The market is a series of sectors. Investors who invest in the right sectors at the right time can capture a big part of the market’s performance. Those who pick the wrong sector risk being on the losing end of the market.

And within a sector, there will be times when some companies fare better than others. That’s when it becomes a stock picker’s market. Those who can navigate the challenge can make better returns, even in a sector that’s no longer completely going up.

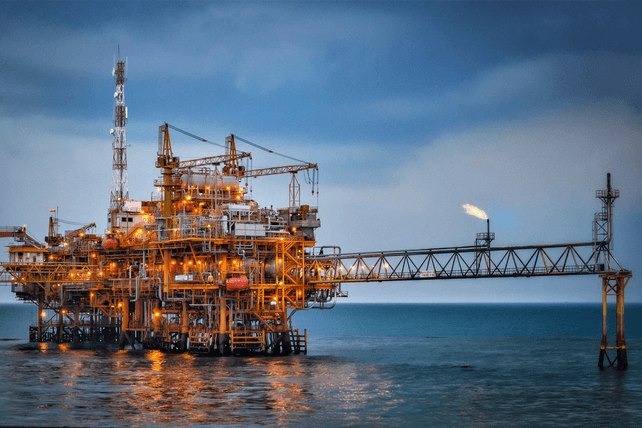

The energy market has become a stock picker’s market. That’s because oil prices have come back down, so the space as a whole is giving up the big gains they saw at the start of the year.

In the energy space, some companies will fare better than others. Apache (APA) is one such company, given its relatively modest size and global range. The company’s operations in the US, Egypt, and elsewhere are sidestepping the major crisis points impacting the energy market right now.

Action to take: While share are already up 41 percent in the past year, earnings are up nearly 193 percent over the same time. And the company is well positioned to profit from the current market, making shares a buy in the current energy market downturn. Shares also yield about 2.7 percent at current prices.

For traders, the January $40 calls, last going for about $2.45, can deliver mid-double-digits from here in the months ahead on a rebound in shares.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.