Investors tend to gravitate towards great companies. Those companies tend to dominate their industry, and tend to grow massive. That makes it easier for investors to justify owning. While we’re fans of big-name tech companies thanks to their high profit margins and industry positioning, many more off-the-radar companies can be big winners too.

That’s especially true getting out of well-known tech and consumer brand name companies and into infrastructure and industrial stocks.

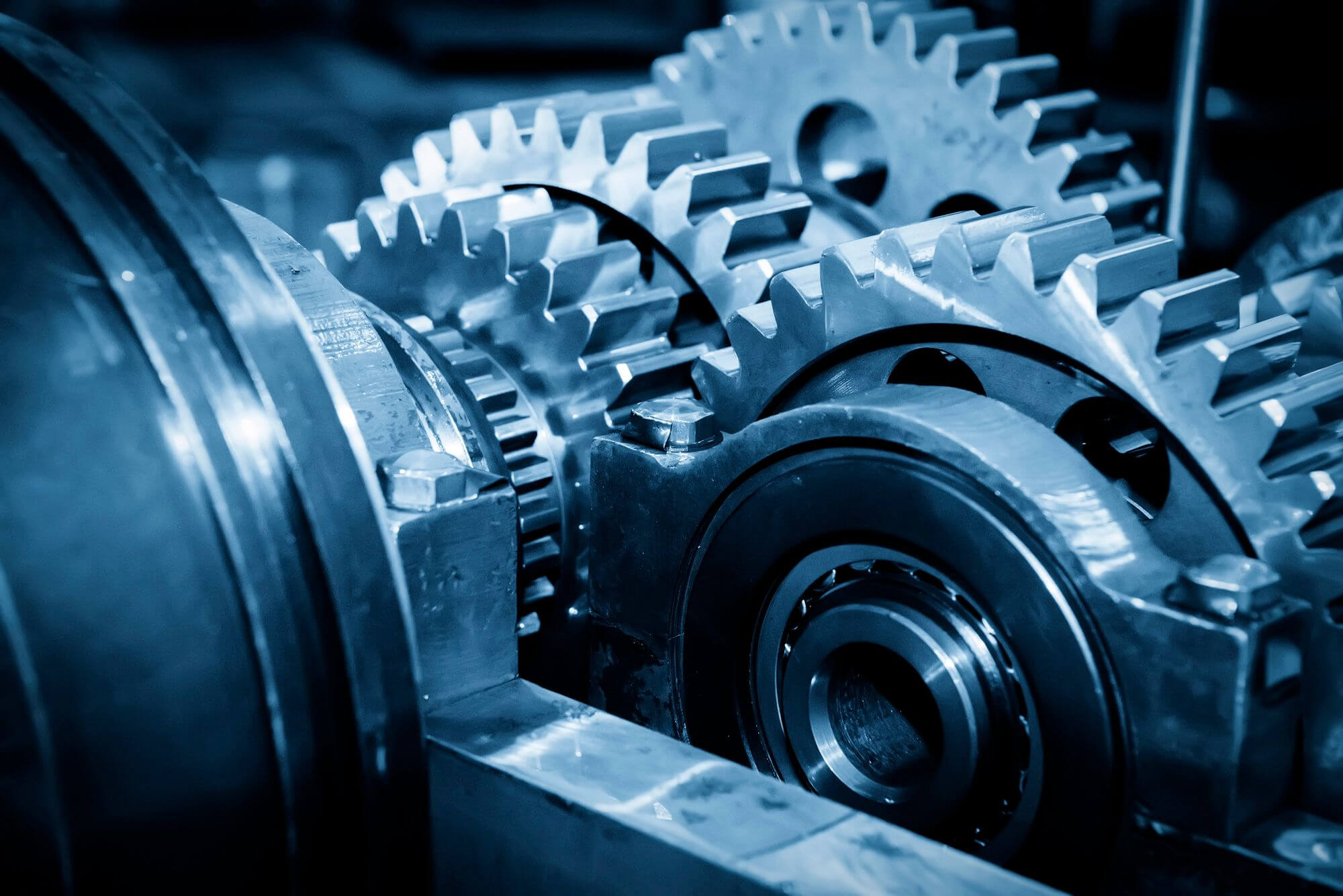

These companies manufacture many of the products needed for other companies to succeed. One such company is Regal Rexnord Corporation (RRX), a producer of motors and powertrain equipment. Those tools are critical for factories.

Shares have underperformed other industrial stocks recently. That trend may reverse with the stock market next year. Despite a 50 percent rise in earnings and revenue, shares are down 27 percent. That’s created a relative value, with the stock trading for about 10 times forward earnings.

Action to take: Besides being inexpensive during a slowing economy, shares pay a 1.2 percent dividend. The company has a low payout ratio and has been growing the dividend.

For traders, the May 2023 $135 calls, last going for about $3.00, could offer mid-to-high double-digit returns in the months ahead on a catch-up rally in shares.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.