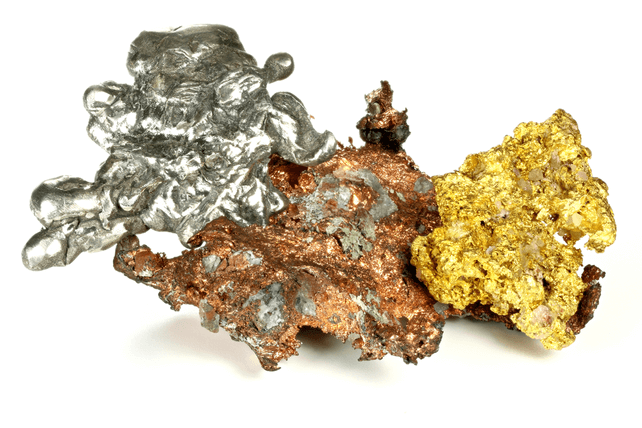

Shares of commodity producer Freeport-McMoRan (FCX) have been sliding in recent weeks, on signs of cooling inflation. One trader sees the possibility for a further decline in the coming weeks.

That’s based on the September 9th $27 put options. With 18 days until expiration, 2,905 contracts traded compared to a prior open interest of 127, for a 23-fold rise in volume on the trade. The buyer of the puts paid $0.24 to make the bet.

Shares recently traded just over $31, so they would need to drop $4, or about 13 percent for the option to move in-the-money. The stock has a 52-week low of $25, set back in June.

While shares performed strongly when the economy was faring well, declining demand is starting to show on the company’s finances. Earnings are down 22 percent compared to last year, and revenue has dropped 6 percent.

Action to take: The metals miner is a leading global player, so may be worth picking up on a drop under $30 as a long-term holding. Shares yield near 2 percent right now, with a possibility for further increases if inflation rates or commodity prices fall less than expected in the months ahead.

For traders, the put is a solid short-term trade in the coming weeks. Shares have had a strong bounce off their lows, but are now looking overbought in the short-term. The option is inexpensive enough to deliver high-triple-digit gains or better.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.