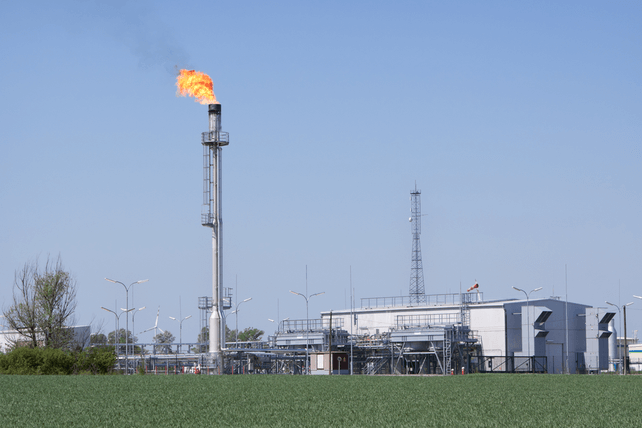

Insider Trading Report: National Fuel Gas Co (NFG)

David Bauer, President and CEO at

National Fuel Gas Co (NFG), recently added 3,000 shares. The buy increased his stake by nearly 5 percent, and came to a total purchase price of just over $154,000. This marks the first insider buy at the company in the past three years. There has been some insider sales back in 2019, but otherwise insider activity at the company has been fairly quiet. Overall, insiders own about 1.5 percent of shares. The share price has held in ...

Read More About This

National Fuel Gas Co (NFG), recently added 3,000 shares. The buy increased his stake by nearly 5 percent, and came to a total purchase price of just over $154,000. This marks the first insider buy at the company in the past three years. There has been some insider sales back in 2019, but otherwise insider activity at the company has been fairly quiet. Overall, insiders own about 1.5 percent of shares. The share price has held in ...

Read More About This

Unusual Options Activity: UBS Group AG (UBS)

Shares of megabank

UBS Group AG (UBS) have been trending higher the past year, with a few sizeable drops during periods of market fears. One trader sees the possibility for another such drop in the next few months. That’s based on the February $12.50 puts. With 143 days left on the trade, over 6,025 contracts traded, a 54-fold jump in volume from the prior open interest of 112. The buyer of the puts paid $0.25 to make the trade. With shares currently in ...

Read More About This

UBS Group AG (UBS) have been trending higher the past year, with a few sizeable drops during periods of market fears. One trader sees the possibility for another such drop in the next few months. That’s based on the February $12.50 puts. With 143 days left on the trade, over 6,025 contracts traded, a 54-fold jump in volume from the prior open interest of 112. The buyer of the puts paid $0.25 to make the trade. With shares currently in ...

Read More About This

One of the World’s Top Retailers Continues to Demonstrate its Strength

Retail still makes up the backbone of consumer spending, and thus the economy. That’s why providing investors with sales data can provide a clue as to how the economy is performing outside other measures like employment or housing costs.

One such retailer is

Costco (COST). The company recently released its latest earnings, which shows that consumers are continuing to spend at a good pace, and even increasing in some areas such as fresh food. The earnings numbers and the company’s outlook were ...

Read More About This

Costco (COST). The company recently released its latest earnings, which shows that consumers are continuing to spend at a good pace, and even increasing in some areas such as fresh food. The earnings numbers and the company’s outlook were ...

Read More About This

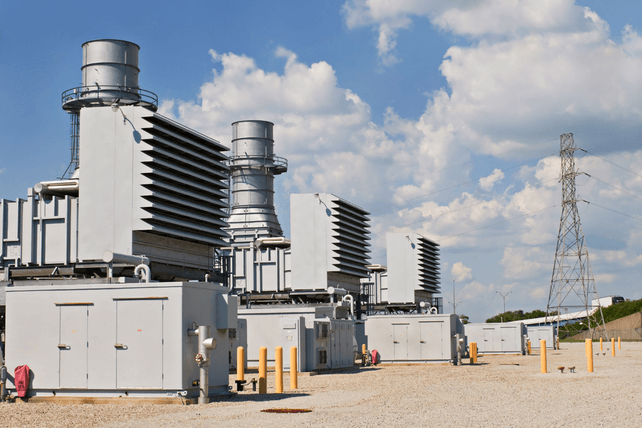

Insider Trading Report: Evergy Inc (EVRG)

David Campbell, President and CEO at

Evergy (EVRG), recently bought 7,850 more shares. The buy increased his stake by over 12 percent and came to a total purchase price of just under $500,000. He was joined by the company CFO, who bought 7,875 shares on the same day. That buy increased his stake by 55 percent, and cost just over $501,000. This marks the second and third insider buys of the year, following a company director picking up over 2.25 million shares back ...

