Markets go up more often than they go down. But investors often forget when in the middle of a bear market. One way to break through the fear is to look at companies that are planning for a bright future now.

At a time when many firms are scaling back, those looking forward are likely to best capitalize on the long-term return to rising markets and a booming economy.

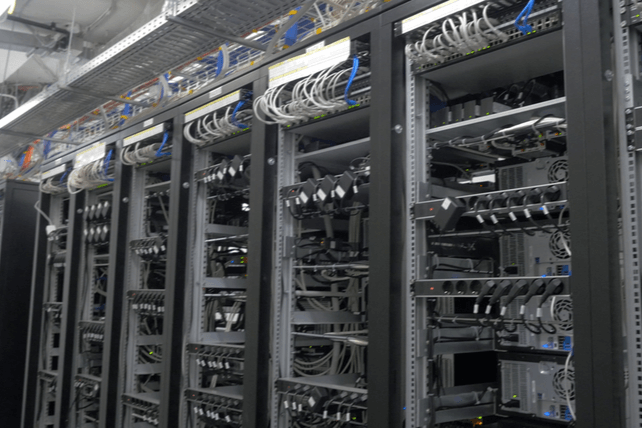

One example is with Oracle (ORCL). The database giant has embraced cloud services and applications in recent years.

That’s now leading to new growth, and allowing it to take on bigger player in the space. As a result, the company is growing at its fastest pace in more than 10 years, and even if the market hasn’t caught onto that trend yet.

Revenue is up 18 percent in the past year, even as share prices have slid 16 percent. And the stock has fallen from 19 times earnings to 15 times forward earnings in the past year, leading to a stock that’s reasonably priced now for its growth.

Action to take: Investors should look to accumulate shares under $80. The company pays a modest dividend of 1.6 percent at current prices as well.

For traders, shares have been in a long-term downtrend that may have started reversing in recent weeks. The March 2023 $90 calls, last going for about $2.20, offer high double-digit upside returns on a further rally in shares from here in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.