This High-Income Trade Is Also Looking at Growth

With stock market volatility on the rise and likely to persist, investors should think more defensively. That means looking for great companies to buy on big down days for the market. It can also mean taking a more income-oriented approach.

That can include companies with low to moderate dividend yields with a history of increasing that payout over time, or companies with a high current yield. Either could help boost investor returns in today’s jittery markets.

Plus, dividend stocks should perform well ...

Read More About This

Read More About This

Insider Activity Alert: Wynn Resorts (WYNN)

Tilman Fertitta, a major holder at Wynn Resorts (WYNN), recently bought 400,000 shares. The buy increased his position by 3%, and came to a total cost of $27,872,500.

Fertitta was the last buyer with a 16,500 share pickup back in March for $1.38 million. Two company directors were also buyers back in February. Going further over the past two years, Wynn insiders were sellers of shares at far higher prices than where the stock trades today.

Overall, Wynn insiders own 21.6% ...

Read More About This

Read More About This

Unusual Options Activity: Citigroup (C)

Wall Street megabank Citigroup (C) has been hit hard with the rest of the market in recent weeks, with the stock down 30% from recent highs. One trader sees further downside in the coming weeks.

That’s based on the May $57.50 puts. With 32 days until expiration, 4,803 contracts traded compared to a prior open interest of 134, for a 36-fold rise in volume on the trade. The buyer of the puts paid $2.86 to make the bearish bet.

Citigroup recently traded ...

Read More About This

Read More About This

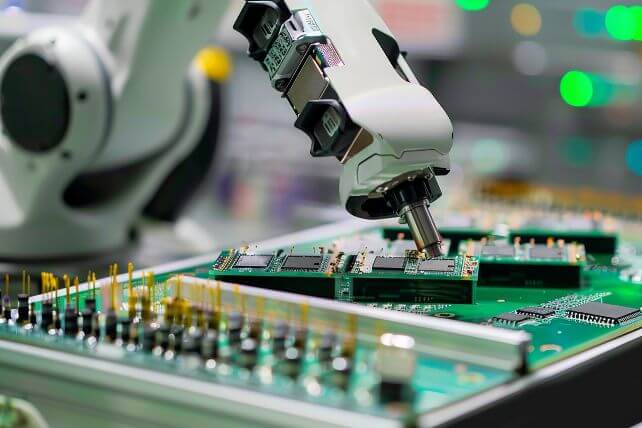

Get Ahead of a Manufacturing Renaissance

The tariff whipsaw in markets may be past the worst of the pain, but it’s not over yet. However, there’s a clear sign that many companies will be increasing their domestic manufacturing to avoid the dangers of rapid change in tariff policies.

That could bode well for many American manufacturers, particularly those who produce higher-end technologies. And owning shares of these companies could lead to outperformance as they see higher growth.

That includes industrial giant Honeywell (HON). The industrial conglomerate has a ...

Read More About This

Read More About This

Insider Activity Report: Clear Channel Outdoor Holdings (CCO)

Arturo Moreno, a major holder at Clear Channel Outdoor Holdings (CCO), recently bought 5,000,000 shares. The buy increased his stake by 10%, and came to a total cost of $4,775,000.

This is the third insider buy of the year, following an 800,000 share buy from a company director for just over $1 million at the end of February, and a 50,000 share buy from the CEO for $63,000 around the same time.

Overall, Clear Channel insiders own 17.3% of shares.

The billboard ...

Read More About This

Read More About This

Unusual Options Activity: Transocean (RIG)

Offshore oil rig operator Transocean (RIG) is down 65% over the past year, given the high costs of operating offshore and a continued decline in energy prices. One trader sees further weakness into 2027.

That’s based on the January 2027 $2 puts. With 644 days until expiration, 14,184 contracts traded compared to prior open interest of 144, for a 99-fold rise in volume on the trade. The buyer of the puts paid $0.63 to make the bearish bet.

Transocean shares recently traded ...

Read More About This

Read More About This

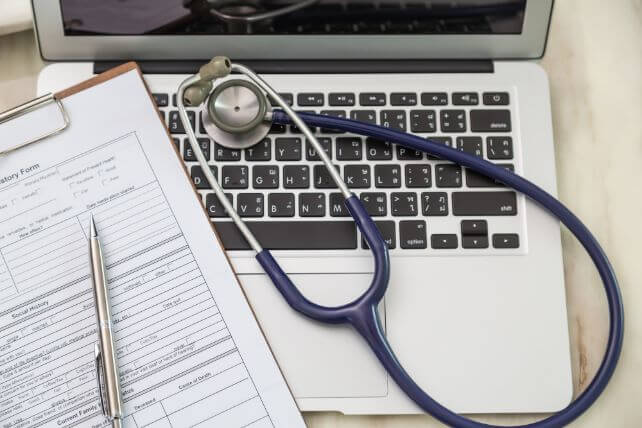

This Winning Sector for 2025 Gets Another Bullish Tailwind

Investors have had a rocky year. Stocks touched bear market territory within just a few weeks of hitting all-time highs back in February. While many names have been hit hard, a few sectors have been standouts in this market carnage.

One big performer here is the healthcare sector. These companies were generally laggards during the market’s big run over the past two years. Today, that’s reversing.

Health insurers also received notice that Medicare payment rates would increase. That’s providing a tailwind ...

Read More About This

Read More About This

Insider Activity Report: Applied Materials (AMAT)

Gary Dickerson, President and CEO of Applied Materials (AMAT), recently bought 50,000 shares. The buy increased his position by 3%, and came to a total cost of $6.85 million.

This marks the first insider buy at the company over the past two years. Otherwise, insiders have been periodic sellers of shares over the past two years. That includes Dickerson, who sold 400,000 shares last June, at a share price over $100 higher from where AMAT trades today.

Overall, Applied Materials insiders ...

Read More About This

Read More About This