Insider Trading Report: Huntington Bancshares (HBAN)

Richard King, a director at

Huntington Bancshares (HBAN), recently picked up 2,178 more shares of the company. The buy increased his holdings by nearly 3 percent, and came to a total price of just over $30,000. This is the second buy at the regional bank year-to-date. The prior buy was also from a director. Company executives have been regular sellers of shares over the past three years, with the net result of large sales by insiders overall. Overall, company insiders own about ...

Read More About This

Huntington Bancshares (HBAN), recently picked up 2,178 more shares of the company. The buy increased his holdings by nearly 3 percent, and came to a total price of just over $30,000. This is the second buy at the regional bank year-to-date. The prior buy was also from a director. Company executives have been regular sellers of shares over the past three years, with the net result of large sales by insiders overall. Overall, company insiders own about ...

Read More About This

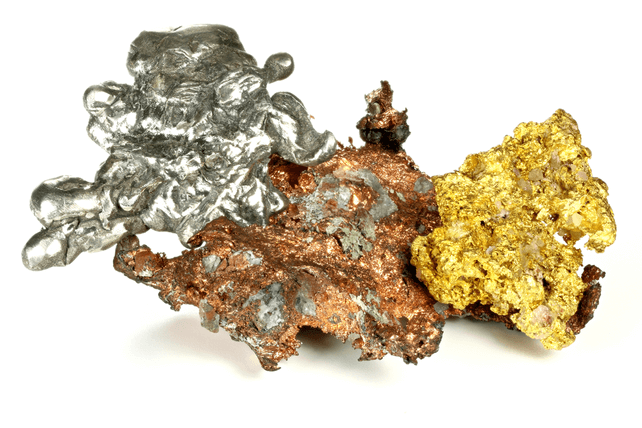

Unusual Options Activity: Freeport-McMoRan (FCX)

Shares of mining giant

Freeport-McMoRan (FCX) have been in a strong uptrend until the past few trading days, when shares quickly dropped. One trader sees the stock returning to rally mode. That’s based on the August $49 calls. With 112 days until expiration, 3,283 contracts traded compared to a prior open interest of 121, for a 27-fold rise in volume on the trade. The buyer of the calls paid $2.21 to get into the position. Shares last traded just under $42, so they ...

Read More About This

Freeport-McMoRan (FCX) have been in a strong uptrend until the past few trading days, when shares quickly dropped. One trader sees the stock returning to rally mode. That’s based on the August $49 calls. With 112 days until expiration, 3,283 contracts traded compared to a prior open interest of 121, for a 27-fold rise in volume on the trade. The buyer of the calls paid $2.21 to get into the position. Shares last traded just under $42, so they ...

Read More About This

Pricing Power Continues to Point to Profitable Companies In Today’s Tough Environment

Every industry has a key metric that analysts are looking for. That could relate to gross profit margins, sales volume, or the spread between the cost of borrowing and the cost of lending.

For the restaurant industry, sales are a key component. Higher-end chains may look at how many times a table turns over in the course of an evening, but for most players, that still translates to plain sales.

Chipotle Mexican Grill (CMG) just reported that their sales have been unaffected ...

Read More About This

Chipotle Mexican Grill (CMG) just reported that their sales have been unaffected ...

Read More About This

Insider Trading Report: Charles Schwab Corp (SCHW)

Walter Bettinger, CEO at

Charles Schwab Corp (SCHW), recently picked up 36,640 shares. The buy increased his holdings by just over 12 percent, and came to a total price of just over $2.5 million. This marks the first insider buy at the company going back to February, 2021. Company insiders, from C-suite executives and the company chairman, as well as a few directors, have been sellers of shares over the past two years as the stock has more than doubled. Overall, company ...

Read More About This

Charles Schwab Corp (SCHW), recently picked up 36,640 shares. The buy increased his holdings by just over 12 percent, and came to a total price of just over $2.5 million. This marks the first insider buy at the company going back to February, 2021. Company insiders, from C-suite executives and the company chairman, as well as a few directors, have been sellers of shares over the past two years as the stock has more than doubled. Overall, company ...

Read More About This

Unusual Options Activity: Cantaloupe (CTLP)

Shares of unattended retail market payment and software provider

Cantaloupe (CTLP) have shed nearly half their value in the past year. One trader is betting on a strong rebound in the coming months. That’s based on the September $7.50 calls. With 141 days until expiration, 21,673 contracts traded compared to a prior open interest of 464, for a 47-fold rise in volume on the trade. The buyer of the calls paid $0.32 to get into the position. Shares recently went for just over ...

Read More About This

Cantaloupe (CTLP) have shed nearly half their value in the past year. One trader is betting on a strong rebound in the coming months. That’s based on the September $7.50 calls. With 141 days until expiration, 21,673 contracts traded compared to a prior open interest of 464, for a 47-fold rise in volume on the trade. The buyer of the calls paid $0.32 to get into the position. Shares recently went for just over ...

Read More About This

Stick With Recession-Resistant Companies that Are Performing Well Now

Most stocks follow the overall market. When stocks are rising, even poorly-managed companies can go along for a rally. And when stocks are falling, even great companies can get sold off as well.

Right now, only a handful of companies are performing well in today’s markets. Some of those are commodity plays, others are companies capable of growing no matter what the overall economy does.

One such company is the

Coca-Cola Company (KO). The beverage giant has some issues with supply chain issues, ...

Read More About This

Coca-Cola Company (KO). The beverage giant has some issues with supply chain issues, ...

Read More About This

Insider Trading Report: Xerox Holdings Corp (XRX)

Carl Icahn, a major owner of

Xerox Holdings Corp (XRX), recently added 2,130,423 shares to his holdings. The buy increased his stake by 6.6 percent, and came to a total price of just over $36.3 million. This marks the first insider transaction of the year. Over the past two years, company insiders have generally been sizeable buyers of shares on a regular basis, with only one insider sale in that timeframe. Overall, company insiders, not including major owners like Icahn, own 6.5 ...

Read More About This

Xerox Holdings Corp (XRX), recently added 2,130,423 shares to his holdings. The buy increased his stake by 6.6 percent, and came to a total price of just over $36.3 million. This marks the first insider transaction of the year. Over the past two years, company insiders have generally been sizeable buyers of shares on a regular basis, with only one insider sale in that timeframe. Overall, company insiders, not including major owners like Icahn, own 6.5 ...

Read More About This

Unusual Options Activity: Fortress Transportation and Infrastructure Investors LLC (FTAI)

Shares of rental and leasing service company

Fortress Transportation and Infrastructure Investors LLC (FTAI) have been sliding over the past year. However, one trader sees the potential for a move higher in the coming months. That’s based on the June $28 calls. With 51 days until expiration, 3,592 contracts traded compared to a prior open interest of 123, for a 29-fold rise in volume on the trade. The buyer of the calls paid $0.70 to get into the trade. Shares recently traded ...

Read More About This

Fortress Transportation and Infrastructure Investors LLC (FTAI) have been sliding over the past year. However, one trader sees the potential for a move higher in the coming months. That’s based on the June $28 calls. With 51 days until expiration, 3,592 contracts traded compared to a prior open interest of 123, for a 29-fold rise in volume on the trade. The buyer of the calls paid $0.70 to get into the trade. Shares recently traded ...

Read More About This