Insider Trading Report: Luminar Technology (LAZR)

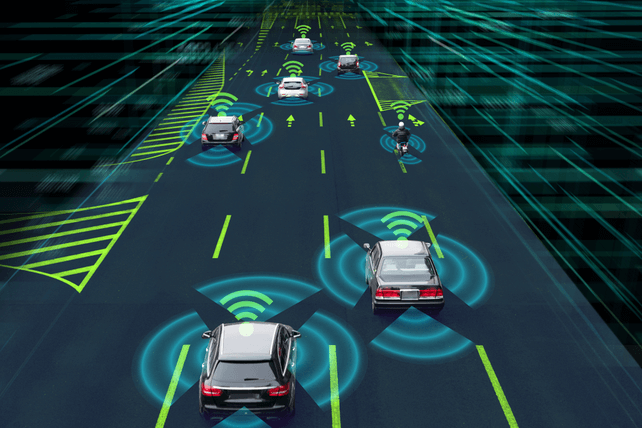

Matthew Simoncini, a director at

Luminar Technology (LAZR), recently added 10,000 shares. The buy increased his holdings by 28 percent, and came to a total cost just over $160,000. This is the second buy from the director in as many weeks, following a 4,355 share buy in mid-December for just under $66,000. A number of other directors and the company CFO have been buyers in the past few weeks. Overall, insiders own 16.7 percent of company shares. The buys have come in as ...

Read More About This

Luminar Technology (LAZR), recently added 10,000 shares. The buy increased his holdings by 28 percent, and came to a total cost just over $160,000. This is the second buy from the director in as many weeks, following a 4,355 share buy in mid-December for just under $66,000. A number of other directors and the company CFO have been buyers in the past few weeks. Overall, insiders own 16.7 percent of company shares. The buys have come in as ...

Read More About This

Unusual Options Activity: American Tower Corporation (AMT)

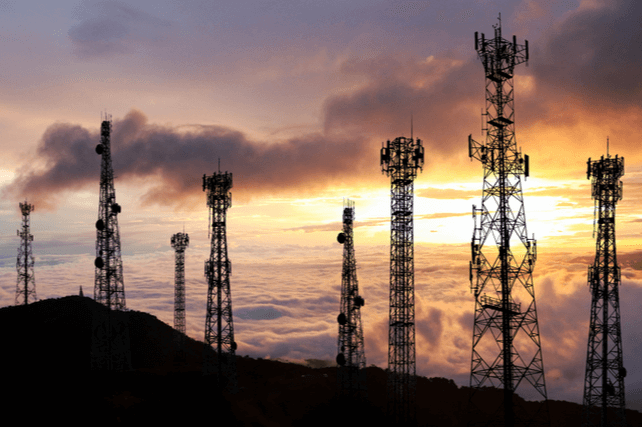

Shares of communications real estate investment trust

American Tower Corporation (AMT) have been trending higher in the last year, although they’ve flatlined in recent months. One trader sees a deep value in shares and the potential for them to move higher. That’s based on the January 2023 $150 calls. With 389 days until expiration, 1,770 calls traded against a prior open interest of 121, for a 15-fold rise in volume. The buyer of the calls paid $131.65 to make the trade. Shares of ...

Read More About This

American Tower Corporation (AMT) have been trending higher in the last year, although they’ve flatlined in recent months. One trader sees a deep value in shares and the potential for them to move higher. That’s based on the January 2023 $150 calls. With 389 days until expiration, 1,770 calls traded against a prior open interest of 121, for a 15-fold rise in volume. The buyer of the calls paid $131.65 to make the trade. Shares of ...

Read More About This

Fear From Policy Changes Leads to Another Profit Opportunity in This Tech Niche

The threat of changing laws and regulations has weighed on some tech stocks. However, the hardest hit stocks have been hurt the most from changes coming from other businesses, not government regulators.

For instance, earlier this year,

Apple (AAPL) changed advertising-tracking policies on its devices. That’s led to poor performance in a number of companies, particularly those that offer social media services. The biggest loser?

Snapchat (SNAP). Shares peaked at $83 earlier this year, and have since lost 45 percent of their value, and ...

Read More About This

Apple (AAPL) changed advertising-tracking policies on its devices. That’s led to poor performance in a number of companies, particularly those that offer social media services. The biggest loser?

Snapchat (SNAP). Shares peaked at $83 earlier this year, and have since lost 45 percent of their value, and ...

Read More About This

Insider Trading Report: Planet Labs PBC (PL)

Kevin Weil, a President of product and business at

Planet Labs (PL), recently bought 165,580 shares. The buy increased his holdings by over 15 percent, and came to a total purchase price of just over $995,000. This is the second recent buy from insiders, as a company director bought 36,785 shares valued at over $245,000 the week before. These two buys constitute the only insider activity since the company went public. Overall, insiders own about 14 percent of company shares. The company operates ...

