Stephan Eastman, a director at

Fastenal Co (FAST), recently picked up 1,000 shares. The buy increased his holdings by over 11 percent, and came to a total cost of just under $44,000.

He was joined by another director who picked up 500 shares around the same time, paying about $22,500 to get in. Theis follows on a number of director buys last month, and a 5,000 share buy from the company President and CEO.

Overall company insiders own 0.2 percent of shares.

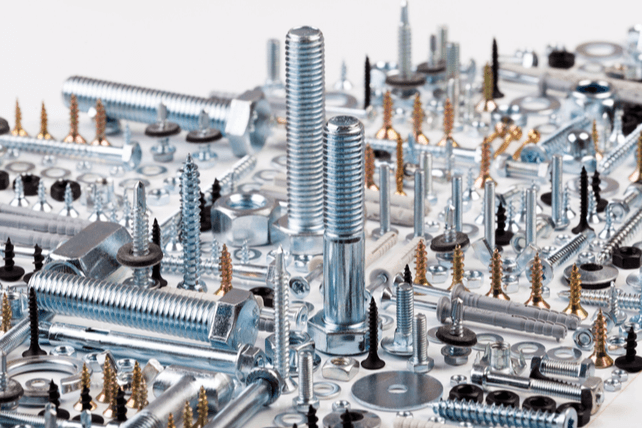

Shares of the manufacturer and seller of fastening equipment are down about in-line with the S&P 500 over the past year with an 18 percent drop.

However, Fastenal is still seeing earnings and revenue growth in the high teens. That’s taken shares from a PE ratio of over 41 last year to under 23 times forward earnings today.

Action to take: At current prices, shares yield 2.7 percent, with room for more growth as earnings continue to trend higher. In the current market environment, investors can start to buy in over the next few months, but should use further market weakness to pick up more shares.

For traders, shares are still in a short-term downtrend. The February 2023 $40 puts, last going for about $1.50, could deliver mid-to-high double-digit returns on a further downtrend before the option expires.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.