If Earnings Matter, This Company Could be the Tech Winner of 2025

Stocks famously climb a “wall of worry.” One thing that worries some investors now is the market’s valuation. By some metrics, the stock market is near values last seen near big peaks, like in 2000 and 2008.

That’s not a healthy sign, by any means. However, if companies can grow their earnings, revenues, and income, the extreme valuation issue can be fixed in time. Some companies are also clearly still a strong value today.

One such value today is Alibaba Group Holding ...

Read More About This

Read More About This

Insider Activity Report: Greif (GEF)

Lawrence Hilsheimer, CFO of Greif (GEF), recently bought 550 shares. The buy increased his stake by less than 1%, and came to a total cost of $37,384. He was joined by a company director, who bought 3,500 shares at a total cost of $245,700, establishing a new position.

This adds on to further company buys earlier in the year. However, going further back, company insiders were more likely to be sellers rather than buyers.

Overall, Greif insiders own 4.9% of shares.

The ...

Read More About This

Read More About This

Unusual Options Activity: Apple (AAPL)

Consumer tech giant Apple (AAPL) is up 32% over the past year, slightly outperforming the overall stock market. One trader sees shares trending higher in the coming weeks.

That’s based on the January 17 $267.50 calls. With 21 days until expiration, 3,840 contracts traded compared to a prior open interest of 150, for a 26-fold rise in volume on the trade. The buyer of the calls paid $1.07 to make the bullish bet.

Apple shares recently traded for about $258, so the ...

Read More About This

Read More About This

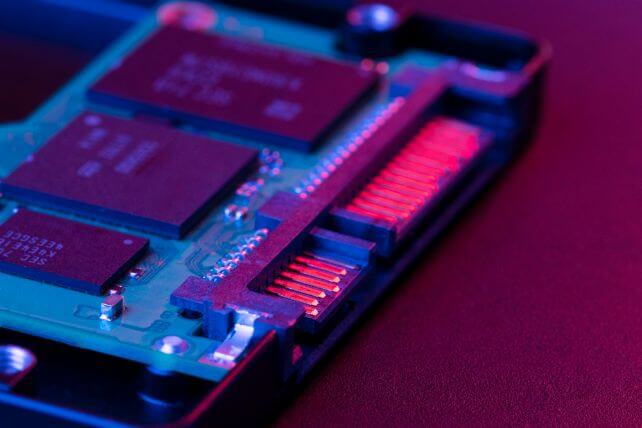

Another Chipmaker Is Poised For Further Gains In 2025

While investors may be looking for other opportunities in the AI space, chipmakers still remain the key hardware provider. And the increase in AI tools could potentially continue to fuel strong growth for the right chipmakers in 2025 and beyond.

Investors who got into the trade early are right to look around for other opportunities and diversify out some profits. But other chipmakers are potentially set for some big and surprising growth in the months ahead.

One such player is Qualcomm (QCOM) ...

Read More About This

Read More About This

Insider Activity Report: Conoco Phillips (COP)

R.A. Walker, a director at Conoco Phillips (COP), recently bought 10,400 shares. The buy increased his stake by 30%, and came to a total cost of $1,017,161.

He was joined by another director last week, who bought 2,500 shares, paying just under $240,000 to do so. The two buys are the first since February 2023. Otherwise, company insiders, including both the CEO and CFO, have been sellers over the past two years.

Overall, Conoco Phillips insiders own 0.1% of shares.

The oil ...

Read More About This

Read More About This

Unusual Options Activity: Home Depot (HD)

Home improvement store chain Home Depot (HD) is up about 12% over the past year, returning about half that of the S&P 500. One trader sees further weakness in the weeks ahead.

That’s based on the February 21, 2025 $360 puts. With 56 days until expiration, 10,548 contracts traded compared to a prior open interest of 345, for a 31-fold rise in volume on the trade. The buyer of the puts paid $3.80 to make the bearish bet.

Home Depot shares recently ...

Read More About This

Read More About This

Stick With Winning Players as the AI Rollout Is Set to Continue Through 2025

While markets have been a bit jittery heading into the holidays, companies are generally bullish on the continued rollout of AI technologies into 2025. Billions continue to be invested in the hardware, software, and infrastructure needs for this trend.

Investors may have missed some early gains, but there’s still much more ahead. Especially as new generative AI models and even artificial general intelligence (AGI) comes into play. The infrastructure for those plays is still crucial.

That’s where chipmakers like Astera Labs (ALAB) ...

Read More About This

Read More About This

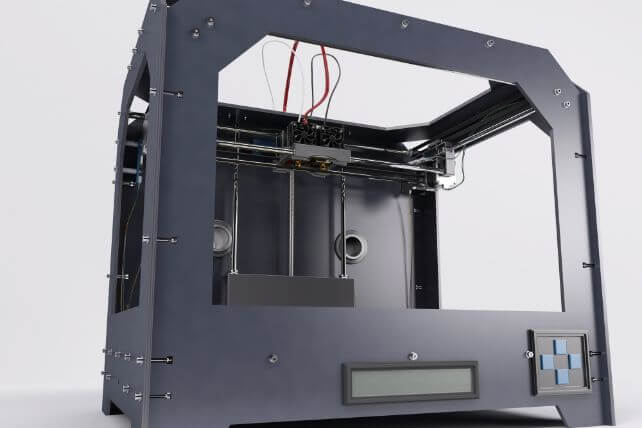

Insider Activity Report: 3D Systems Corp (DDD)

Jeffrey Graves, President and CEO of 3D Systems Corp (DDD), recently bought 60,000 shares. The buy came to a total cost of $231,000, and increased his position by 6%.

This is the first insider buy in 13 months, since a company director picked up 100,000 shares across two transactions in November 2023. Otherwise, there was one insider sale in 2024, from the company CTO, who sold 20% of his position for just under $448,000.

Overall, 3D Systems insiders own 2.9% ...

Read More About This

Read More About This