This

Unusual Options Activity: Tesla Motors (TSLA)

Shares of electric vehicle giant

Tesla Motors (TSLA) hit a new all-time high on Monday on news of a massive sale of 100,000 vehicles to a rental car agency. One trader sees shares moving higher. That’s based on the January 2024 $680 calls. With 814 days until expiration, 13,322 contracts traded, a 125-fold jump in volume from the prior open interest of 107 contracts. The buyer of the calls paid $479, or $47,900 per contract, to make the trade. With the stock ...

Read More About This

Tesla Motors (TSLA) hit a new all-time high on Monday on news of a massive sale of 100,000 vehicles to a rental car agency. One trader sees shares moving higher. That’s based on the January 2024 $680 calls. With 814 days until expiration, 13,322 contracts traded, a 125-fold jump in volume from the prior open interest of 107 contracts. The buyer of the calls paid $479, or $47,900 per contract, to make the trade. With the stock ...

Read More About This

The Market Is Clear: When in Doubt, Buy Quality

Some stocks in the same industry may have a vastly different valuation than others. This is typically the market’s way of indicating which company is the industry leader. That may be higher profit margins, or a better product, or even more loyal customers.

This notion recently appeared on the market when chipmaker

Intel (INTC) reported earnings. As with its prior reports, the numbers were okay, but poor guidance and a sense that the company was treading water operationally led to a selloff. While ...

Read More About This

Intel (INTC) reported earnings. As with its prior reports, the numbers were okay, but poor guidance and a sense that the company was treading water operationally led to a selloff. While ...

Read More About This

Insider Trading Report: Mueller Industries (MLI)

Gary Gladstein, a director at

Mueller Industries (MLI), recently picked up 11,399 additional shares. The buy increased his stake by over 9 percent, and came to a total cost of just under $544,000. This is the first insider buy at the company since February. A number of company insiders have been regular sellers of shares, including both directors and the company CEO over the past three years, even as shares have trended higher. At present, company insiders own 2.8 percent of shares. The ...

Read More About This

Mueller Industries (MLI), recently picked up 11,399 additional shares. The buy increased his stake by over 9 percent, and came to a total cost of just under $544,000. This is the first insider buy at the company since February. A number of company insiders have been regular sellers of shares, including both directors and the company CEO over the past three years, even as shares have trended higher. At present, company insiders own 2.8 percent of shares. The ...

Read More About This