Peter Orthwein, a director at

Thor Industries (THO), recently added 20,000 shares. The buy increased his holdings by 2 percent, and came to a total cost of $1,450,000.

This marks the first insider activity since July, when the company COO bought 1,225 shares, paying about $100,000. And insiders have only been buyers this year. Going back further, the results are more mixed, with some large insider sales at a much higher price in 2021.

Overall, company insiders own 4.5 percent of shares.

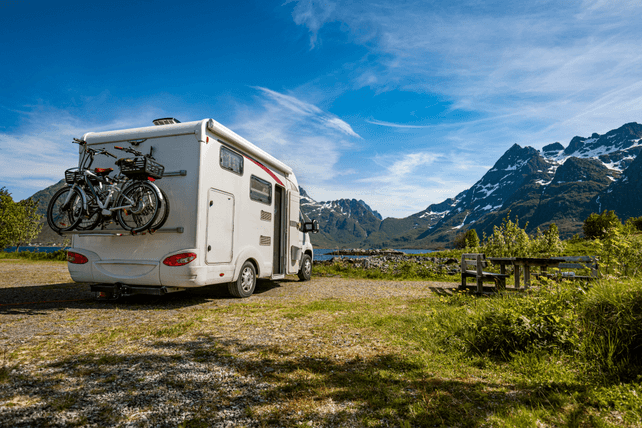

The recreational vehicle manufacturer is down about 42 percent in the past year, thanks to rising gas prices and lower demand following a pandemic-era boom. Behind that headline data, however, the company managed to fare well, with a 6 percent increase in revenue, and a 22 percent increase in earnings.

That drop has now taken the stock from 12 times earnings to 4 times earnings, and from 2.4 times book value to about book value.

Action to take: The company continues to fare well in a challenging environment, and looks like a reasonable long-term value play. Investors who pick up shares near today’s prices in the coming weeks can likely fare well on the next market rebound. Plus, the stock yields 2.4 percent here.

For traders, shares have been trending higher in the past few days, even amid an ugly market. The January 2023 $85 calls, last going for about $4.50, can likely deliver mid-double-digit gains on a further move higher in shares.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.