Read More About This

Evergy (EVRG), recently bought 7,850 more shares. The buy increased his stake by over 12 percent and came to a total purchase price of just under $500,000. He was joined by the company CFO, who bought 7,875 shares on the same day. That buy increased his stake by 55 percent, and cost just over $501,000. This marks the second and third insider buys of the year, following a company director picking up over 2.25 million shares back ...

Read More About This

Unusual Options Activity: Johnson Controls International (JCI)

Shares of engineering and construction materials firm

Johnson Controls International (JCI) have been in a steady uptrend for more than a year. One trader is betting that steady progress higher will continue. That’s based on the April 2022 $75 calls. With 199 days until expiration, over 5,200 contracts traded against a prior open interest of 134, for a 39-fold rise in volume. The buyer of the calls paid $4.60 to make the trade. Shares of JCI are already up 78 percent over the ...

Read More About This

Johnson Controls International (JCI) have been in a steady uptrend for more than a year. One trader is betting that steady progress higher will continue. That’s based on the April 2022 $75 calls. With 199 days until expiration, over 5,200 contracts traded against a prior open interest of 134, for a 39-fold rise in volume. The buyer of the calls paid $4.60 to make the trade. Shares of JCI are already up 78 percent over the ...

Read More About This

This Slowly Recovering Industry May Continue to Surprise to the Upside

Many industries have moved on from the pandemic. For those in travel and tourism, however, trends still remain far under pre-pandemic levels.

However, the trend is improving, albeit slowly. One such sector that’s continuing to recover is the cruise industry. Completely shut down for nearly a year, the slow resumption of cruises in the post-pandemic era is a true sign as to whether or not large, confined crowds can come together without creating health scares.

So far, signs are good. And

Carnival Corporation ...

Read More About This

Carnival Corporation ...

Read More About This

Insider Trading Report: The AES Corp (AES)

Maura Shaughnessy, a director at

The AES Corp (AES) recently picked up 30,000 more shares. The buy increased her stake by nearly 70 percent, and came to a total cost of just under $714,000. This marks the first insider buy at the company since June 2020, and a buy as shares have pulled back from recent highs. Three company employees sold shares back in August, with the total size of those sales far exceeding this insider buy. Overall, insiders own a scant ...

Read More About This

The AES Corp (AES) recently picked up 30,000 more shares. The buy increased her stake by nearly 70 percent, and came to a total cost of just under $714,000. This marks the first insider buy at the company since June 2020, and a buy as shares have pulled back from recent highs. Three company employees sold shares back in August, with the total size of those sales far exceeding this insider buy. Overall, insiders own a scant ...

Read More About This

Unusual Options Activity: Salesforce.com (CRM)

Shares of cloud provider

Salesforce.com (CRM) jumped higher on Thursday following solid earnings and a bullish full-year outlook. One trader sees the possibility for a move higher in the coming weeks. That’s based on the October 29 $280 calls. With 35 days until expiration, over 2,200 contracts traded, a 22-fold rise in volume from the prior open interest of 101 contracts. The buyer of the calls paid $4.98 to make the trade. The recent rally in shares brings the stock up 9 ...

Read More About This

Salesforce.com (CRM) jumped higher on Thursday following solid earnings and a bullish full-year outlook. One trader sees the possibility for a move higher in the coming weeks. That’s based on the October 29 $280 calls. With 35 days until expiration, over 2,200 contracts traded, a 22-fold rise in volume from the prior open interest of 101 contracts. The buyer of the calls paid $4.98 to make the trade. The recent rally in shares brings the stock up 9 ...

Read More About This