Market sentiment has shifted from bullish to mixed in the past week with the rise of the Omicron variant, inflation fears, and how the Fed might be acting too little, too late. However, even with those fears, some trends are still continuing no matter what short-term fears pop up.

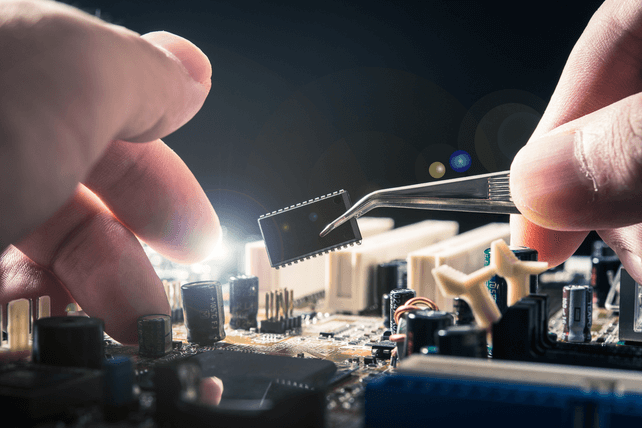

One of those trends is the growth of microchips in a variety of technologies. Rising uses still means a shortage now, but companies are rising to the occasion.

Case in point? Marvell Technology (MRVL). The company reported better-than-expected earnings last week with earnings up 61 percent, and provided a strong outlook.

Shares jumped on the news, and are now up nearly 80 percent in the past year. That growth will likely continue, given the multi-year growth in demand for chips.

Marvell has been inconsistently profitable in the past few quarters, but in the most recent earnings came in at 22 times earnings, a reasonable value in today’s market.

Action to take: Investors should consider shares, which still have more upside from here. There’s also a small dividend, paying out about 0.3 percent right now.

Traders might want to bet on a continued move higher with a call option trade. The March $85 calls, last going for about $6.50, are a near-the-money trade with limited downside if shares slow in their upward trend from here. Otherwise, traders could potentially book mid-to-high double-digit yields.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.