Buy Companies Doing This for Shareholders Right Now

There are two main ways companies can reward shareholders. One way is to pay a growing dividend from rising cash flows over time. Another way is to buy back shares when the company’s valuation is compellingly low.

Some companies can do both, provided they don’t overpay to buy back shares. With many stocks down right now, a few companies are setting up for better returns when the market sentiment turns bullish again with increased buybacks.

One company making a big buyback and ...

Read More About This

Read More About This

Insider Trading Report: Tilly’s (TLYS)

Michael Henry, CFO at

Tilly’s (TLYS), recently picked up 4,000 shares. The buy increased his stake by 16 percent, and came to a total cost of just under $29,000. This follows up on a 6,005 share buy from the director a few days before. This marks the first insider buy at the company since September 2020. Insiders were active buyers during the Covid selloff, and then have generally been sellers of shares in the past two years after shares rallied higher. Overall, insiders ...

Read More About This

Tilly’s (TLYS), recently picked up 4,000 shares. The buy increased his stake by 16 percent, and came to a total cost of just under $29,000. This follows up on a 6,005 share buy from the director a few days before. This marks the first insider buy at the company since September 2020. Insiders were active buyers during the Covid selloff, and then have generally been sellers of shares in the past two years after shares rallied higher. Overall, insiders ...

Read More About This

Unusual Options Activity: Pinterest (PINS)

Shares of online board

Pinterest (PINS) have shed 75 percent of their value in the past year. One trader sees the chance for a further decline in the coming few days. That’s based on the July 1 $15 puts. With 8 days until expiration, 19,778 contracts traded compared to a prior open interest of 116, for a 171-fold rise in volume on the trade. The buyer of the puts paid $0.10 to get into the trade. The stock recently traded for around $18, ...

Read More About This

Pinterest (PINS) have shed 75 percent of their value in the past year. One trader sees the chance for a further decline in the coming few days. That’s based on the July 1 $15 puts. With 8 days until expiration, 19,778 contracts traded compared to a prior open interest of 116, for a 171-fold rise in volume on the trade. The buyer of the puts paid $0.10 to get into the trade. The stock recently traded for around $18, ...

Read More About This

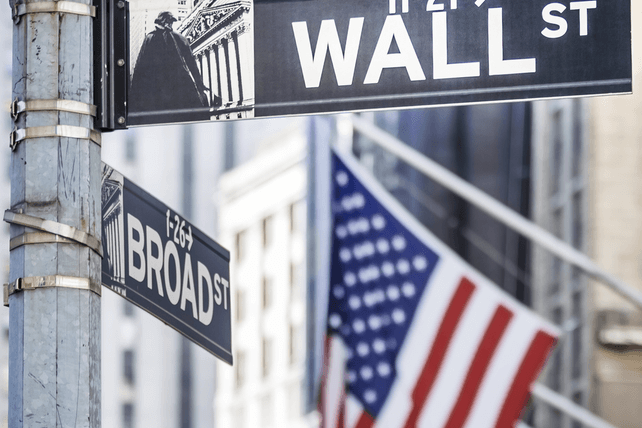

This Sector Gets Hit Hard in a Bear Market – and Tends to Lead in a Bull Market

Some sectors of the stock market perform differently at different times. Commodity producers and utilities have held up somewhat well in the current bear market, even as tech stocks have been hit hard.

Another area hit hard has been financial stocks, particularly banks. These companies have had to contend with rising interest rates. Demand for mortgages has stalled, which tends to be a big source of business, as well as mergers and acquisitions for big banks.

That said, valuations for a number ...

Read More About This

Read More About This

Insider Trading Report: Vistra Corp (VST)

Brian Ferraioli, a director at

Vistra Corp (VST), recently picked up 8,050 shares. The buy increased his holdings by nearly 12 percent, and came to a total purchase price of just over $181,000. The buy came three days after the company president and CEO picked up 32,000 shares for just over $547,000. Over the past three years, company insiders have been active as both buyers and sellers, with buyers having a slight edge over that time period. Overall, insiders at the company own ...

Read More About This

Vistra Corp (VST), recently picked up 8,050 shares. The buy increased his holdings by nearly 12 percent, and came to a total purchase price of just over $181,000. The buy came three days after the company president and CEO picked up 32,000 shares for just over $547,000. Over the past three years, company insiders have been active as both buyers and sellers, with buyers having a slight edge over that time period. Overall, insiders at the company own ...

Read More About This

Unusual Options Activity: Magnite (MGNI)

Shares of advertising agency

Magnite (MGNI) have shed two-thirds of their value in the past year. One trader sees further downside going into the latter half of the year. That’s based on the January 2023 $12.50 puts. With 212 days until expiration, 3,950 contracts traded compared to a prior open interest of 131, for a 30-fold rise in volume on the trade. The buyer of the puts paid $4.30 to get in. Shares recently traded for just over $9.50, meaning the options are ...

Read More About This

Magnite (MGNI) have shed two-thirds of their value in the past year. One trader sees further downside going into the latter half of the year. That’s based on the January 2023 $12.50 puts. With 212 days until expiration, 3,950 contracts traded compared to a prior open interest of 131, for a 30-fold rise in volume on the trade. The buyer of the puts paid $4.30 to get in. Shares recently traded for just over $9.50, meaning the options are ...

Read More About This

Keep Adding Big Tech Winners Amid This Bear Market

Markets have rapidly repriced in the growth prospects for a number of companies. While some of the most speculative names have taken the biggest dive, even great companies that have remained profitable while showing slow and steady growth are at a point where they’ve oversold.

For long-term investors, this marks the best point in years to buy growth at a respectable valuation. That’s especially true when it involves companies playing to strong growth trends now.

Investors looking forward can get great returns ...

Read More About This

Read More About This

Insider Trading Report: Fastenal (FAST)

Holden Lewis, CFO at

Fastenal (FAST), recently added 1,000 shares. The buy increased his stake by nearly 12 percent, and came to a total price of just under $50,000. He was joined by another EVP, who also picked up 1,000 shares on the same day for about the same price. This adds to further insider buys in recent months, from company executives and directors alike. Going back over the past three years, there has been a mix of insider buys and sells. Overall, ...

Read More About This

Fastenal (FAST), recently added 1,000 shares. The buy increased his stake by nearly 12 percent, and came to a total price of just under $50,000. He was joined by another EVP, who also picked up 1,000 shares on the same day for about the same price. This adds to further insider buys in recent months, from company executives and directors alike. Going back over the past three years, there has been a mix of insider buys and sells. Overall, ...

Read More About This