Chip manufacturer Taiwan Semiconductor (TSM) is up 96% over the past year, nearly triple the return of the overall stock market. One trader sees shares continuing higher in the weeks ahead.

That’s based on the December 13 $200 calls. With 29 days until expiration, 19,727 contracts traded compared to a prior open interest of 310, for a 64-fold rise in volume on the trade. The buyer of the calls paid $5.25 to make the bullish bet.

TSM shares recently traded for about $191, so they would need to rise by $9, or about 4.7%, for the option to move in-the-money.

TSM has been trending higher all year, and shares recently pulled back from a 52-week high of $212.60.

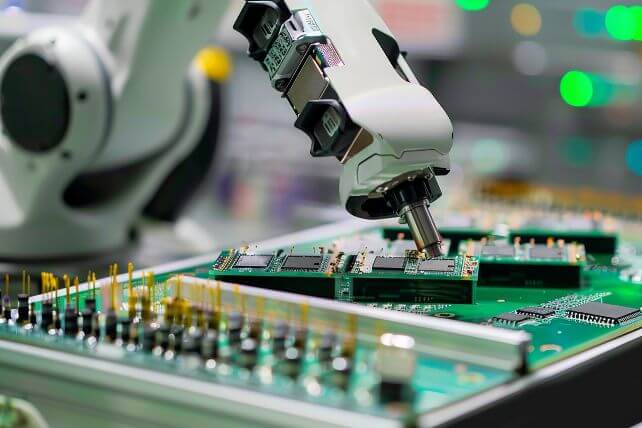

Thanks to the AI chip boom, TSM has been a major beneficiary. The company has grown revenues by 39% over the past year and overall earnings are up 54%.

Plus, TSM sports a hefty 39% profit margin, reflecting its position as a leader in manufacturing.

Action to take: Investors may like shares here or on any pullback, as the rollout in AI likely still has a few strong years ahead of it. At current prices, TSM also pays a 1.3% dividend.

For traders, the December 13 $200 calls are an inexpensive way to bet on a continued rally in shares in the weeks ahead. Traders can likely see high double-digit returns.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any company mentioned in this article.