Don’t Overlook Steady Income Plays in an Unsteady Market

The market may have hit a recent low in the past few weeks. Time will tell. Until we know more, uncertainty continues to reign. And many companies are now starting to report on the unusual conditions of the last quarter, which could lead to a further selloff. Companies with a large international presence are noting the effect that the strong US Dollar is having on their international operations. That’s leading to lower outlooks going forward. But if the economy starts to show ...

Read More About This

Read More About This

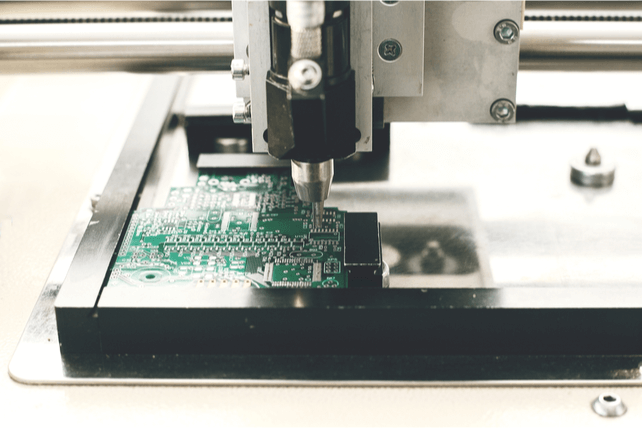

Continued Chip Demand Makes for Long-Term Buying Opportunities Now

Congress is weighing on legislation to support domestic semiconductor production before it goes on recess. The goal is to counter the global chip shortage. If passed, it will make it easier for mega-factories to be built stateside, but the chip shortage is still likely to continue. That’s because demand remains strong, and many new technologies require a larger number of more advanced chips than ever before. That bodes well across the industry. One company set to benefit from the shortage, and get ...

Read More About This

Read More About This

Stick With Proven Winners as Retail Spending Slows

While the latest data shows that retail spending is up – rising 1 percent in the past month—the rate of spending has slowed. That’s an indicator that consumers will likely cut back on luxury goods, and focus more on buying basics where they can get reasonable prices. For investors, that’s potentially bad news for a number of retail stocks. However, some companies tend to fare well as they provide customers a variety of goods at inexpensive prices. With retail stocks already down ...

Read More About This

Read More About This

Don’t Bet Against Today’s Tech Winners in Today’s Fearful Markets

The stock market is in a downtrend, and that will likely continue until the Federal Reserve stops its current policy of raising interest rates. This downtrend is throwing out great companies along with weaker ones, and has hit the tech space fairly hard. That’s creating one of the best buying opportunities for investors in tech in years. That’s especially true with companies that can still deliver on growth in a slowing economy. Case in point is wireless semiconductor chip company Qualcomm (QCOM) ...

Read More About This

Read More About This

Consumer Brands Have Pricing Power Here—Making for Inflation-Beating Investments Now

Rising inflation has brought down stock values as uncertainty has increased. But a number of companies are able to raise prices and pass on the costs of inflation to their customers. That makes these companies able to maintain or even grow their profit margins during multi-decade high inflation. Once markets stop their current downtrend, these companies could continue to pay off and reward investors in the future. Consumer goods companies are best positioned for this trend. In this space, one leader is ...

Read More About This

Read More About This

Now’s The Time to Look for Well-Managed Companies Lagging Peers

A company’s management can make or break a business. Some managers are so good that they can even become household names. Most aren’t so lucky. That’s how rare that quality is. In today’s markets, with nearly everything selling off, great companies with strong management are seeing their share price sag even if they’re setting up their business to prosper with the next economic turnaround. One case in point is Jamie Dimon, CEO at JPMorgan Chase (JPM). The bank has sagged nearly 30 ...

Read More About This

Read More About This

Keep Accumulating Industry-Leading, Inflation-Beating Consumer Goods Plays Here

Markets can turn on a dime. One piece of good news, whether from earnings reports, the Federal Reserve, or a change in government policy could turn around the current market fears. While there may be more downside first, that just gives investors a few extra weeks or even months to buy great companies at reasonable prices. That’s especially true when buying shares of consumer goods companies. These stocks tend to trade at a premium, but can become a reasonable value in ...

Read More About This

Read More About This

Look for Steady Operators in Volatile Markets

In a bear market, good stocks will be thrown out with bad. And high growth names will be heavily discounted, while even those that can continue to grow will also face a downturn, even if things are going well. Investors can use bear markets to buy both growth names and value names at a relative discount to where they’ll trade once the next bull market is underway. Investors looking for bargains now could find one in Watsco (WSO). The company is a ...

Read More About This

Read More About This