Smaller Tech Stocks Are Poised to Rally into Next Year

Despite some likely market weakness in September and October, stocks are likely to close the year at new all-time highs. Even better, the trend has been shifting away from a handful of mega-cap large stocks, and the rally has been broadening out. Investors who buy smaller companies can likely see the best return on their investment in the months ahead. And investors have plenty of options that include companies that still play to today’s tech trends. For instance, Arm Holdings (ARM) is ...

Read More About This

Read More About This

This Niche Retail Space Is Ripe for Further Growth

Every investment sector has its subgroup. The retail sector comprises a number of companies, from high-end shops to big-box stores. Depending on the economic cycle and valuation, some of those niche areas will perform better than others. With the economy cooling off, consumers are likely to look for lower-cost shopping experiences. And it could mean a rise in spending on little luxuries, rather than large ones. That bodes well for convenience store chains. These stores have seen high growth, and cater across ...

Read More About This

Read More About This

The Market Loves This Consistent Form of Revenue

Companies have plenty of ways to make sales and obtain revenues from customers. They can charge a one-time fee. They can provide financing for a larger item, or for long-term services. Or, for services, they can charge a recurring fee. Wall Street loves companies that charge recurring revenues. Unlike building a business off of one-time sales, recurring revenues show the strength of ongoing relationships. That’s why subscription-based service companies can see big moves higher or lower as they report results. While the ...

Read More About This

Read More About This

Grab Safety with a Dash of Growth

Markets are likely to trade sideways over the next few months, and may face another pullback similar to the one seen in August. Investors can use a pullback as an opportunity to buy stocks on a drop. Or they can look for steadier stocks that can pay a sizeable income while continuing to trend higher. Many stocks are still near 52-week highs. A few of them are also companies that offer dividend growth over time. Since over an investment lifetime, reinvested dividends ...

Read More About This

Read More About This

High Margin Companies Can Deliver Great Returns Over Time

There are many ways to measure a company’s valuation. One is to look at a company’s earnings, and how it trades relative to its price. Another factor is to look at a company’s profit margins. Some companies, such as manufacturers, have high costs of production. It’s hard to get a great profit margin. But other companies, like software-related businesses, can see great returns. That’s because the marginal cost of making an additional copy of software is essentially zero. Investors have plenty of ...

Read More About This

Read More About This

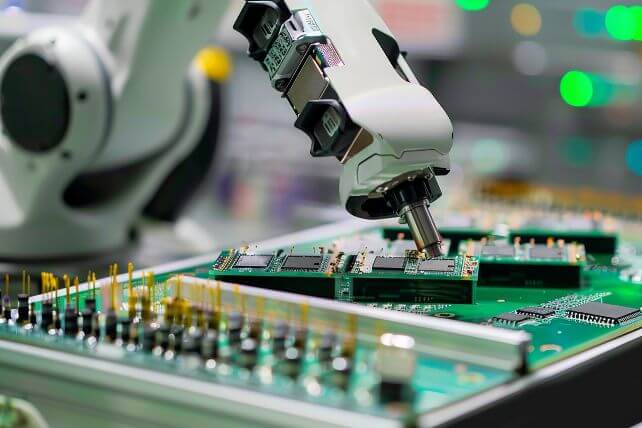

Smaller Chipmakers Can Still Take Over Market Leadership Here

The stock market could potentially continue higher in the months ahead, this time led by smaller companies than just a handful of large-cap giants. That includes smaller tech companies that can also supply hardware for the AI boom. While the boom will eventually end, this quarter’s earnings reports across corporate America suggest that the AI spending boom is alive and well. And that plenty of other companies have yet to see the biggest benefit from this trend. One potential winner is chipmaker ...

Read More About This

Read More About This

This Stealth AI Play Still Has More Room to Run

The AI rollout continues. Earnings season indicates that many companies are continuing to invest and build in AI projects. While that growth may slow down in a few years, for now, the trend is on. That means investors should look to buy AI-related plays on any reasonable selloff. Finding high-growth companies and buying them after a quick 10-20% pullback is one way to play the AI trend without buying in at the top. One AI-related play is the growth of data centers ...

Read More About This

Read More About This

As the AI Trend Shifts, Look for High Profits

AI stocks remain hot, although it’s clear that many companies expect sales to start to cool off. The initial wave of AI buying will likely be over by the end of next year. That still offers investors plenty of time to make a little more out of big hardware plays. But it also suggests that investors may fare better investing with software companies. That’s because software tends to be a high-margin product. Even better, many software services generate recurring revenues through monthly ...

Read More About This

Read More About This