Insider Trading Report: Tilly’s (TLYS)

Michael Henry, CFO atTilly’s (TLYS), recently picked up 4,000 shares. The buy increased his stake by 16 percent, and came to a total cost of just under $29,000. This follows up on a 6,005 share buy from the director a few days before. This marks the first insider buy at the company since September 2020. Insiders were active buyers during the Covid selloff, and then have generally been sellers of shares in the past two years after shares rallied higher. Overall, insiders ...

Read More About This

Read More About This

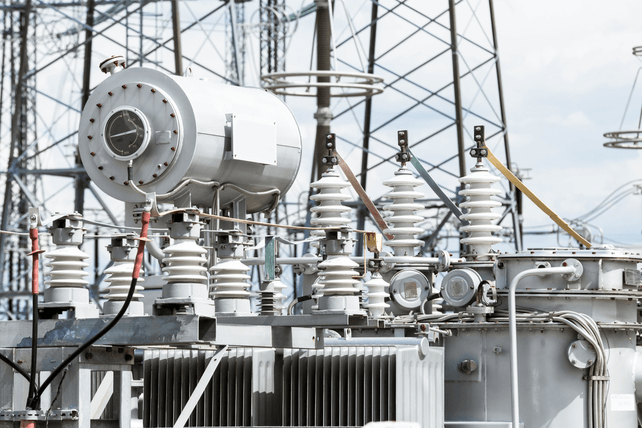

Insider Trading Report: Vistra Corp (VST)

Brian Ferraioli, a director atVistra Corp (VST), recently picked up 8,050 shares. The buy increased his holdings by nearly 12 percent, and came to a total purchase price of just over $181,000. The buy came three days after the company president and CEO picked up 32,000 shares for just over $547,000. Over the past three years, company insiders have been active as both buyers and sellers, with buyers having a slight edge over that time period. Overall, insiders at the company own ...

Read More About This

Read More About This

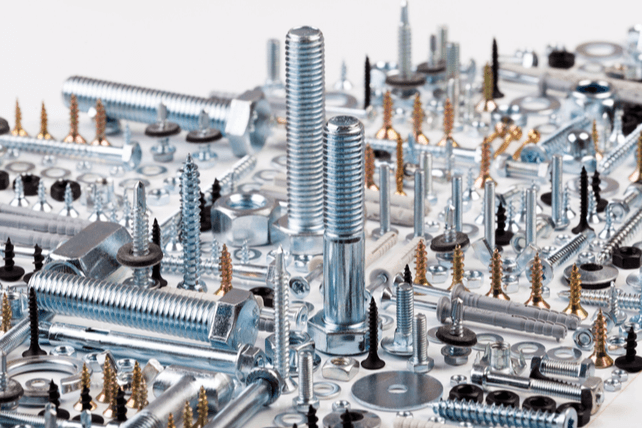

Insider Trading Report: Fastenal (FAST)

Holden Lewis, CFO atFastenal (FAST), recently added 1,000 shares. The buy increased his stake by nearly 12 percent, and came to a total price of just under $50,000. He was joined by another EVP, who also picked up 1,000 shares on the same day for about the same price. This adds to further insider buys in recent months, from company executives and directors alike. Going back over the past three years, there has been a mix of insider buys and sells. Overall, ...

Read More About This

Read More About This

Insider Trading Report: NortonLifeLock (NLOK)

Peter Feld, a director atNortonLifeLock (NLOK), recently picked up 2,500,000 shares. The buy increased his holdings by 15 percent, and came to a total price of $55.5 million. This marks the first insider buy at the cyber safety solution company since the summer of 2019. Otherwise, company insiders, including both C-suite executives and directors, have been sellers of shares, irrespective of how shares have traded over the past three years. Overall, company insiders own about 0.5 percent of the company. The stock is ...

Read More About This

Read More About This

Insider Trading Report: Fiserv (FSV)

ValueAct Capital Master Fund, a major holder ofFiserv (FSV), recently added 1,000,000 shares. The buy increased the fund’s holdings by 7.3 percent, and came to a total cost of just under $92 million. Over the past three years, insiders have generally been sellers of shares. That includes both directors and c-suite executives. Funds have tended to be large buyers of shares at the company. Overall, insiders own just over 12.1 percent of the company. Shares of the financial tech services company have shed ...

Read More About This

Read More About This

Insider Trading Report: Alliant Energy Corp (LNT)

Nanco Falotico, a director atAlliant Energy Corp (LNT), recently added 1,200 shares. The buy increased her stake by 12,000 percent, and came to a total price just over $73,000. This marks the first insider activity since late 2019. Back then, there were a number of insider buys and sells. And going further back, both company directors and executives have been modest buyers and sellers of company shares. Overall, insiders own 0.15 percent of the company. The utility company shed 2 percent over the ...

Read More About This

Read More About This

Insider Trading Report: Shutterstock (SSTK)

Paul Hennessy, a director atShutterstock (SSTK), recently picked up 10,000 shares. The buy increased his stake by 47 percent, and came to a total price of just over $564,000. This marks the first insider buy at the company in the past three years. Over that timeframe, most insider sales have come from the company’s Executive Chairman, who is also a major holder. Even with the massive sales, company insiders still own 33.3 percent of the company. Shares are down about 40 percent over ...

Read More About This

Read More About This

Insider Trading Report: American Eagle Outfitters (AEO)

David Sable, a director atAmerican Eagle Outfitters (AEO), recently picked up 1,500 shares. The buy increased his stake by 6 percent, and came to a total price of just under $19,000. This marks the second insider buy this year, also from a director. And a third director picked up shares late last year. Otherwise, company executives have been large and consistent sellers of shares over the past three years. Overall, company insiders own about 6.3 percent of shares. Shares of the apparel retailer ...

Read More About This

Read More About This