Inflation rates are coming down off of a 40-year high. But they’re still far higher than average. The process will take time to fully play out. When it does, prices will remain higher than they are now overall.

Companies that can raise prices and still maintain market share and their customer base will be just fine as this trend fully plays out. Some companies keep customers thanks to popular, low-priced products.

Others are able to raise prices as there are few, if any, alternatives to the goods or services they provide.

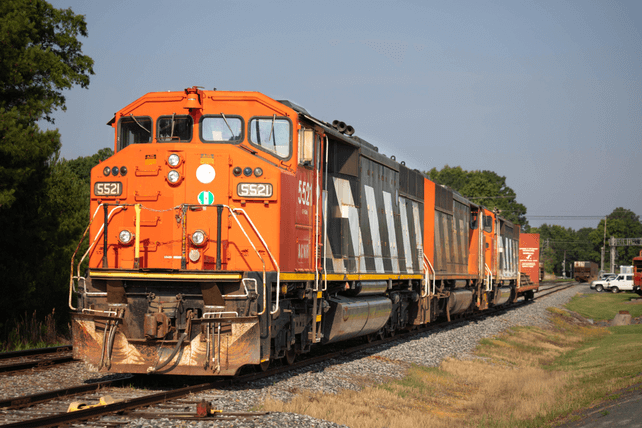

One such example is in railroads, as each rail company operates a regional monopoly for moving around goods.

Union Pacific (UNP) recently revealed in its earnings that increased prices helped revenues jump 8 percent.

The company did miss on its overall earnings as the economic slowdown has led to lower goods and services being shipped right now. But when the upcycle resumes, UNP will benefit from today’s higher prices and a higher volume of goods shipped.

Action to take: Investors may like shares here, as the company trades at about 17 times earnings, its best valuation in the past two years. Plus, the company has a 2.6 percent dividend, which, like the prices charged for shipping, tends to rise over time.

For traders, the May $220 calls, last going for about $3.60, offer mid-double-digit returns on a move higher in shares in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.