Market Fears Create Opportunities in Industry-Leading Companies

There’s an old saying that the Chinese word for crisis is also the same word for opportunity. That can be the case in the stock market often, as short-term fears create long-term buying opportunities for astute investors. That’s the case with many beaten-down tech stocks right now. While there are still some pockets of overvaluation, a number of opportunities are available for industry-leading companies at a reasonable price right now. One clear-cut example is Advanced Micro Devices (AMD). Last week’s market selloff ...

Read More About This

Read More About This

The Market’s Still Rewarding Companies Growing Right Now

The current economic data shows inflation is running hot, supply chains are strained, and consumers are increasingly uncertain. A company that can thrive and grow now is one that’s going to be rewarded by investors in today’s market. The best place to find such companies are one that offer a powerful brand, which tends to hold more value, or which offer a service, as services are removed from supply chain constraints and tend to be highly profitable. One such area that looks ...

Read More About This

Read More About This

For Better Investment Results, Find Cash Flow Kings

The economy is rapidly changing. But one consistency for investors is to consider companies with strong cash flow. Any firm that can keep money coming in during good times and bad is one worth considering for the long haul. It’s even better for investors when a company finds new venues for generating cash during poor times. The pandemic created a number of opportunities for companies, with some still continuing to grow in the post-pandemic era. Case in point? The Walt Disney Company ...

Read More About This

Read More About This

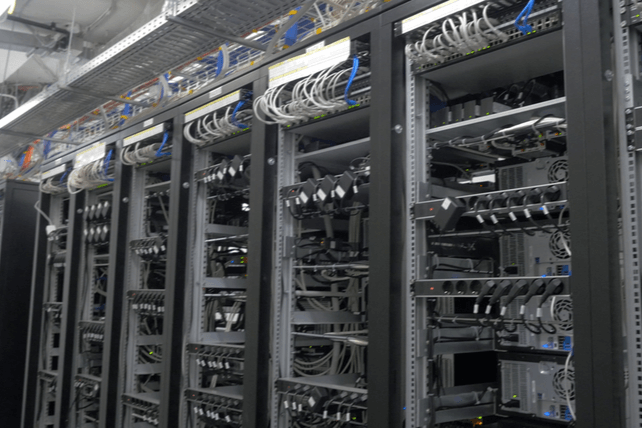

This Company Offers Investors a Win for Any Tech Trend

A number of high-profile technologies are being rapidly developed and will become mainstream in the next few years. That includes everything from the rise of cryptocurrencies, to the growing Metaverse, to other tech like self-driving cars. While each of those tech trends has specific companies, the infrastructure for those technologies will disproportionately will fall on a small number of firms. The absolute top player for these tech trends is graphics processing company Nvidia (NVDA). The company has already been a big winner, ...

Read More About This

Read More About This

Large Buys Ahead Point to Profits For this Volatile Niche Sector

One way to profit in the stock market is to find where large buy orders are occurring and then follow along. That’s typically done by institutional investors, but the launch of a popular new ETF could also bring a lot of new capital into a niche sector and lead to a big move higher. That could be the case in the coming days as a new ETF focused on Bitcoin mining companies comes onto the market. With crypto prices starting to ...

Read More About This

Read More About This

In a Market Selloff, Consider the Power of Brands

Companies with a strong brand have pricing power. They can raise prices faster than a product without a brand attached to it. That can create a valuable company, and one with higher profit margins than competitors. With a market correction, many companies with strong brands have seen their shares get thrown out like the proverbial baby with the bathwater. Astute investors should view big selloffs as buying opportunities. One such opportunity may be in Clorox (CLX). The cleaning supply brand, best known ...

Read More About This

Read More About This

For Better Market Returns, Consider Companies Nipping at the FANG Stock’s Heels

For years, the FANG stocks have become market dominators. It’s easy to see why. But in the past decade since the term was coined, many of these companies have seen new firms eat into their profit margins. That could come from a proliferation of competitors, such as in social media or streaming services. That’s why investors are seeing wild swings in these companies as earnings season unfolds. It’s also revealing another truth about the market. It’s the fact that nothing lasts forever ...

Read More About This

Read More About This

This Down-and-Out Player Has More Room to Run on Its Successful Turnaround

Turnaround opportunities can be tough for investors, as many turnaround plays often fail to, well, turn around. However, when a company does manage to pull it off, it can beat the market for years as it regains lost market share, and potentially even grows into new markets and new heights. That can be incredibly rewarding for investors. While those who got in at the start may fare best, those who wait to see a successful turnaround can earn great returns too. The ...

Read More About This

Read More About This