This Leading Brand Is About to Get Another Round of Global Exposure

The stock market’s returns this year have been concentrated heavily into tech stocks. That’s created an opportunity, as there’s are still several values in other segments of the market, even with stocks near all-time highs. Astute investors will be able to find opportunities likely to trend higher in the coming months outside of tech. One place that could be ripe for big returns comes from companies with strong brands. That’s because a strong brand tends to grow the most when the economy ...

Read More About This

Read More About This

Get Ready for the Next Wave of AI Investments

The first wave of AI investments has been centered around big-tech companies providing hardware or software needed to run AI programs. The next wave is unfolding, and will create new investment opportunities elsewhere. While the current generation of AI programs requires significant processing power, the next wave will include simpler programs that can be run on-the-go. That’s what creates new investment opportunities for investors today. For those looking for an AI system that can run on a piece of hardware like a ...

Read More About This

Read More About This

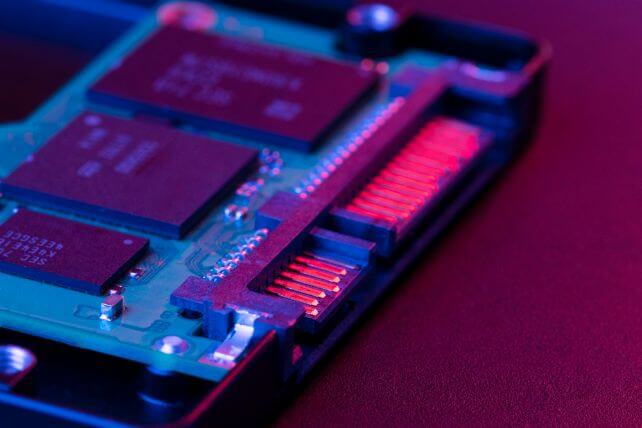

This Chip Player Could Beat Nvidia’s Returns Through the Rest of 2024

The stock market’s return has been massively influenced by the returns in Nvidia (NVDA). The designer of GPUs and other hardware has surged thanks to an interest in AI. But with the share split over, the stock price may slow its gains from here. That will allow other chipmakers also seeing a big boost in business right now to see massive returns in their share price. A few could even outperform Nvidia in the second half of the year. One contender is ...

Read More About This

Read More About This

This Shortage Will Keep Producers Growing

Supply and demand are the key elements to understanding economics. It can also be the key to understanding an investment opportunity. Right now, demand for semiconductor chips for AI is soaring. That will make those companies more profitable over time. And that’s why their share prices continue to soar. But that’s just one part of the overall market. Other sectors likewise are seeing some big shifts in supply and demand. And those shifts can also lead to big profits. One such sector ...

Read More About This

Read More About This

Look For Opportunities in the Commodity Space as Prices Pull Back

Commodities have had a strong performance this year. However, prices in everything from gold and silver to base metals have pulled back in the past few weeks. For investors interested in the long-term opportunity in the commodity space, it may be close to a buying point. That’s because the slight pullback in commodity prices has hit many commodity stocks even harder. With many of these stocks now in a correction off their recent highs, it may be time to buy. One potential ...

Read More About This

Read More About This

Don’t Overlook AI Opportunities That Extend to Hardware

The best returns in the AI space have come from semiconductor designers and manufacturers. However, that’s just part of the hardware needed for AI programs to succeed. Investors have started to branch out, rewarding companies that make power distribution systems and server racks. That’s still just scratching the surface. New devices will be needed to best utilize AI systems, and building out the next generation of technology will expand the hardware investment opportunities even further. One such opportunity might be in Corning ...

Read More About This

Read More About This

Creativity Will Win in the Next Phase of the AI Rollout

The first phase of the AI rollout was centered around generative AI. This is simply a prompt that users could provide questions to, and receive information from a database. Now, AI is already rapidly improving. One major change is the rise of better prompting. These tools can allow creative workers to generate images, and even videos from a prompt, far beyond the level of a text response. It’s also a strong sign for some companies. One big winner that we’ve noted before ...

Read More About This

Read More About This

This Company Hitting New All-Time Highs Can Keep Going Significantly Higher

Usually, when a company breaks to new all-time highs, it’s likely going to trend higher for some time later. That’s especially true when a company can point to a positive trend such as growing earnings, a new product, or a new partnership. Investors who typically might not be interested in a great company at all-time highs can carve out an exception when a great company has made it clear their business is on the rise. That looks like the case with Oracle ...

Read More About This

Read More About This