Jason VanWees, an Executive Vice President at

Teledyne Technologies (TDY), recently picked up 1,500 shares. The buy increased his stake by nearly 4 percent, and came to a total price of $639,000.

This marks the first insider buy since March, when a cluster of company insiders picked up shares. Prior to that, company insiders have been sellers going back to 2018. Insiders own about 1.3 percent of the company.

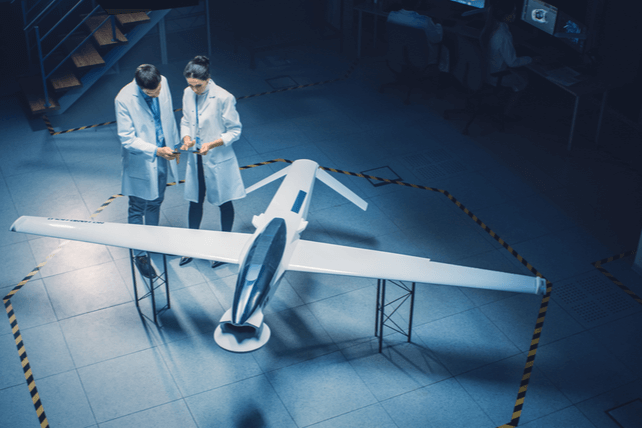

Shares of the aviation electronics company have performed about in-line with the overall stock market in the past year. While revenues are up substantially, with a 50 percent rise, overall earnings are down in that timeframe, having dropped about 30 percent over the past year.

Over the past several years, share prices have risen relatively consistently.

Action to take: Investors may like shares for the long haul given the firm’s government contracts business. However, shares are pricey. While analysts have no forward estimates, share recently went for a pricey 45 times earnings, so further returns may take time. Also shares don’t pay a dividend.

For traders, shares are in an uptrend. Given the high price of shares, the December $470 calls may be a reasonable trade. The option last went for about $6.75, and could deliver mid-double-digit profits.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.