David Bauer, President and CEO at

National Fuel Gas Co (NFG), recently added 3,000 shares. The buy increased his stake by nearly 5 percent, and came to a total purchase price of just over $154,000.

This marks the first insider buy at the company in the past three years. There has been some insider sales back in 2019, but otherwise insider activity at the company has been fairly quiet.

Overall, insiders own about 1.5 percent of shares.

The share price has held in a steady range over the past six months, following a decline in 2019 into early 2020. Shares have underperformed the S&P 500 by about 10 points in the past year.

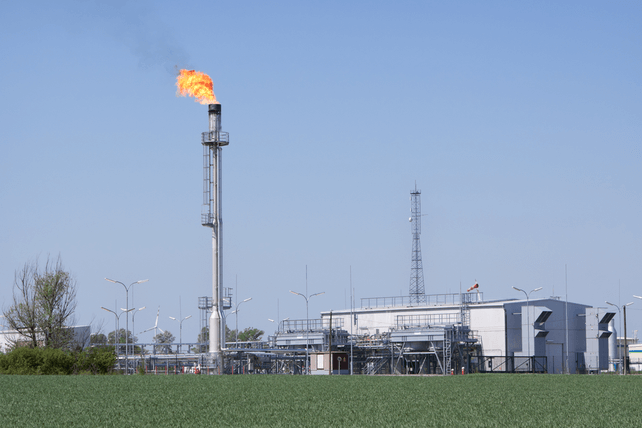

The natural gas exploration and development company also provides services in upstate New York, and also includes about 95,000 acres of timber property.

Action to take: Shares look attractively valued at 11 times forward earnings. Energy prices appear to be holding steady or even moving higher this year, and natural gas prices tend to rise in the winter months which should bode well for the next few quarters.

Shareholders can also obtain a 3.5 percent dividend yield to start with here with room for some slight growth over time.

For traders willing to swing for the fence, the April $65 calls, last going for about $0.20, are an inexpensive bet that could deliver triple-digit returns if natural gas prices soar this winter.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.