Stay Defensive with Recession-Resistant Trades Now

While investors have largely soured on growth stocks, a few sectors are holding up well. Most of them are commodity-based companies, as that space has delivered strong returns this year. Some companies are also holding up well because business tends to be steady, no matter what’s happening in the economy. One of the better possible trades in the coming months could come from companies offering both. Agricultural commodities have been rising as geopolitical tensions and reduced fertilizer production have impacted the global ...

Read More About This

Read More About This

Look For Companies That Can Succeed in New Growth Endeavors Now

Bear markets offer companies the ability to refocus and retrench. Companies that look toward the future when times are tough can rapidly expand into new growth areas ahead of the next economic swing higher. That can leave them positioned to take advantage of new opportunities that don’t sound appealing when markets are dropping. The housing crash in 2008 led many investors to avoid potential growth stories in the new technology of electric cars or to overlook the development of smartphones and ...

Read More About This

Read More About This

In a Rising or Falling Economy, Don’t Bet Against Defensive Consumer Plays

Consumer spending makes up the bulk of economic spending – over two-thirds, by most estimates. That means that any change in where and how consumers are spending can lead to a shift of billions of dollars. As retailers report their quarterly earnings, some are seeing consumers head their way amid rising economic uncertainty. Others aren’t faring as well. But a few players could be a standout play at current prices, given the role consumers play in the economy. For instance,Home Depot (HD), ...

Read More About This

Read More About This

Consider This Profitable Media Space as Streaming Stocks Slide

The media space is a lucrative one, and one where just a few companies control the bulk of the industry. However, the past few years has seen many media companies rise and fall as plans have come to fruition to build their own streaming services and compete with each other. While this has been going on, another niche part of the media space has been growing steadily, and even before the pandemic was posting better numbers than the box office. That space ...

Read More About This

Read More About This

Why This Strong Performing Player Can Continue Higher Now

The past six months have been devastating for growth companies. From the tech space to speculative startups to everything crypto, many of the well-known growth stories of the past year have seen their gains evaporate – and then some. However, the more slow-and-steady companies have been holding up far better now. And some even play to multiple favorable market trends now, which make them likely to continue performing well in the future. That latter category is whereBerkshire Hathaway (BRK-B) has been a ...

Read More About This

Read More About This

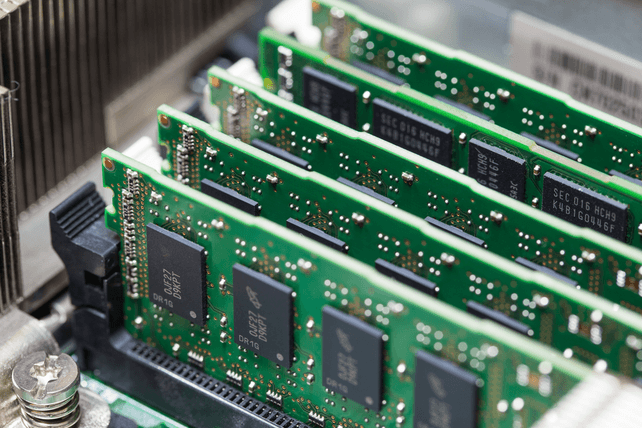

Long-Term Trends Bode Well for Tech Infrastructure Plays Now

Even with a modest slowdown in the overall economy in the first quarter of the year, and even with a potential recession if the second quarter also shows a slowdown, the world continues to improve. New technologies and networks are rolled out. New ideas hit the drawing board. And there’s still ample demand for those products to make an investment in the right tech stocks now a worthwhile one. With a number of new developments in the space, semiconductor companies are likely ...

Read More About This

Read More About This

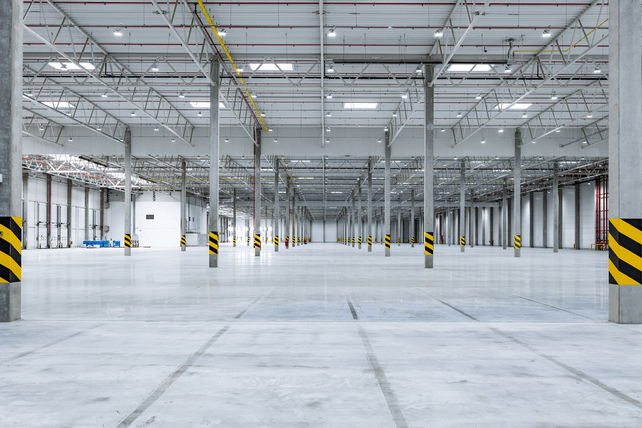

Slow and Steady Still Makes Real Estate A Compelling Sector For Investors Now

Real estate has been holding up better than the stock market. Even rising interest rates are seen as a potential way to cool the rapidly-rising housing market. Other parts of the real estate market have likewise held up well, but have different dynamics that should enable more value to be unlocked ahead. One such area is in industrial real estate. Most investors can’t or don’t want to own this space directly, so a number of REITs exist to make it easy. Industrial ...

Read More About This

Read More About This

Stick With Strong Brands and Intellectual Properties in Today’s Markets

With the stock market significantly off its highs, investors are looking for companies that can deliver on strong earnings right now. This earnings season, companies with strong brands and intellectual properties have been able to hold up relatively well. That’s a trend likely to continue going forward, as investors pull back from newer and riskier ventures with unknown prospects for the future. Such companies also tend to have the ability to raise prices better to counteract inflation, while still retaining customers. One such ...

Read More About This

Read More About This