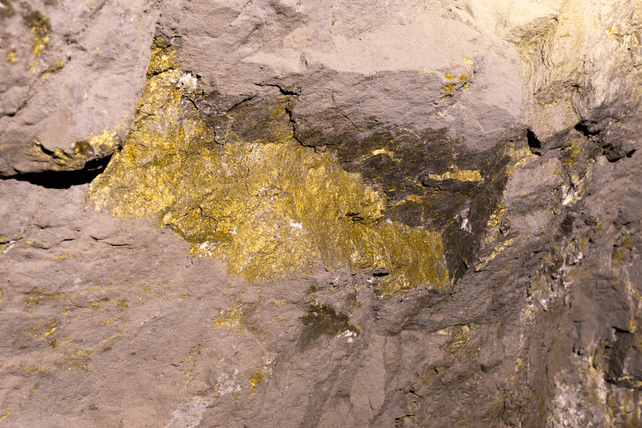

Shares of gold mining company

SSR Mining (SSRM) have been trending higher in recent days, likely fueled by a rising price of gold. One trader sees the potential for a bigger move higher in the coming months.

That’s based on the March $20 calls. With 125 days until expiration, 5,555 contracts traded against an open interest of 105, for a 53-fold jump in volume. The buyer of the calls paid $1.33 to make the trade.

The Canadian-based gold mining company has seen shares drop about 11 percent in the past year, as gold prices peaked in mid-2020 and have been trading in a range ever since. However, gold prices have risen enough that the company has been profitable, with earnings up 114 percent over the past year, and revenue growth up 43 percent.

Action to take: Shares are inexpensive at just 13 times earnings. And the company is paying out a growing dividend right now, with a yield of 1.1 percent to start. Shareholders may find this a reasonable investment to hedge against inflationary fears.

For traders, the options look reasonable, given gold’s move higher and an increased investor interest in inflation protection in recent sessions. The calls could potentially deliver triple-digit results before expiration, and shares would only need to rise about 8 percent from here for the trade to move in-the-money.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.