Unusual Options Activity: Nvidia (NVDA)

Shares of graphics processing company

Nvidia (NVDA) have been hit hard with the recent tech market selloff. One trader sees share reversing higher in the next month. That’s based on the February $235 calls. With 23 days left until expiration, 9,309 contracts were traded compared to an open interest of 304, for a 31-fold gain in shares. The buyer of the options paid $15.23 to make the trade. Shares of the company recently went for just about $235, making this an at-the-money ...

Read More About This

Nvidia (NVDA) have been hit hard with the recent tech market selloff. One trader sees share reversing higher in the next month. That’s based on the February $235 calls. With 23 days left until expiration, 9,309 contracts were traded compared to an open interest of 304, for a 31-fold gain in shares. The buyer of the options paid $15.23 to make the trade. Shares of the company recently went for just about $235, making this an at-the-money ...

Read More About This

Opportunities Rise in Big Tech Amid Market Meltdown

Investors looking for bargains in today’s market have their pick right now. This may be a good time to look at companies that dominate their industry now, as a rebound will likely make a leader prohibitively expensive to buy later.

With a market drop heavily focused on the tech space, this may represent the best opportunity for buying big tech names for some time to come.

One such opportunity right now is

Amazon (AMZN). While shares fared well during the pandemic, the stock ...

Read More About This

Amazon (AMZN). While shares fared well during the pandemic, the stock ...

Read More About This

Insider Trading Report: Oracle Corp (ORCL)

Charles Moorman, a director at

Oracle Corp (ORCL), recently picked up 15,000 shares. The buy increased his stake by 27 percent, and came to a total price just over $1.25 million. Insiders have a mixed history over the past few years, with more sales than buys, as is fairly typical for tech companies, which tend to be generous with their share issuance to company executives. The last buy came from another director back in October for nearly $222,000. Even with regular and large ...

Read More About This

Oracle Corp (ORCL), recently picked up 15,000 shares. The buy increased his stake by 27 percent, and came to a total price just over $1.25 million. Insiders have a mixed history over the past few years, with more sales than buys, as is fairly typical for tech companies, which tend to be generous with their share issuance to company executives. The last buy came from another director back in October for nearly $222,000. Even with regular and large ...

Read More About This

Unusual Options Activity: Boeing (BA)

Shares of airline manufacturer

Boeing (BA) have been gradually trending down over the past year. However, one trader sees the possibility for a strong rebound in shares in the next few weeks. That’s based on the March 4 $250 calls. With just under 40 days until expiration, 4,707 contracts traded compared to a prior interest of 138, for a 34-fold jump in volume. The buyer of the calls paid $1.26 to make the trade. Shares of the company last went for about $205, ...

Read More About This

Boeing (BA) have been gradually trending down over the past year. However, one trader sees the possibility for a strong rebound in shares in the next few weeks. That’s based on the March 4 $250 calls. With just under 40 days until expiration, 4,707 contracts traded compared to a prior interest of 138, for a 34-fold jump in volume. The buyer of the calls paid $1.26 to make the trade. Shares of the company last went for about $205, ...

Read More About This

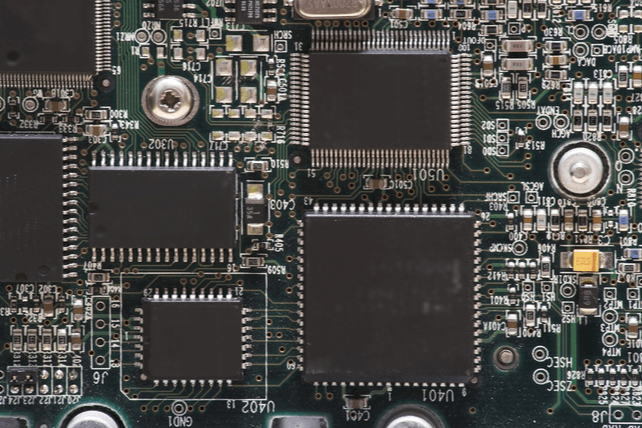

This Chipmaker Will Be One of the Leaders in the Next Market Move Higher

The stock market’s recent decline has been felt most heavily in technology stocks. That’s the typical case of selloffs in general, as tech stocks tend to outperform the market on the way up.

Investors who buy industry-leading tech names during a market correction can typically improve their returns as the market inevitably rebounds. While it may be too soon to say if the current bottom is in, we’re likely closer to the bottom than not.

That makes it the perfect time to ...

Read More About This

Read More About This

Insider Trading Report: Stitch Fix (SFIX)

Working Capital Advisors, a major holder of

Stitch Fix (SFIX), recently picked up 500,000 more shares. The buy increased the fund’s stake by nearly 4.4 percent, and came to a total price of just under $8.2 million. This adds to a number of buys from the fund over the past two months, including a pickup of nearly 3.4 million shares in mid-December. These buys have occurred as shares have had a major slump in the past year. Overall, company insiders own about 3.5 ...

Read More About This

Stitch Fix (SFIX), recently picked up 500,000 more shares. The buy increased the fund’s stake by nearly 4.4 percent, and came to a total price of just under $8.2 million. This adds to a number of buys from the fund over the past two months, including a pickup of nearly 3.4 million shares in mid-December. These buys have occurred as shares have had a major slump in the past year. Overall, company insiders own about 3.5 ...

Read More About This

Unusual Options Activity: Northern Oil & Gas (NOG)

Shares of energy producer

Northern Oil & Gas (NOG) have more than doubled in the past year. One trader sees that trend continuing as energy prices continue higher. That’s based on the June $30 calls. With 143 days until expiration, 2,577 contracts recently traded compared to an open interest of 108, for a 24-fold jump in volume. The buyer of the calls paid $1.45 to make the trade. With a current share price near $23, shares would need to rally a further ...

Read More About This

Northern Oil & Gas (NOG) have more than doubled in the past year. One trader sees that trend continuing as energy prices continue higher. That’s based on the June $30 calls. With 143 days until expiration, 2,577 contracts recently traded compared to an open interest of 108, for a 24-fold jump in volume. The buyer of the calls paid $1.45 to make the trade. With a current share price near $23, shares would need to rally a further ...

Read More About This

Opportunities Abound as the Video Game Sector Prepares to Shrink

Microsoft (MSFT) made its biggest acquisition offer yet, with the proposal to buy

Activision Blizzard (ATVI) at $95 per share. Judging by how the share prices of both companies have moved, the market isn’t quite satisfied that such a merger will go through. However, a few other names in the video game space have had a selloff on the news. Whether a deal pans out between the two companies or not, these other firms will likely recover in time and continue to ...

Read More About This