Insider Activity Report: Natural Gas Services (NGS)

Justin Jacobs, CEO of Natural Gas Services (NGS), recently bought 2,500 shares. The buy came to a cost of $47,700, and increased his holdings by 691%.

This marks the first insider buy at the company over the past two years. The last insider activity as NGS was a sale of just 3,000 shares from a director in December 2022, for a total cost of $33,150.

Overall, NGS insiders own 7.6% of shares.

The natural gas compression equipment services company is up over ...

Read More About This

Read More About This

Unusual Options Activity: Medtronic (MDT)

Medical device manufacturer Medtronic (MDT) is down 6% over the past year. One trader is betting that shares will continue to decline over the next 18 months.

That’s based on the January 2026 $85 puts. With 569 days until expiration, 9,101 contracts traded compared to a prior open interest of 167, for a 55-fold rise in volume on the trade. The buyer of the puts paid $9.36 to make the bearish bet.

Medtronic shares recently traded for about $81, meaning the option ...

Read More About This

Read More About This

This Leading Brand Is About to Get Another Round of Global Exposure

The stock market’s returns this year have been concentrated heavily into tech stocks. That’s created an opportunity, as there’s are still several values in other segments of the market, even with stocks near all-time highs.

Astute investors will be able to find opportunities likely to trend higher in the coming months outside of tech. One place that could be ripe for big returns comes from companies with strong brands.

That’s because a strong brand tends to grow the most when the economy ...

Read More About This

Read More About This

Insider Activity Report: Franklin Resources (BEN)

Charles Johnson, a major holder at

Franklin Resources (BEN), recently added 100,000 shares to his stake. The buy came to a total cost of $2.23 million, and increased his position by less than 1%. This marks the first insider buy at the asset management company over the past two years. There have been a half dozen insider sales over the same time, mostly coming from company executives. The largest sale was for $1.6 million from the company CEO in mid-2022. Overall, Read More About This

Franklin Resources (BEN), recently added 100,000 shares to his stake. The buy came to a total cost of $2.23 million, and increased his position by less than 1%. This marks the first insider buy at the asset management company over the past two years. There have been a half dozen insider sales over the same time, mostly coming from company executives. The largest sale was for $1.6 million from the company CEO in mid-2022. Overall, Read More About This

Unusual Options Activity: Amazon (AMZN)

Internet retailer

Amazon (AMZN) is up 44% over the past year, nearly double the return of the overall stock market. One trader sees shares trending higher over the coming weeks. That’s based on the August 2 $220 calls. With 38 days until expiration, 13,711 contracts traded compared to a prior open interest of 145, for a 95-fold rise in volume on the trade. The buyer of the calls paid $1.35 to make the bullish bet. Amazon shares recently traded close to $190, meaning ...

Read More About This

Amazon (AMZN) is up 44% over the past year, nearly double the return of the overall stock market. One trader sees shares trending higher over the coming weeks. That’s based on the August 2 $220 calls. With 38 days until expiration, 13,711 contracts traded compared to a prior open interest of 145, for a 95-fold rise in volume on the trade. The buyer of the calls paid $1.35 to make the bullish bet. Amazon shares recently traded close to $190, meaning ...

Read More About This

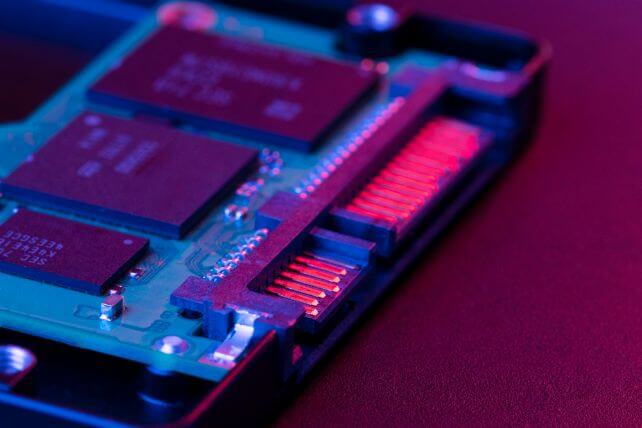

Get Ready for the Next Wave of AI Investments

The first wave of AI investments has been centered around big-tech companies providing hardware or software needed to run AI programs. The next wave is unfolding, and will create new investment opportunities elsewhere.

While the current generation of AI programs requires significant processing power, the next wave will include simpler programs that can be run on-the-go. That’s what creates new investment opportunities for investors today.

For those looking for an AI system that can run on a piece of hardware like a ...

Read More About This

Read More About This

Insider Activity Report: ExxonMobil (XOM)

Maria Dreyfus, a director at

ExxonMobil (XOM), recently bought 18,310 shares. The buy increased her stake by 105%, and came to a total cost just over $2 million. This is the first insider buy at the oil giant since November, when another director bought 250,000 shares for just under $26.5 million. Over the past two years, Exxon executives have been slight sellers of shares, while directors have been buyers. Overall, Exxon insiders own 0.04% of shares. The oil giant is up 6% over ...

Read More About This

ExxonMobil (XOM), recently bought 18,310 shares. The buy increased her stake by 105%, and came to a total cost just over $2 million. This is the first insider buy at the oil giant since November, when another director bought 250,000 shares for just under $26.5 million. Over the past two years, Exxon executives have been slight sellers of shares, while directors have been buyers. Overall, Exxon insiders own 0.04% of shares. The oil giant is up 6% over ...

Read More About This

Unusual Options Activity: Rollins (ROL)

Wildlife and pest control company

Rollins (ROL) is up 20% over the past year, slightly underperforming the overall stock market. One trader sees shares trending higher through the summer. That’s based on the August $52.50 calls. With 52 days until expiration, 3,936 contracts traded compared to a prior open interest of 116, for a 34-fold rise in volume on the trade. The buyer of the calls paid $0.88 to make the bullish bet. Rollins shares recently traded for about $49.50, meaning the stock ...

Read More About This

Rollins (ROL) is up 20% over the past year, slightly underperforming the overall stock market. One trader sees shares trending higher through the summer. That’s based on the August $52.50 calls. With 52 days until expiration, 3,936 contracts traded compared to a prior open interest of 116, for a 34-fold rise in volume on the trade. The buyer of the calls paid $0.88 to make the bullish bet. Rollins shares recently traded for about $49.50, meaning the stock ...

Read More About This