Read More About This

Planet Labs (PL), recently bought 165,580 shares. The buy increased his holdings by over 15 percent, and came to a total purchase price of just over $995,000. This is the second recent buy from insiders, as a company director bought 36,785 shares valued at over $245,000 the week before. These two buys constitute the only insider activity since the company went public. Overall, insiders own about 14 percent of company shares. The company operates ...

Read More About This

Unusual Options Activity: Newmont Mining (NEM)

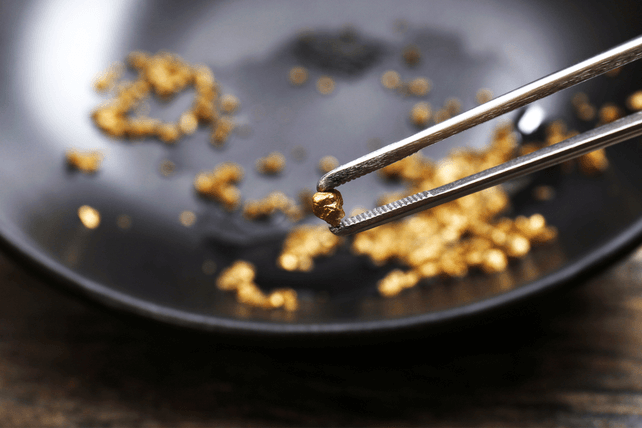

Shares of gold mining firm

Newmont Mining (NEM) have been range-bound over the past few months. One trader sees the company moving back down to the lower end of its range in the next few weeks. That’s based on the February $52.50 put. With 56 days until expiration, 6,930 contracts traded against a prior open interest of 295, for a 23-fold rise in volume. The buyer of the puts paid $0.88 to make the trade. Overall, shares are down about 2 percent ...

Read More About This

Newmont Mining (NEM) have been range-bound over the past few months. One trader sees the company moving back down to the lower end of its range in the next few weeks. That’s based on the February $52.50 put. With 56 days until expiration, 6,930 contracts traded against a prior open interest of 295, for a 23-fold rise in volume. The buyer of the puts paid $0.88 to make the trade. Overall, shares are down about 2 percent ...

Read More About This

Industry Leaders Can Keep Delivering In Any Economy

While uncertainty has been weighing on the stock market, great companies can continue to deliver, no matter what the economy or latest fears are doing. Quality results and returns speak for themselves.

It’s even easier when a company has strong demand for its products and is a leader in its industry. That makes it ideal to buy during periods of market fears.

Case in point?

Nike (NKE). The sports apparel company is continuing to demonstrate that it’s a global powerhouse. In its most ...

Read More About This

Nike (NKE). The sports apparel company is continuing to demonstrate that it’s a global powerhouse. In its most ...

Read More About This

Insider Trading Report: Funko Inc (FNKO)

Charles Denson, a director at

Funko Inc. (FNKO), recently bought 99,300 shares. The buy increased his stake by over 115 percent, and came to a total purchase price of just over $1.7 million. This marks the first insider buy since August, when a fund with a major ownership stake added to their holdings. Otherwise, company insiders, including both directors and company insiders, have been large sellers of shares. Overall, insiders own about 14 percent of company shares. Insider sellers have been missing out, ...

Read More About This

Funko Inc. (FNKO), recently bought 99,300 shares. The buy increased his stake by over 115 percent, and came to a total purchase price of just over $1.7 million. This marks the first insider buy since August, when a fund with a major ownership stake added to their holdings. Otherwise, company insiders, including both directors and company insiders, have been large sellers of shares. Overall, insiders own about 14 percent of company shares. Insider sellers have been missing out, ...

Read More About This

Unusual Options Activity: Riot Blockchain (RIOT)

Shares of cryptocurrency mining company

Riot Blockchain (RIOT) have been sliding along with the price of Bitcoin the past few months. However, one trader sees shares moving far higher in the next year. That’s based on the January 2023 $85 call. With 393 days until expiration, 3,845 contracts traded compared to a prior open interest of 197, for a 20-fold rise in volume. The buyer of the calls paid $3.45 to make the trade. Shares last traded near $22.50. The $85 strike price ...

Read More About This

Riot Blockchain (RIOT) have been sliding along with the price of Bitcoin the past few months. However, one trader sees shares moving far higher in the next year. That’s based on the January 2023 $85 call. With 393 days until expiration, 3,845 contracts traded compared to a prior open interest of 197, for a 20-fold rise in volume. The buyer of the calls paid $3.45 to make the trade. Shares last traded near $22.50. The $85 strike price ...

Read More About This