John Holder, a director at

Genuine Parts Company (GPC) recently picked up 2,200 shares. The buy increased his total holdings by over 20 percent, and cost the director just over $201,000.

This is the second insider buy at the company this year, also from a director back in March. Insiders have been both buyers and sellers of shares over the past few years. Insiders own nearly 3 percent of the company.

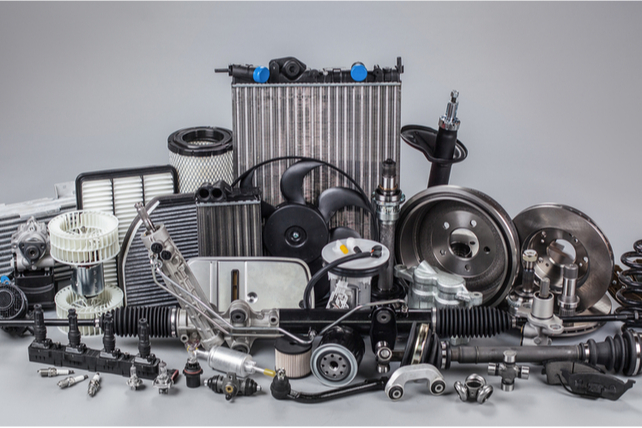

Genuine Parts Company distributes automotive and industrial parts and materials worldwide, with a focus on automotive parts. While shares are considerably off their March lows, shares are still down 12 percent over the past year.

The company is coming off some poor quarters where it barely eked out a profit, but now shares trade for 18 times forward earnings, and less than one times price to sales.

Action to take: Investors may like shares here, with their generous 3.5 percent dividend yield. Automotive parts have seen a strong demand in the past few months, and that trend is likely to continue pushing shares higher.

Traders may do better betting on a continued upside in shares. The February 2021 $95 calls have a bid/ask spread around $4.40, and could deliver mid-to-high double-digit returns if shares continue trending back to their 52-week high.