This New Shopping Trend Could Lead to Big Profits In this Niche

The holiday season has been challenging. Overall spending is up, but not enough to cover the change in inflation over the past year. Consumer savings are down, and credit card spending is on the rise. That could push consumer spending lower. As a major part of the economy, that’s not good. However, there’s a niche for retail spending that’s been growing tremendously in recent years. And a few companies behind that trend stand to benefit. That trend is the rise of the ...

Read More About This

Read More About This

Buy Shares of Companies Looking at Long-Term Profitable Returns Now

In a rough market, even great companies will miss on earnings. But how they miss can be illustrative of their potential future returns. For instance, with inflation data coming down, companies dealing with high costs could see that factor fade away. With Wall Street looking at each quarter’s numbers compared to the year before, declining costs could lead to a big move higher for any company with something positive to report. For instance, Carnival Cruise Lines (CCL) reported a narrower loss in ...

Read More About This

Read More About This

Use Bear Markets to Accumulate Companies That Can Buck the Trend

In a bull market, investors can buy just about any stock and make money. While it’s tougher in a bear market, there are several stocks that can hold their own and even gain. That’s true of every bear market. 28 of the 30 Dow stocks dropped in 2008, but 2 of them managed to move higher. In this current market, with rising interest rates and a slow economy, it’s no surprise investors are turning to defensive stocks once again. One defensive stock ...

Read More About This

Read More About This

Look for Market-Beating Returns in Off-the-Beaten Path Names

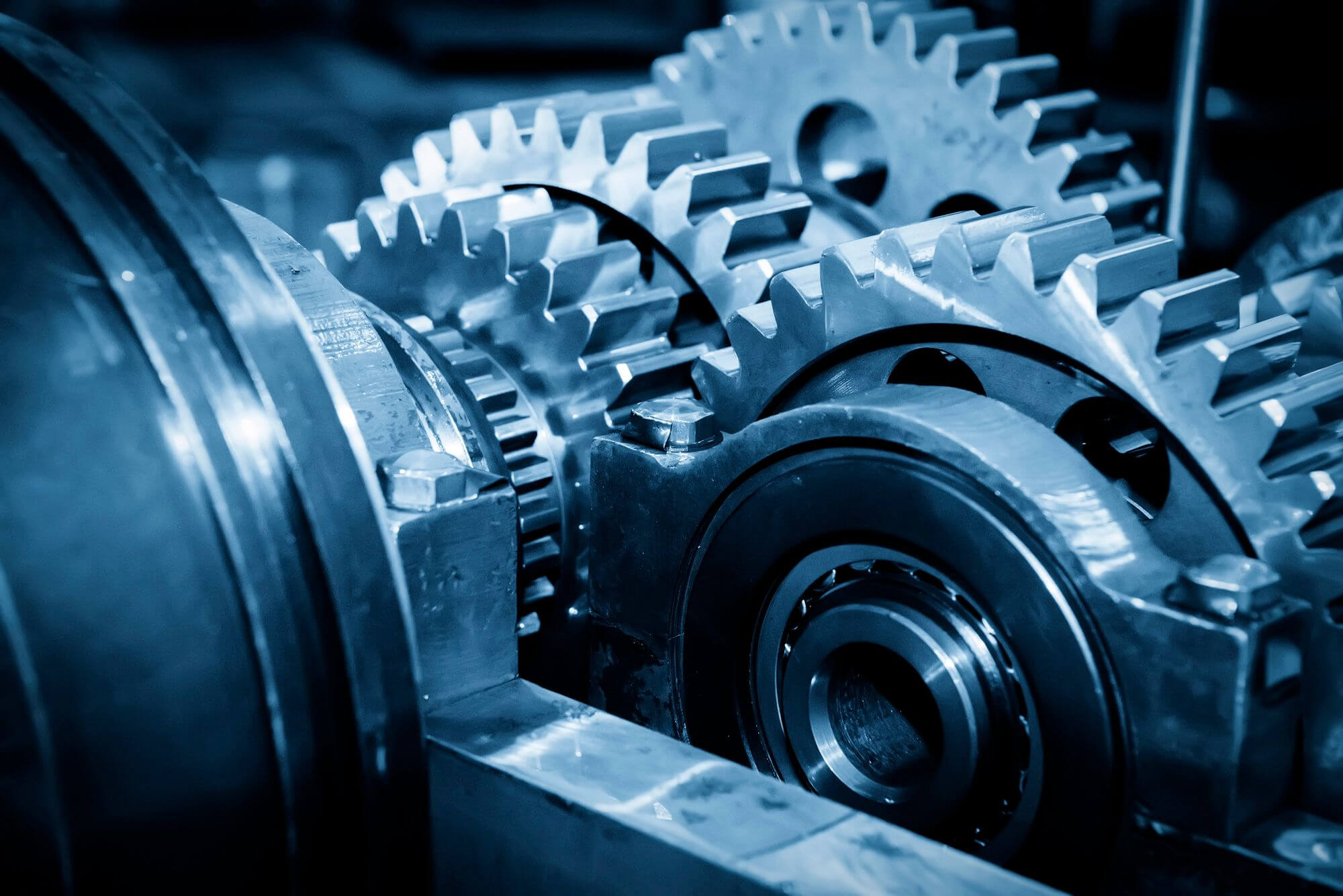

Investors tend to gravitate towards great companies. Those companies tend to dominate their industry, and tend to grow massive. That makes it easier for investors to justify owning. While we’re fans of big-name tech companies thanks to their high profit margins and industry positioning, many more off-the-radar companies can be big winners too. That’s especially true getting out of well-known tech and consumer brand name companies and into infrastructure and industrial stocks. These companies manufacture many of the products needed for other ...

Read More About This

Read More About This

Stick With Industry Winners, Even When They’re Being Cautious

The economy continues to slow. While that’s starting to show up in declining year-over-year inflation rates, the market is warning about a recession in several ways. Big businesses are one of the places where the alarm has been sounded. That’s because a few companies have announced layoffs, of anywhere from 5 to 30 percent of their workforces. Typically, a company that can do more with less can fare well over time, however. One of the most recent companies to announce layoffs is ...

Read More About This

Read More About This

Play This Stealth Winner in the Cloud Space

In any sector or trend, a few companies come to dominate. The headline names may attract considerable attention, but the real returns can often be in the companies providing the infrastructure behind it. These “pick and shovel” plays may lack for an exciting story, but when it comes to investing, a boring idea that’s profitable tends to have a better valuation than going after the exciting story. In the cloud services space, server processors make the most attractive story. Rather than focus ...

Read More About This

Read More About This

This Tech Industry Leader Offers High Appreciation Potential and a High Dividend

Investors often see a trade-off between high growth opportunities and income. However, in a market selloff, growth names can go on sale. And when they do, any dividend that they may be paying can become much larger than average. Striking a balance between the two involves looking at where some of the best bargains lie under current market conditions. But investors looking for growth and income have a growing number of opportunities right now. One such opportunity is in Qualcomm (QCOM). The ...

Read More About This

Read More About This

Go Where the Growth Is Now, Even If You’re Early

There’s an old Wall Street saying that they don’t ring a bell at the top. That’s also true of the bottom for the stock market, a sector, or individual companies. The best that investors can do is look for companies that are growing during a tough time – and increasing their market share. These companies will survive, and likely be rewarded for their growth, even if that takes time to play out with a new bull market. One company we’ve seen play ...

Read More About This

Read More About This