Continue to Add Defensive Names in Today’s Market

The stock market will always be volatile. In today’s environment, big daily swings have been the norm. For investors who are using those swings to pick up quality companies at a reasonable price, they’ll be rewarded on top of any trading income as well.

Right now, markets are fearful over a potential decline in corporate earnings. That’s already been the case for a few quarters, but high energy prices this year are causing higher prices in everything from electrical generation to ...

Read More About This

Read More About This

Insider Trading Report: Comstock Resources (CRK)

M. Jay Allison, Chairman and CEO of

Comstock Resources (CRK), recently picked up 50,000 shares. The buy increased the CEO’s holdings by 3 percent, and came to a total price of $975,000. A company director also picked up 14,000 shares on the same day, increasing their stake by about 10 percent with a $254,000 buy. Three other company directors have been buyers in the past three months. All of these transactions have been the sole insider trading at the company in the last ...

Read More About This

Comstock Resources (CRK), recently picked up 50,000 shares. The buy increased the CEO’s holdings by 3 percent, and came to a total price of $975,000. A company director also picked up 14,000 shares on the same day, increasing their stake by about 10 percent with a $254,000 buy. Three other company directors have been buyers in the past three months. All of these transactions have been the sole insider trading at the company in the last ...

Read More About This

Unusual Options Activity: Roblox Corporation (RBLX)

Shares of metaverse gaming platform

Roblox Corporation (RBLX) are down nearly 50 percent in the past year on a drop in tech stocks. One trader sees the potential for a jump higher in the coming days. That’s based on the October 7th $45 calls. With 16 days until expiration, 4,847 contracts traded compared to a prior open interest of 155, for a 31-fold increase in volume on the trade. The buyer of the calls paid $0.51 to make the bet. Shares recently ...

Read More About This

Roblox Corporation (RBLX) are down nearly 50 percent in the past year on a drop in tech stocks. One trader sees the potential for a jump higher in the coming days. That’s based on the October 7th $45 calls. With 16 days until expiration, 4,847 contracts traded compared to a prior open interest of 155, for a 31-fold increase in volume on the trade. The buyer of the calls paid $0.51 to make the bet. Shares recently ...

Read More About This

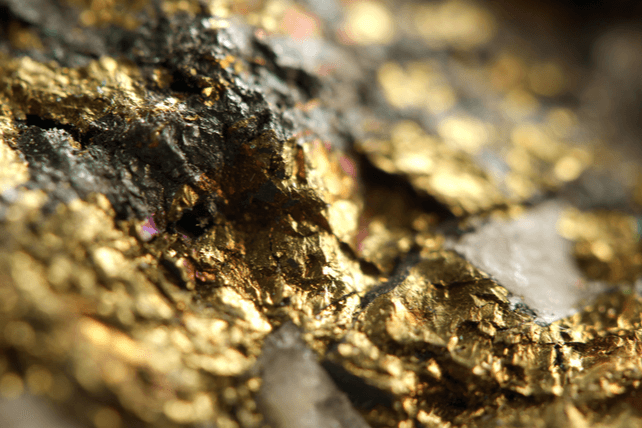

It’s Time to Consider This Old-School Inflation Hedge

Inflation continues to eat away at consumer’s purchasing power. And while it’s blindsided some investors, it’s also been tough to hedge right now. That’s because conventional hedges haven’t worked too well yet, as investors have gone through other alternatives first.

However, gold is starting to look undervalued relative to other commodities. And it has a long history of holding up well compared to inflation, both expected and unexpected, over time.

As gold prices look undervalued, so do prices for gold mining companies ...

Read More About This

Read More About This

Insider Trading Report: HomeTrust Bancshares (HTBI)

Robert James, a director at

HomeTrust Bancshares (HTBI), recently added 2,500 shares. The buy increased his holdings by nearly 22 percent, and came to a total cost of $57,025. That’s the first insider buy at the company since mid-2020. Otherwise, insiders have been big sellers of shares over the past two years, with some major sales right as the stock market started to peak nearly a year ago. Overall, company insiders own 10.1 percent of the company. The regional bank, based out of ...

Read More About This

HomeTrust Bancshares (HTBI), recently added 2,500 shares. The buy increased his holdings by nearly 22 percent, and came to a total cost of $57,025. That’s the first insider buy at the company since mid-2020. Otherwise, insiders have been big sellers of shares over the past two years, with some major sales right as the stock market started to peak nearly a year ago. Overall, company insiders own 10.1 percent of the company. The regional bank, based out of ...

Read More About This

Unusual Options Activity: Alcoa Corporation (AA)

Shares of aluminum producer

Alcoa Corporation (AA) are down about in-line with the S&P 500 over the past year. One trader is betting that the company will move far lower in the coming weeks. That’s based on the November $25 puts. With 59 days until expiration, 8,617 contracts traded compared to a prior open interest of 166, for a 32-fold rise in volume on the trade. The buyer of the puts paid $0.32 to make the bet. Shares recently traded just over ...

Read More About This

Alcoa Corporation (AA) are down about in-line with the S&P 500 over the past year. One trader is betting that the company will move far lower in the coming weeks. That’s based on the November $25 puts. With 59 days until expiration, 8,617 contracts traded compared to a prior open interest of 166, for a 32-fold rise in volume on the trade. The buyer of the puts paid $0.32 to make the bet. Shares recently traded just over ...

Read More About This

Find Companies With Strong Real Demand Now

Inflation can be an insidious force, making investing a challenge. That’s because there are some areas where customers have to spend more due to inflation, whether they like it or not. Other businesses are more elastic, so higher prices can lead to a big drop in volume.

Companies that have strong real demand now can likely perform well in the future as inflation starts to wane. The trick is in finding the right trend to track amid today’s high inflation.

One trend ...

Read More About This

Read More About This

Insider Trading Report: Six Flags Entertainment (SIX)

Arik Ruchim, a director and major owner of

Six Flags Entertainment (SIX), recently picked up 200,000 shares. The buy increased his holdings by 1.9 percent, and came to a total cost of just over $4.595 million. He was joined by another major owner, who also picked up 200,000 shares for the same price. Both of the major owners were buyers in August, with multiple buys each totaling over 1,000,000 shares. Other company executives including the CFO have also been buyers this year. Overall, ...

Read More About This

Six Flags Entertainment (SIX), recently picked up 200,000 shares. The buy increased his holdings by 1.9 percent, and came to a total cost of just over $4.595 million. He was joined by another major owner, who also picked up 200,000 shares for the same price. Both of the major owners were buyers in August, with multiple buys each totaling over 1,000,000 shares. Other company executives including the CFO have also been buyers this year. Overall, ...

Read More About This