Look For Companies That Can Succeed in New Growth Endeavors Now

Bear markets offer companies the ability to refocus and retrench. Companies that look toward the future when times are tough can rapidly expand into new growth areas ahead of the next economic swing higher.

That can leave them positioned to take advantage of new opportunities that don’t sound appealing when markets are dropping. The housing crash in 2008 led many investors to avoid potential growth stories in the new technology of electric cars or to overlook the development of smartphones and ...

Read More About This

Read More About This

Insider Trading Report: DISH Network Group (DISH)

James DeFranco, a director at

DISH Network Group (DISH), recently picked up 1,250,000 shares. The buy increased his stake by over 154 percent, and came to a total purchase price of just under $24.3 million. The buy comes a day after another company director picked up 5,000 shares for just over $95,000. Going further back, the last insider buys occurred in July 2019, and company insiders have generally been moderate sellers of shares over the past three years. Overall, insiders at the company ...

Read More About This

DISH Network Group (DISH), recently picked up 1,250,000 shares. The buy increased his stake by over 154 percent, and came to a total purchase price of just under $24.3 million. The buy comes a day after another company director picked up 5,000 shares for just over $95,000. Going further back, the last insider buys occurred in July 2019, and company insiders have generally been moderate sellers of shares over the past three years. Overall, insiders at the company ...

Read More About This

Unusual Options Activity: FedEx Corporation (FDX)

Shares of freight and logistics company

FedEx Corporation (FDX) have lost over one-third of their value in the past year. One trader is betting on a further decline. That’s based on the July $180 put. With 56 days until expiration, 15,182 contracts traded compared to a prior open interest of 661, for a 23-fold rise in volume on the trade. The buyer of the puts paid $6.80 to get in. Shares are a little bit off their 52-week low of $193, so ...

Read More About This

FedEx Corporation (FDX) have lost over one-third of their value in the past year. One trader is betting on a further decline. That’s based on the July $180 put. With 56 days until expiration, 15,182 contracts traded compared to a prior open interest of 661, for a 23-fold rise in volume on the trade. The buyer of the puts paid $6.80 to get in. Shares are a little bit off their 52-week low of $193, so ...

Read More About This

In a Rising or Falling Economy, Don’t Bet Against Defensive Consumer Plays

Consumer spending makes up the bulk of economic spending – over two-thirds, by most estimates. That means that any change in where and how consumers are spending can lead to a shift of billions of dollars.

As retailers report their quarterly earnings, some are seeing consumers head their way amid rising economic uncertainty. Others aren’t faring as well. But a few players could be a standout play at current prices, given the role consumers play in the economy.

For instance,

Home Depot (HD), ...

Read More About This

Home Depot (HD), ...

Read More About This

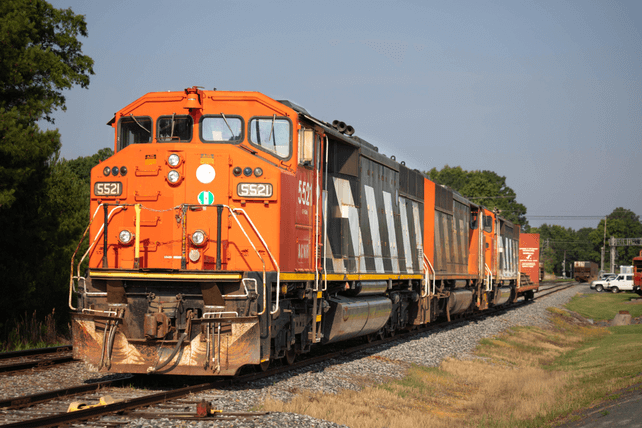

Insider Trading Report: CSX Corp (CSX)

James Wainscott, a director at

CSX Corp (CSX), recently picked up 10,000 shares. The buy increased his position by nearly 95 percent, and came to a total price of just over $330,000. This marks the first insider buying at the company since the summer of 2020, and the first insider activity of any kind since last October. Otherwise, company directors and executives, have been sellers of shares though the end of last year. Overall, insiders own just over 0.2 percent of the ...

Read More About This

CSX Corp (CSX), recently picked up 10,000 shares. The buy increased his position by nearly 95 percent, and came to a total price of just over $330,000. This marks the first insider buying at the company since the summer of 2020, and the first insider activity of any kind since last October. Otherwise, company directors and executives, have been sellers of shares though the end of last year. Overall, insiders own just over 0.2 percent of the ...

Read More About This

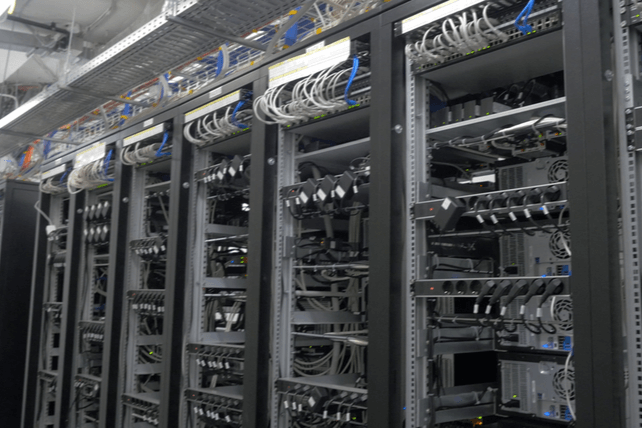

Unusual Options Activity: Cisco Systems (CSCO)

Shares of internet hardware provider

Cisco Systems (CSCO) have been in a downtrend for the past few months. One trader sees the prospect of further declines in the months ahead. That’s based on the June 2023 $45 puts. With 393 days until expiration, 4,001 contracts traded compared to an open interest of 183, for a 22-fold rise in volume. The buyer of the puts paid $3.73 to get into the trade. Shares last went for about $50, so the stock would need to ...

Read More About This

Cisco Systems (CSCO) have been in a downtrend for the past few months. One trader sees the prospect of further declines in the months ahead. That’s based on the June 2023 $45 puts. With 393 days until expiration, 4,001 contracts traded compared to an open interest of 183, for a 22-fold rise in volume. The buyer of the puts paid $3.73 to get into the trade. Shares last went for about $50, so the stock would need to ...

Read More About This

Consider This Profitable Media Space as Streaming Stocks Slide

The media space is a lucrative one, and one where just a few companies control the bulk of the industry. However, the past few years has seen many media companies rise and fall as plans have come to fruition to build their own streaming services and compete with each other.

While this has been going on, another niche part of the media space has been growing steadily, and even before the pandemic was posting better numbers than the box office.

That space ...

Read More About This

Read More About This

Insider Trading Report: Morgan Stanley (MS)

Stephen Luczo, a director at

Morgan Stanley (MS), recently bought 25,000 shares. The buy increased his stake by 11.8 percent, and came to a total price of just over $1.98 million. This marks the first insider buy at the company since late 2020. Over the past three years, company insiders, including both executives and directors, have generally been regular and consistent sellers of shares. Despite those sales, insiders at the investment bank own 21.8 percent of shares. The stock has pulled back in ...

Read More About This

Morgan Stanley (MS), recently bought 25,000 shares. The buy increased his stake by 11.8 percent, and came to a total price of just over $1.98 million. This marks the first insider buy at the company since late 2020. Over the past three years, company insiders, including both executives and directors, have generally been regular and consistent sellers of shares. Despite those sales, insiders at the investment bank own 21.8 percent of shares. The stock has pulled back in ...

Read More About This