Insider Activity Report: Constellation Brands (STZ)

William Giles, a director at Constellation Brands (STZ), recently bought 1,000 shares. The buy increased his stake by a massive 216%, and came to a total cost of $186,390.

This marks the first insider buy at the company over the past two years. Insiders have been hefty sellers of shares over the past two years, including the President & CEO, as well as major holders. Most sales occurred at prices at least 30% higher from where shares currently trade.

Overall, Constellation ...

Read More About This

Read More About This

Unusual Options Activity: Western Alliance Bancorporation (WAL)

Regional bank Western Alliance Bancorporation (WAL) is up 37% over the past year, far outperforming the overall stock market. One trader sees further upside in the first half of 2025.

That’s based on the June 20 $100 calls. With 148 days until expiration, 4,291 contracts traded compared to a prior open interest of 157, for a 27-fold rise in volume on the trade. The buyer of the calls paid $5.80 to make the bullish bet.

Western Alliance shares recently traded for about ...

Read More About This

Read More About This

Don’t Count Out Industrial Plays Amid Today’s Tech Boom

The market still loves tech plays, whether AI or not. However, the rest of the economy still continues to show signs of booming. That means that other sectors can also perform well. And they may even be better performers this year.

Recent data shows that inflation is moderate, and the jobs market remains strong. That bodes well for areas such as construction and other signs of a physical booming economy.

That includes industrial goods. And that could mean a good year for ...

Read More About This

Read More About This

Insider Activity Report: United Fire Group (UFCS)

Micah Woolstenhulme, a SVP at United Fire Group (USFC), recently bought 2,500 shares. The buy came to a total cost of $48,003, and increased his stake by 7%.

Woolstenhulme was a buyer last year for 1,000 shares. Two company directors were also buyers last year, as well as the company CFO. Two other directors and a major holder were sellers of shares last year, with insider sales slightly exceeding insider buys.

Overall, United Fire Group insiders own 18.2% of shares.

The property ...

Read More About This

Read More About This

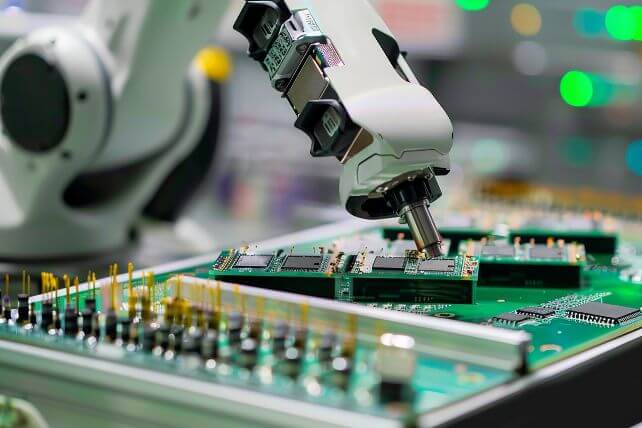

Unusual Options Activity: Taiwan Semiconductor (TSM)

Semiconductor manufacturer Taiwan Semiconductor (TSM) is up 88% over the past year, and just provided strong guidance in the quarters ahead. One trader is betting on a further rally.

That’s based on the May $200 calls. With 113 days until expiration, 20,265 contracts traded compared to a prior open interest of 553, for a 37-fold rise in volume on the trade. The buyer of the calls paid $25.65 to make the bullish bet.

Taiwan shares recently traded for about $212, meaning the ...

Read More About This

Read More About This

Beaten-Down Consumer Food Brands Could Rebound This Year

It’s been a challenging year for packaged food companies. Consumers have cut back on favorite name brands following years of above-average inflation. And the rise of new weight loss drugs have curbed appetites for many packaged foods.

However, markets tend to not just react to events, but overreact. And now, investors may have a chance to pick up leading consumer brands at a reasonable price. Such stocks could even be market leaders this year.

For instance, chocolate maker Hershey (HSY) has dropped ...

Read More About This

Read More About This

Insider Activity Report: Lamb Weston Holdings (LW)

Robert Niblock, a director at Lamb Weston Holdings (LW), recently bought 3,000 shares. The buy increased his stake by 13%, and came to a total cost of $182,819.

This marks the first buy of 2025. In 2024, Niblock and two other directors were also buyers of shares, with purchases ranging from over $75,000 to $554,000. There were no insider sales in 2024, but there were in 2023, when prices traded more than 40% higher.

Overall, Lamb Weston Holdings insiders own about ...

Read More About This

Read More About This

Unusual Options Activity: Peabody Energy (BTU)

Coal miner Peabody Energy (BTU) shed over 25% last year amid a weak energy market and a continued shift away from the use of coal. One trader sees shares rebounding a bit over the coming weeks.

That’s based on the February $18 calls. With 31 days until expiration, 7,262 contracts traded compared to a prior open interest of 186, for a 39-fold rise in volume on the trade. The buyer of the calls paid $1.52 to make the bullish bet.

Peabody shares ...

Read More About This

Read More About This