The stock market trended down in the first half of the year. Then, starting in late June, investors enjoyed a summer rally. Given the continuing strength in the economy and high inflation numbers, it’s likely that stocks will trend down as interest rates continue to rise.

However, some assets can see a move higher here. That’s specifically true with assets that moved higher in the first half of the year, then took a breather when stocks rallied.

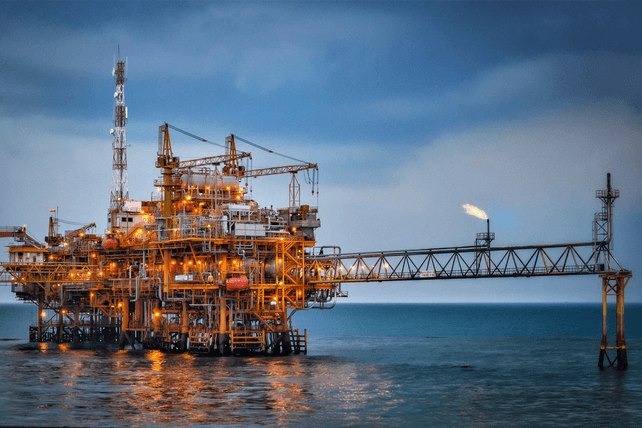

One standout asset to perform well as markets decline is oil. Crude prices spiked in the spring to nearly $120 per barrel, and today are around $90. But with OPEC looking to cut production by 100,000 barrels per day in expectation of a slowing economy, oil prices could perform surprisingly well here.

Action to take: One leading oil company that looks inexpensive here is

Conoco Phillips (COP). The company trades at less than 10 times earnings, and shares pay out a 1.7 percent and growing dividend. But the stock is also a bit less expensive than other major oil firms, which could give it more upside potential as oil prices rise.

For traders, the January $125 calls, last going for about $6.25, could deliver mid-double-digit returns in the coming months. The options are priced right near the stock’s 52-week high, which could be retested in the coming weeks.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.