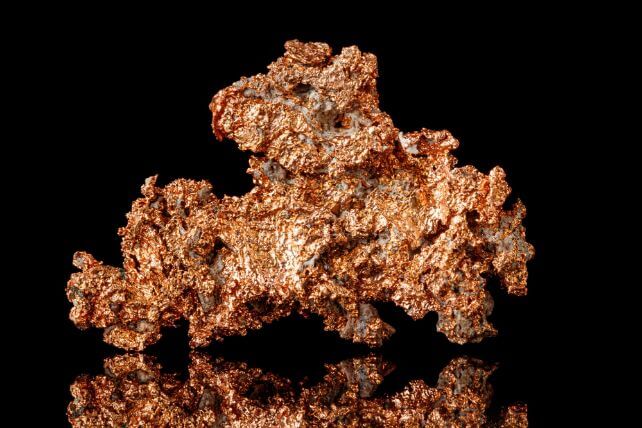

Copper producer

Freeport-McMoRan (FCX) is up 23% over the past year, however shares have recently fallen about 10% from its 52-week high. One trader sees the potential for shares to rebound in the coming weeks.

That’s based on the July 5 $52 calls. With 21 days until expiration, 29,520 contracts traded compared to a prior open interest of 156, for a 189-fold surge in volume on the trade. The buyer of the calls paid $0.66 to make the bullish bet.

FCX shares recently traded for about $49, meaning the stock would need to rise by about $3, or 6%, for the option to move in-the-money.

Besides being down about 10% from its 52-week high of $55.24, FCX shares appear to be in a support zone. If that zone holds, shares can trend higher once again.

If not, a short-term bounce in the coming weeks may form the right shoulder of a head-and-shoulders pattern, which could mean a further drop from here.

Action to take: Long-term investors may be able to get a better entry price in the coming weeks, if shares fail to hold their current support zone.

For traders, the July $52 calls work as a very short-term trade. Look to take quick profits, as any very short-term rally may not hold, even with just three weeks potentially on the trade.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any company mentioned in this article.