Matthew Tonn, Chief Commercial Officer at

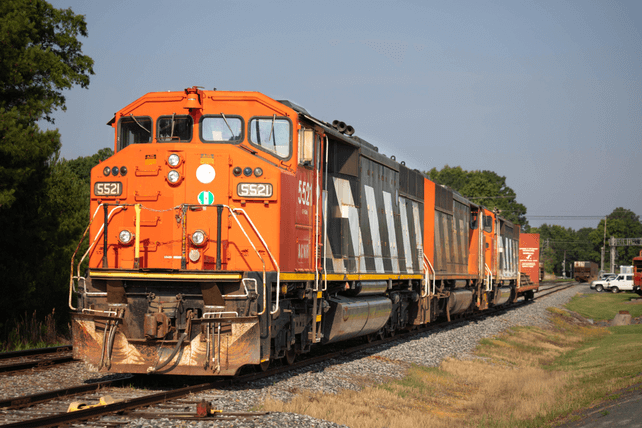

FreightCar America (RAIL), recently picked up 5,700 shares. The buy increased his holdings by 3.5 percent, and came to a total cost just over $20,000.

This is the first insider activity at the company since June, following a 2,550 share pickup from the company CEO. Going back over the past 3 years, executives, directors, and major owners have all been buying up shares, with no insider sales.

Overall, insiders own 31.3 percent of the railcar manufacturer.

Shares are down 12 percent over the past year, just slightly less than the drop in the S&P 500.

FreightCar also managed to lose money, even with a 47 percent increase in revenue. Nevertheless, shares trade at about 10 times forward earnings, and the company trades at a very low 0.27 times its price to sales ratio.

Action to take: Shares look moderately attractive as a value play. However, in a slowing economy, demand for replacement railway parts such as freight cars will drop, which could impact short-term profitability even more. Interested investors should look for a chance to buy closer to the 52-week lows near $3 per share.

For traders, the stock essentially has traded flat in the past year, with a few jumps higher periodically. That suggests a trade like a put sale. The June 2023 $2.50 put, last going for about $1.35, would add instant income now, while potentially leaving an investor on the hook to buy shares at $2.50.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.